Capital vs Revenue Expenditure: Key Differences

Capital vs Revenue Expenditure: Key Differences

Business expenditures drive success but classification determines financial impact. Understanding capital expenditure and revenue expenditure differences shapes strategic decisions. Master these concepts for accurate financial reporting and tax optimization.

Understanding Capital Expenditure and Revenue Expenditure: The Fundamentals

Proper expenditure classification forms the foundation of accurate financial reporting and strategic business planning. Capital expenditure and revenue expenditure serve different purposes in business operations. Financial statements reflect these differences through distinct accounting treatments.

Think of expenditures like seeds and fertilizer in farming. Capital expenditure plants seeds for future harvests. Revenue expenditure provides fertilizer for current crops. Both are essential but serve different timelines.

Business expenses fall into two primary categories based on benefit duration. Expenditure fundamentals require understanding time periods and asset creation. Budget allocation decisions depend on classification accuracy.

Financial statements presentation varies dramatically between expenditure types. Balance sheet shows capital expenditures as assets. Income statement displays revenue expenditures as current period expenses.

Definitions and Basic Characteristics

Capital expenditure definition centers on long-term benefit creation. These investments provide value beyond current accounting periods. Business accounting requires precise classification for compliance.

Capital expenditure characteristics include:

-

Creates or enhances business assets

-

Provides benefits exceeding one year

-

Appears on balance sheet initially

-

Gets depreciated over useful life

-

Supports future revenue generation

Revenue expenditure definition focuses on immediate operational benefits. Day-to-day operations consume these expenses within current periods. Long-term assets receive no enhancement from revenue expenditures.

Revenue expenditure characteristics include:

-

Maintains current operational capacity

-

Benefits consumed within current period

-

Recorded directly on income statement

-

No future asset value creation

-

Supports current period activities

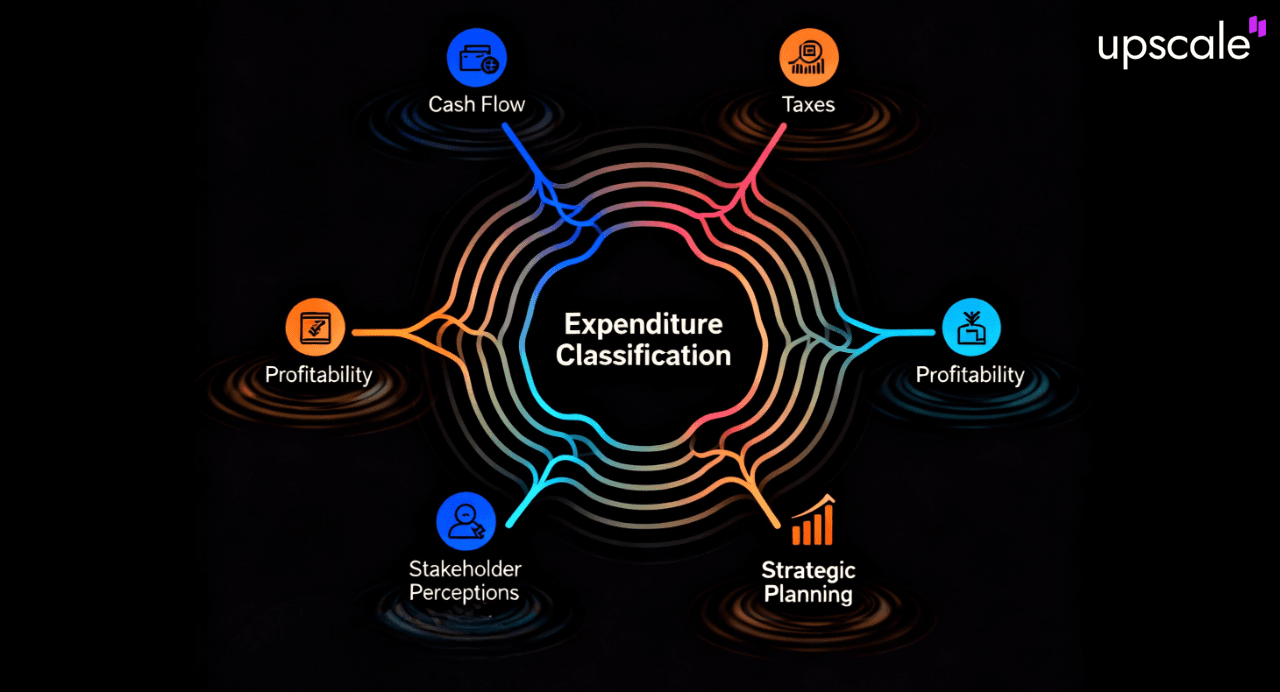

The Business Impact of Expenditure Classification

Financial impact extends beyond accounting compliance requirements. Strategic decisions rely on accurate expenditure classification for optimal resource allocation. Business operations efficiency improves through proper expense categorization.

Expenditure classification impact affects multiple business dimensions. Financial health indicators depend on accurate reporting. Business growth planning requires understanding investment types.

Misclassification consequences can distort business performance metrics. Stakeholder confidence depends on reliable financial reporting. Strategic planning requires accurate asset and expense recognition.

Key Differences Between Capital and Revenue Expenditure

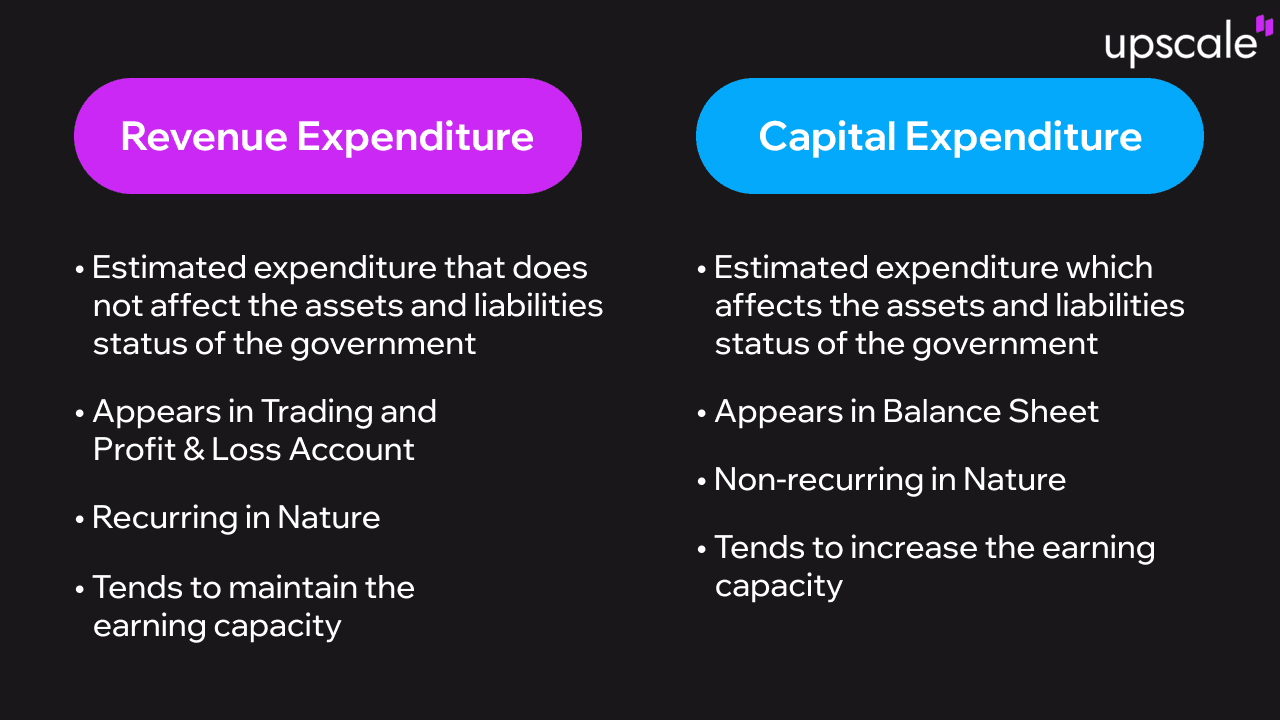

Understanding the fundamental distinctions between these expenditure types enables better financial decision-making. The difference between capital and revenue expenditure determines accounting treatment, tax implications, and strategic planning approaches. This comprehensive comparison reveals why classification matters for business success.

Comparative analysis reveals distinct characteristics across multiple dimensions. Expenditure comparison shows purpose, duration, and financial impact differences. Accounting distinctions affect financial statement presentation significantly.

Financial reporting differences create varying stakeholder perceptions. Investment decisions rely on accurate expenditure classification. Tax planning opportunities emerge through proper categorization.

Comparative Analysis: Duration, Purpose, and Impact

Expenditure duration represents the most fundamental classification criterion. Business purpose determines whether spending creates assets or maintains operations. Financial impact varies significantly between immediate expense recognition and long-term asset depreciation.

Strategic differences emerge through timing and benefit realization patterns. Accounting period limitations affect revenue expenditure recognition. Useful life considerations drive capital expenditure treatment.

Duration comparison framework:

-

Assess expected benefit period length

-

Evaluate asset creation potential

-

Consider operational enhancement versus maintenance

-

Analyze control and ownership factors

-

Review accounting standard guidance

Purpose analysis requires examining expenditure substance over form. Asset enhancement suggests capital classification. Operational maintenance indicates revenue treatment.

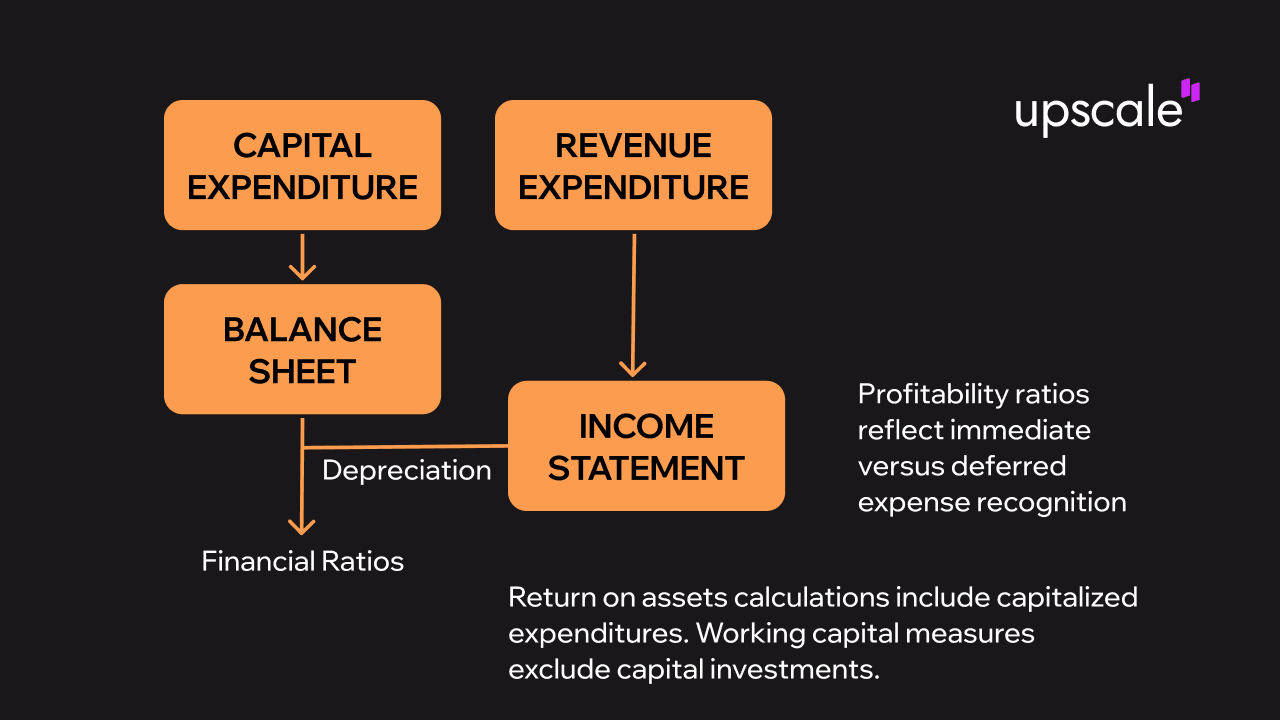

Effect on Financial Statements and Ratios

Financial statements presentation differs dramatically between expenditure types. Balance sheet impact occurs immediately for capital expenditures through asset recognition. Income statement effects vary based on classification decisions.

Financial ratios respond differently to each expenditure type. Balance sheet impact affects asset turnover calculations. Income statement impact influences profitability measures.

Profitability ratios reflect immediate versus deferred expense recognition. Return on assets calculations include capitalized expenditures. Working capital measures exclude capital investments.

Capital Expenditure: Long-term Investment for Business Growth

Capital expenditure represents strategic investments in future business capacity and competitiveness. These long-term investments create tangible and intangible assets that generate economic benefits over multiple accounting periods. Strategic assets built through capital expenditure form the foundation for sustained business growth and market positioning.

CapEx decisions require careful evaluation of expected returns and strategic alignment. Business expansion often depends on strategic capital allocation. Infrastructure investments enable operational scalability.

Long-term investment planning balances growth objectives with financial capacity. Strategic assets provide competitive advantages through enhanced capabilities. Business growth acceleration occurs through targeted capital investments.

Types of Capital Expenditure

Capital expenditure types vary based on strategic objectives and operational needs. Expansion CapEx increases business capacity and market reach. Maintenance CapEx preserves existing operational capabilities.

Major capital expenditure categories include:

-

Expansion investments: New facilities, additional equipment, market

-

Maintenance investments: Equipment replacement, facility upgrades

-

Acquisition investments: Business purchases, strategic asset

-

Modernization investments: Technology upgrades, process improvements

-

Compliance investments: Regulatory requirement fulfillment, safety

Strategic CapEx supports competitive positioning and market leadership. Compliance CapEx ensures regulatory adherence and operational continuity. Modernization CapEx maintains technological competitiveness.

Accounting Treatment of Capital Expenditure

Capitalization requires recording expenditures as balance sheet assets initially. Depreciation methods systematically allocate costs over useful lives. Asset recognition creates future expense patterns through depreciation schedules.

Financial reporting follows established depreciation approaches. Useful life determination affects annual depreciation amounts. Accumulated depreciation reduces asset carrying values.

Common depreciation methods include:

-

Straight-line: Equal annual depreciation amounts

-

Declining balance: Higher early-year depreciation

-

Units of production: Usage-based depreciation patterns

-

Sum-of-years-digits: Accelerated depreciation approach

Balance sheet treatment shows gross asset values and accumulated depreciation. Income statement reflects annual depreciation expense. Asset recognition continues until full cost recovery.

Revenue Expenditure: Powering Day-to-Day Operations

Revenue expenditure enables continuous business operations and maintains current service levels. These operational expenses support immediate business activities without creating long-term assets. Operating expenses ensure business continuity while consuming benefits within current accounting periods.

The relationship between capital expenditure and revenue expenditure creates operational balance. Day-to-day expenses maintain business functionality and customer service. Business maintenance through revenue expenditure preserves operational capacity.

OpEx management affects current period profitability and cash flow. Recurring expenses require ongoing budget allocation and cost control. Operational efficiency improvements often target revenue expenditure optimization.

Categories of Revenue Expenditure

Revenue expenditure types encompass all operational business activities and support functions. Administrative expenses support general business management. Selling expenses drive revenue generation activities.

Primary revenue expenditure categories include:

-

Administrative expenses: Salaries, rent, utilities, insurance,

-

Selling expenses: Advertising, sales commissions, marketing

-

Maintenance expenses: Routine repairs, cleaning supplies, consumable

-

Production costs: Raw materials, direct labor, manufacturing

-

Operational costs: Transportation, communication, training, licenses

Indirect expenses support overall business operations without direct revenue connection. Production costs directly relate to product creation and delivery.

Recording Revenue Expenditure in Financial Statements

Expense recognition follows accrual accounting principles for accurate period matching. Income statement displays revenue expenditures as current period expenses reducing profitability. Accounting period alignment ensures proper performance measurement.

Accrual accounting requires recording expenses when incurred regardless of payment timing. Cash flow impact may differ from accounting recognition timing. Profit and loss statement reflects all revenue expenditures.

Immediate expense recognition prevents balance sheet asset creation. Income statement impact affects current period profitability measures. Expense recognition principles ensure accurate period allocation.

How to Correctly Classify Expenditures

Successful expenditure classification requires systematic evaluation frameworks and consistent application of established criteria. Accounting guidelines provide structured approaches for determining proper expenditure treatment based on economic substance. Professional judgment combines with regulatory requirements for accurate classification.

Classification criteria include future benefit assessment, asset creation evaluation, and useful life determination. Expenditure decision tree frameworks simplify complex classification scenarios. Accounting judgment requires balancing substance with form.

Financial reporting accuracy depends on consistent classification approaches. Asset recognition standards guide capital expenditure identification. Expense recognition principles determine revenue expenditure treatment.

Decision-making Framework for Classification

Classification framework development requires systematic evaluation of expenditure characteristics. Asset creation potential serves as the primary classification determinant. Liability reduction capabilities may also indicate capital treatment.

Step-by-step classification process:

-

Identify expenditure nature and business purpose

-

Assess future economic benefit probability and measurement

-

Evaluate benefit duration and useful life expectations

-

Consider materiality thresholds and practical significance

-

Apply relevant accounting standard guidance

-

Document classification rationale and supporting evidence

Financial reporting standards provide authoritative guidance for complex scenarios. Decision framework consistency ensures comparable treatment across periods. Accounting judgment documentation supports audit defense.

Common Classification Challenges and Solutions

Grey areas in classification require careful analysis and professional expertise. Borderline expenditures benefit from systematic evaluation using established decision frameworks. Ambiguous expenses challenge classification consistency.

Frequent classification challenges include:

-

Major repairs versus asset replacements: Evaluate capacity

-

Software development costs: Distinguish research phase from

-

Leasehold improvements: Consider lease term and improvement useful

-

Training expenses: Assess asset creation vs current period benefit

-

Website development: Separate content creation from platform

Accounting solutions require analyzing expenditure substance and applying relevant standards. Classification problems often involve hybrid characteristics requiring componentization. Professional judgment guides resolution of ambiguous situations.

Real-world Examples and Case Studies

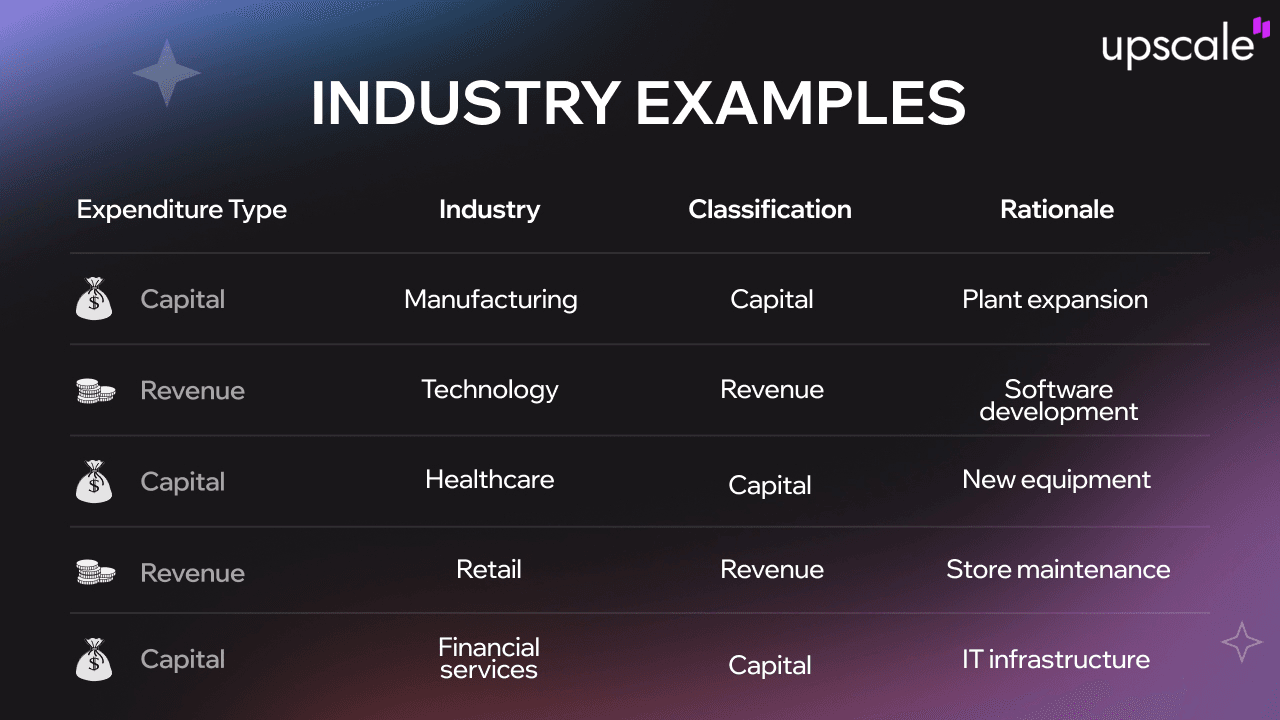

Practical illustrations demonstrate classification principles across diverse business environments and industries. Industry examples reveal how context and business purpose influence expenditure classification decisions. Real-life applications provide concrete guidance for challenging scenarios.

Case studies showcase successful classification approaches and lessons learned. Industry-specific factors affect classification considerations significantly. Practical illustrations bridge theoretical knowledge with operational application.

Manufacturing, technology, service, and retail businesses demonstrate different expenditure patterns. Construction industry examples show project-based classification challenges. Financial services illustrations include modern fintech considerations.

Industry-specific Capital and Revenue Expenditure Examples

Contextual classification varies based on industry characteristics and business models. Sector differences create unique classification considerations requiring specialized knowledge. Application examples demonstrate practical decision-making.

Healthcare industry examples:

-

Capital: Medical imaging equipment, facility expansions, electronic

-

Revenue: Medical supplies, pharmaceutical inventory, routine

Technology sector examples:

-

Capital: Data center infrastructure, proprietary software

-

Revenue: Cloud service subscriptions, software licensing fees,

Modern prop trading and funded trading platforms demonstrate evolving expenditure patterns. Upscale, recognized among leading crypto prop trading platforms, illustrates how fintech companies balance infrastructure investment with operational flexibility. Their capital expenditures typically include proprietary trading platform development and core algorithmic systems, while revenue expenditures encompass trader evaluation services, real-time market data feeds, and ongoing platform maintenance costs.

Tax Implications of Capital and Revenue Expenditures

Tax treatment differences create significant planning opportunities and compliance requirements. Immediate tax deduction availability varies dramatically between capital and revenue expenditure classifications. Depreciation tax benefits spread capital expenditure deductions over multiple years.

Tax implications affect cash flow timing and overall tax burden. Capital allowance systems provide structured depreciation approaches. Tax planning requires balancing immediate deductions with long-term benefits.

Tax deduction timing affects business cash flow management. Tax planning opportunities emerge through strategic expenditure timing. Depreciation tax impact provides ongoing annual benefits.

Immediate vs. Deferred Tax Benefits

Revenue expenditure provides immediate full tax deduction in the incurrence year. Capital expenditure creates deferred tax benefits through systematic depreciation deductions over asset useful lives. Cash flow impact considerations affect expenditure timing decisions.

Present value analysis favors immediate deductions over deferred benefits. Tax planning requires evaluating current versus future tax rate expectations. Market impact assessment helps optimize deduction timing.

Strategic considerations include business profit levels and anticipated tax rate changes. Immediate tax deduction reduces current year tax liability. Deferred benefits provide ongoing tax savings over multiple years.

Strategic Tax Planning for Expenditure Classification

Tax optimization requires maintaining compliance while maximizing legitimate benefits. Compliant classification forms the foundation for sustainable tax planning strategies. Tax-efficient business spending balances immediate needs with strategic objectives.

Expenditure planning involves timing decisions around fiscal year-ends and anticipated changes. Classification framework consistency supports tax position defensibility. Tax strategy development requires professional guidance and documentation.

Documentation practices support classification positions during tax examinations. Legitimate tax planning works within established regulatory frameworks. Professional guidance ensures compliance while optimizing tax outcomes.

Strategic Implications for Business Management

Resource allocation decisions affect long-term business competitiveness and operational sustainability. Strategic planning integrates expenditure classification understanding with broader business objectives and market positioning. Financial strategy development requires balancing growth investments with operational excellence.

Expenditure planning affects stakeholder perceptions and investment attractiveness. Business growth strategies depend on optimal capital allocation decisions. Resource allocation requires understanding expenditure type implications.

Capital vs. Revenue Decisions in Resource Allocation

Budget planning requires balancing immediate operational needs with future capacity building. Resource allocation optimization considers both short-term operational requirements and long-term strategic positioning. Financial resources allocation affects business competitiveness.

Capital budgeting frameworks evaluate expected returns on strategic investments. Spending decisions require considering opportunity costs and strategic alignment. Financial management requires balancing competing resource demands.

Strategic decision making integrates financial analysis with market positioning. Resource allocation affects business adaptability and growth potential. Investment timing decisions influence competitive advantage sustainability.

Impact on Financial Performance Metrics

Key performance indicators respond differently to expenditure classification choices. Financial performance measurement reflects classification decisions through profitability ratios, efficiency metrics, and return calculations. Investor relations depend on transparent financial reporting.

Financial health indicators include profitability measures and asset utilization ratios. Performance evaluation requires understanding expenditure impact patterns. Financial analysis benefits from classification accuracy and consistency.

Return on investment calculations incorporate capital expenditure impacts over time. Asset turnover ratios reflect capital investment efficiency. Profitability measures respond to revenue expenditure management.

Common Misconceptions and Pitfalls to Avoid

Classification mistakes can create significant financial reporting errors and tax compliance issues. Frequent misconceptions about expenditure classification lead to costly errors that affect financial statements and stakeholder confidence. Understanding common pitfalls prevents expensive corrections.

Accounting errors often stem from oversimplified classification approaches. Financial reporting suffers when expenditure substance receives insufficient analysis. Compliance risk increases through systematic classification errors.

Common misconceptions include:

-

"All large expenditures should be capitalized" - Amount alone

-

"Repairs are always revenue expenditure" - Major repairs extending

-

"Classification choice is flexible" - Standards require

-

"Training costs build assets" - Control and retention issues

-

"Software licenses are always capital" - Term and nature determine

Accounting misconceptions create audit findings and financial restatement risks. Classification challenges require professional expertise and systematic analysis.

Grey Areas in Classification

Ambiguous expenditures require careful professional analysis and documentation. Professional judgment application requires systematic evaluation of complex scenarios using established frameworks. Borderline cases challenge classification consistency.

Common grey area expenditures:

-

Website development: Platform creation vs content updates

-

Software customization: Enhancement vs maintenance

-

Major refurbishments: Life extension vs capacity restoration

-

Research and development: Investigation vs application phases

-

Equipment modifications: Improvement vs repair

Regulatory guidance provides frameworks for resolving classification uncertainties. Industry practice offers benchmarks for similar expenditure types. Professional consultation helps navigate complex scenarios.

Avoiding Costly Classification Mistakes

Error prevention requires systematic review processes and internal controls. Financial consequences of misclassification include audit adjustments, stakeholder confidence loss, and regulatory compliance issues. Audit readiness depends on classification accuracy.

Error prevention strategies:

-

Establish clear capitalization policies with specific criteria

-

Implement approval workflows for significant expenditures

-

Create classification checklists for common expenditure types

-

Conduct periodic reviews of capital and revenue accounts

-

Maintain comprehensive documentation for classification decisions

-

Provide regular training on classification principles

-

Engage professional advisors for complex transactions

Compliance practices ensure consistent application of classification principles. Documentation standards support audit defense and position sustainability.

CAPEX vs OPEX in the Modern Business Environment

Digital transformation reshapes traditional expenditure patterns across industries. Modern business practices favor operational flexibility over asset ownership through subscription models and cloud computing arrangements. Traditional vs modern expenditure approaches require updated classification frameworks.

Technology investment patterns shift from capital-intensive infrastructure to subscription-based access models. As-a-service models convert traditional capital expenditures into ongoing operational expenses.

Subscription economy growth affects balance sheet composition and financial ratio calculations. Cloud computing reduces capital requirements while increasing operational costs. Software as a Service arrangements typically represent revenue expenditure.

Cloud Services and Subscription-Based Expenditures

IT expense classification requires understanding service arrangements and control factors. Software as a Service subscriptions typically represent revenue expenditure due to limited control and ongoing service nature. Digital service expenditures follow subscription accounting principles.

Cloud computing arrangements eliminate traditional infrastructure ownership. Subscription model prevalence reduces capital expenditure requirements. Digital services consumption occurs over contract periods.

Implementation costs for cloud services may qualify for capitalization when creating identifiable future benefits. Platform customization and configuration costs require individual assessment.

Adapting Classification Approaches for Business Evolution

Evolving business models require updated accounting approaches while maintaining fundamental classification principles. Financial reporting trends reflect changing expenditure patterns. Modern expenditure patterns affect traditional ratio analysis.

Business innovation creates new expenditure types requiring classification guidance. Digital economy transactions challenge traditional accounting frameworks. Business evolution requires accounting adaptation while preserving comparability.

Classification evolution incorporates new expenditure types within established principles. Accounting standards development addresses emerging business models. Financial reporting trends reflect technological advancement impacts.

Building Your Financial Classification System

Systematic classification implementation requires structured frameworks combining accounting expertise with practical business knowledge. Comprehensive expenditure classification systems ensure accuracy, consistency, and compliance while supporting strategic decision-making. Best practices development evolves through experience and regulatory guidance.

Financial decision making improves through systematic classification approaches. Accounting best practices provide frameworks for consistent application. Strategic expenditure decisions benefit from accurate classification systems.

Financial management integration includes classification considerations in budget planning and resource allocation. Professional guidance ensures compliance while optimizing business outcomes.

Visit Upscale.trade for insights into modern expenditure classification challenges in the evolving fintech and crypto trading landscape.

FAQ

What is the difference between capital expenditure and revenue expenditure?

Capital expenditure creates long-term assets providing benefits beyond current accounting periods. Revenue expenditure maintains current operations with benefits consumed within the current period. Classification depends on benefit duration and asset creation.

What are examples of capital and revenue expenditures?

Capital examples include buildings, equipment, vehicles, and software development. Revenue examples include salaries, rent, utilities, and routine maintenance. Context and business purpose determine specific classification in ambiguous cases.

How are capital expenditures and revenue expenditures treated in accounting?

Capital expenditures appear on balance sheets as assets and depreciate over useful lives. Revenue expenditures immediately reduce profit on income statements. Tax treatment follows similar patterns with immediate vs deferred deductions.

What is the impact of capital and revenue expenditures on financial statements?

Capital expenditures increase asset balances and create future depreciation expenses. Revenue expenditures immediately reduce current period profit and cash flow. Financial ratios respond differently to each expenditure type.

How do you classify an expenditure as revenue expenditure or capital expenditure?

Classification requires evaluating benefit duration, asset creation potential, and control factors. Apply systematic decision frameworks considering future economic benefits. Professional judgment and accounting standards guide complex determinations.