Swing Trading Explained: How to Get Started

Swing Trading Explained: How to Get Started

Capture market swings without watching screens all day. Master the perfect balance between day trading and long-term investing.

What is Swing Trading?

Swing trading captures price movements over days to weeks. Not minutes like day trading. Not years like investing. The sweet spot in between.

Think of market prices like ocean waves. Day traders surf ripples. Investors wait for tides. Swing traders ride the perfect waves.

What is swing trading exactly? It's holding positions from 2 days to several weeks. You identify short- to medium-term price movements. Enter at support, exit at resistance. Capture gains from natural market swings.

This trading strategy suits busy professionals perfectly. Check charts once daily. Set alerts for entry points. No need for constant monitoring. Your positions work while you live your life.

Swing trading means profiting from market oscillations. Every stock moves in cycles. Up, down, sideways. These swings happen regardless of overall trends. Smart swing traders use technical analysis to time entries.

Swing Trading vs. Other Trading Styles

Understanding trading styles helps you choose wisely. Each approach demands different commitments.

Swing Trading vs. Day Trading vs. Position Trading

Day trading requires full-time dedication. Positions close before the market closes. Stress runs high. Profits come from tiny moves.

Swing trading and day trading differ fundamentally. Day traders make 10-50 trades daily. Swing traders make 10-20 monthly. Day trading vs position trading shows another extreme.

Position trading holds for months or years. Fundamental analysis dominates. Patience becomes essential. Returns compound slowly.

| Factor | Day Trading | Swing Trading | Position Trading |

|---|---|---|---|

| Holding Period | Minutes-Hours | Days-Weeks | Months-Years |

| Time Required | 6-8 hours daily | 1-2 hours daily | Few hours weekly |

| Stress Level | Very High | Moderate | Low |

| Capital Needed | $25,000+ (PDT rule) | $1,000+ | $10,000+ |

| Analysis Type | Technical only | Technical mainly | Fundamental mainly |

| Profit Potential | 0.5-2% per trade | 5-15% per trade | 20-100% per trade |

The difference between swing trading and other styles? Balance. Better work-life integration. Higher profit potential than day trading. Less patience required than investing.

The Basic Premise of Swing Trading

Markets move in predictable patterns. Peaks follow troughs. Resistance becomes support. Human psychology drives repetition.

Swing trading relies on these cycles. Prices rarely move straight. They oscillate between extremes. Fear pushes prices down. Greed drives them up.

Professional swing traders identify cycle turning points. The uptrend pulls back. Smart money enters. Price resumes higher. Exit near resistance.

This approach captures the meat of moves. Not the entire trend. Just the profitable middle portion. Less risk than holding forever.

Price fluctuations create opportunities daily. News triggers overreactions. Algorithms cause volatility. Swing traders profit from both.

Understanding market psychology matters most. Crowds panic together. They celebrate together. Swing trading is a strategy that exploits these emotions.

Stock Selection for Swing Trading Success

Choosing the right stocks determines success. Not all stocks suit swing trading.

How to Select the Best Stocks for Swing Trading

How to select stocks for swing trading starts with liquidity. You need easy entries and exits. Volume should exceed 1 million shares daily.

Price range matters equally. Stocks between $20-200 work best. Penny stocks lack stability. Ultra-high prices limit position sizing.

How to pick stocks for swing trading involves screening. Use scanners to find movers. Look for 2-5% daily ranges. Volatility creates opportunity.

Large-cap stocks offer reliability. Apple, Microsoft, Tesla move predictably. Patterns repeat consistently. News impacts are measured.

Sector strength influences individual stocks. Tech rallies lift all tech stocks. Energy weakness drags down oil companies. Trade with sector momentum.

Top screening criteria:

-

Average volume above 2 million

-

Price between $20-200

-

Beta between 1.2-2.0

-

Clear technical patterns

-

Recent news catalysts

Professional traders maintain focused watchlists. 20-30 stocks maximum. Know each stock's personality. Tesla moves differently than Walmart.

Key Characteristics of Swing-Worthy Stocks

The best swing trading stocks share traits. Liquidity ranks first. Wide spreads kill profits. Tight spreads enable precision.

Moderate volatility balances opportunity with risk. Too much volatility creates chaos. Too little offers no profit. Find the goldilocks zone.

Technical patterns must be clear. Clean support and resistance levels. Obvious trend channels. Recognizable chart patterns.

Sector alignment amplifies moves. Strong sectors lift weak stocks. Weak sectors suppress strong stocks. Trade with the tide.

Stocks for swing trading evaluation process:

-

Check daily volume trends

-

Analyze price action cleanliness

-

Identify key support/resistance levels

-

Confirm sector strength

-

Review recent news impact

-

Calculate average true range

-

Assess options activity

Avoid stocks with earnings soon. Surprises destroy swing trades. Binary events add unnecessary risk.

Revolutionary Swing Trading Technology

Modern technology transforms swing trading. AI and automation level the playing field.

Modern Trading Platforms for Swing Traders

Technology democratizes professional trading. Advanced tools once cost thousands. Now they're accessible to everyone.

AI optimization enhances decision-making. Algorithms scan thousands of setups. Pattern recognition happens instantly. Human emotion gets removed.

Mobile platforms enable location independence. Trade from beaches or mountains. Set alerts for specific conditions. React to opportunities anywhere.

Telegram integration revolutionizes accessibility. No complex platforms needed. Simple messages execute trades. Perfect for busy professionals.

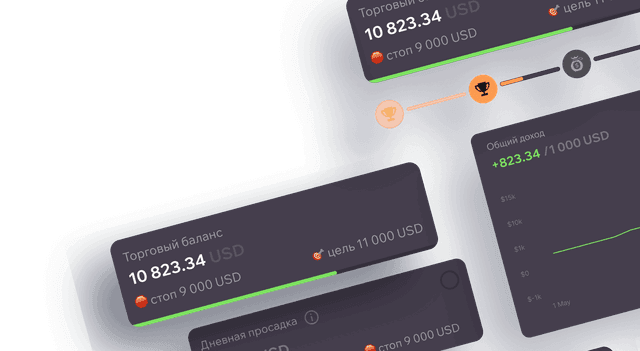

Upscale pioneers this technological revolution. Their platform combines AI optimization with Telegram simplicity. Access up to $100,000 capital. Keep 80% of profits generated.

Traditional swing trading requires multiple tools. Charts, scanners, execution platforms. Upscale consolidates everything. One platform, maximum efficiency.

| Traditional Setup | Upscale Innovation |

|---|---|

| Multiple platforms | Single Telegram interface |

| Manual calculations | AI-powered optimization |

| Personal capital risk | Funded accounts available |

| 100% profit (less losses) | 80% profit (no losses) |

| Complex learning curve | Intuitive design |

Visit Upscale.trade to experience next-generation swing trading.

Capital Access and Profit Maximization

Trading capital limits most traders. Personal accounts stay small. Growth takes years.

Funded accounts change everything. Trade $100,000 without owning it. Your risk stays minimal. Profit potential multiplies.

Swing trading requires adequate position sizing. Small accounts can't diversify. Large accounts spread risk effectively.

Example calculation:

-

Personal $5,000 account: 10% gain = $500

-

Funded $100,000 account: 10% gain = $10,000

-

Your share (80%): $8,000 profit

Professional traders recognize this advantage. Why risk personal capital? Access institutional-level funding instead.

Essential Swing Trading Strategies

Successful swing trading requires proven strategies. Master these core approaches first.

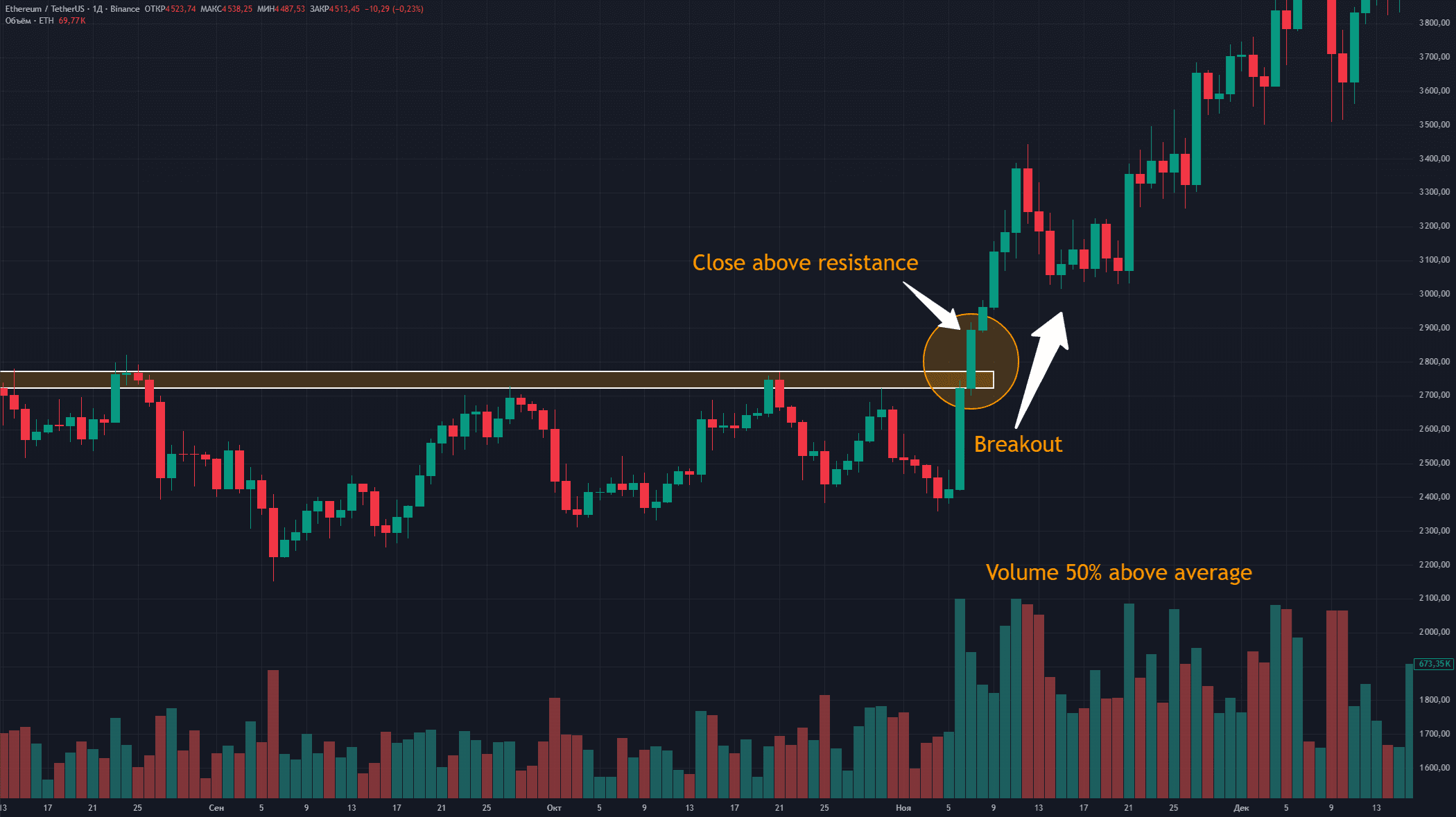

The Breakout Strategy: Capturing Momentum

Breakouts occur when price exceeds resistance. Volume confirms genuine moves. False breakouts lack volume support.

Watch for consolidation patterns first. Triangles, flags, wedges form. Energy builds inside ranges. Eventually, price explodes directionally.

Entry happens on breakout confirmation. Not at resistance touch. Wait for the close above. Volume must exceed average.

Stop-loss sits below the breakout point. Usually 2-3% distance. Never risk more than 1% of capital. Position size accordingly.

Profit targets use measured moves. Pattern height projects upward. Take partial profits at target. Trail stops on remainder.

Example: NVDA consolidates at $450. Breaks above with volume. Entry at $455. Stop at $445. Target $475. Risk $10 to make $20.

Breakout confirmation checklist:

-

Close above resistance

-

Volume 50% above average

-

No immediate resistance overhead

-

Sector showing strength

-

Market trending up

The Pullback Strategy: Trading With the Trend

Pullbacks offer high-probability entries. Trends don't move straight. They breathe and continue.

An uptrend shows higher highs and lows. Price surges, then retraces. Smart money buys the dip. Trend resumes higher.

Fibonacci retracements identify entry zones. 38.2%, 50%, 61.8% levels matter. Moving averages provide support too.

Swing traders often wait patiently. Let others chase momentum. Enter on the pullback. Better risk-reward achieved.

Example: AAPL trends from $150 to $160. Pulls back to $155 (50% retracement). Bounces off 20-day moving average. Entry at $155.50. Stop at $153. Target $165.

Pullback entry flowchart:

-

Confirm existing uptrend

-

Wait for retracement

-

Identify support level

-

Watch for reversal signal

-

Enter with tight stop

-

Target previous high

The best pullbacks stay above key moving averages. The break below signals potential reversal.

Trend Trading for Swing Traders

Trend trading captures directional moves. Short-term trends last days to weeks. Perfect for swing timeframes.

Moving averages define trends clearly. Price above 20-day stays bullish. Below turns bearish. Simple but effective.

Swing traders use multiple timeframes. Daily charts show the trend. Four-hour charts time entries. One-hour confirms signals.

Trading sideways markets wastes time. Wait for a clear direction. Trend trading requires patience. But profits justify waiting.

ADX indicator measures trend strength. Above 25 shows a strong trend. Below 20 suggests ranging. Trade accordingly.

Trend strength checklist:

-

Clear higher highs/lows (uptrend)

-

Price above rising moving averages

-

ADX above 25 and rising

-

Volume increasing on trend days

-

Sector and market aligned

Best Technical Indicators for Swing Trading

The right indicators improve timing. But don't overcomplicate charts.

Top 3 Technical Indicators for Swing Trading Success

Moving averages rank first. They show trend direction clearly. 20, 50, 200-day periods work best. Price crossing signals changes.

Relative Strength Index measures momentum. Overbought above 70. Oversold below 30. Divergences signal potential reversals.

Moving Average Convergence Divergence combines trend and momentum. Crossovers generate signals. Histogram shows strength changes.

These three indicators cover everything. Trend, momentum, and timing. No need for dozens. Master these first.

Swing traders rely heavily on confirmation. One indicator suggests entry. Another confirms it. The third validates timing.

Example setup: Price bounces off 50-day MA (trend support). RSI shows oversold (momentum). MACD crosses positive (timing). High-probability entry achieved.

Settings matter for swing trading:

-

Moving Average: 20-day for short swings

-

RSI: 14-period standard works well

-

MACD: 12, 26, 9 default settings

Oscillators help in ranging markets. Trend indicators excel in trends. Use both appropriately.

Using the Relative Strength Index (RSI) for Swing Trading

RSI identifies overbought and oversold conditions. Standard settings use 14 periods. Swing traders may look for extremes.

Above 70 suggests overbought. But strong trends stay overbought. Don't short automatically. Wait for price confirmation.

Below 30 indicates oversold. Bounces often follow. But trends can stay oversold. Patience prevents premature entries.

Divergences provide powerful signals. Price makes new high. RSI makes lower high. Potential reversal ahead.

Swing traders must understand context. Trending markets behave differently. RSI 40 becomes support in uptrends. RSI 60 becomes resistance in downtrends.

Hidden divergences confirm trend continuation. Price makes higher low. RSI makes lower low. Bullish continuation likely.

Moving Averages for Swing Trading Success

Moving averages smooth price action. They reveal underlying trends. Support and resistance levels become clear.

Simple moving averages weight equally. Exponential moving averages favor recent prices. Both work for swing trading.

The 20-day moving average suits swing timeframes perfectly. Not too fast like 10-day. Not too slow like 50-day.

MA crossovers signal trend changes. The price crossing above turns bullish. Below becomes bearish. Volume confirms validity.

Multiple moving averages create channels. Price bounces between them. Traders identify entry and exit zones.

Golden cross (50 above 200) signals major uptrends. Death cross opposite. Swing traders position accordingly.

Optimal Time Frames for Swing Trading

Choosing the right swing trading time frame affects everything. Analysis, entry, management, exit.

Daily charts dominate swing trading. They filter market noise. Patterns appear clearer. Trends become obvious.

Four-hour charts refine entries. Daily shows opportunity. Four-hour times execution. Precision improves dramatically.

The best time frame for swing trading depends on the hold period. Two-day swings use hourly charts. Two-week swings need daily charts.

Multiple timeframe analysis prevents mistakes. Weekly shows major trend. Daily identifies swings. Four-hour times entries.

Never trade against higher timeframes. If weekly trends down, don't buy daily bounces. Align all timeframes.

Short- to medium-term traders balance perspectives. Too many timeframes are confusing. Too few miss context.

Decision tree for timeframe selection:

-

Hold 2-4 days: Use 4-hour primary

-

Hold 5-10 days: Use daily primary

-

Hold 2-3 weeks: Use daily + weekly

-

All strategies: Confirm with one timeframe higher

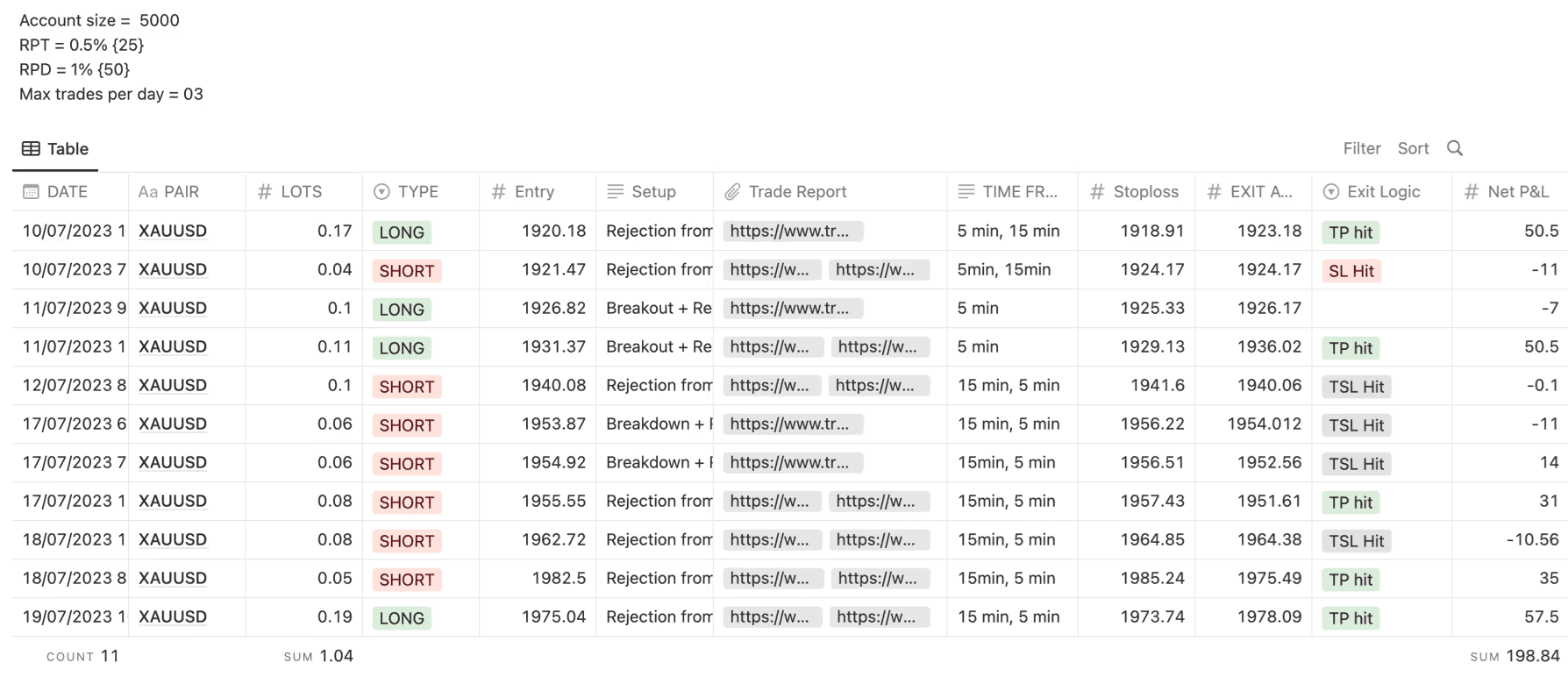

{width="6.267716535433071in" height="2.9305555555555554in"}

{width="6.267716535433071in" height="2.9305555555555554in"}

Risk Management for Swing Trading Success

Risk management separates professionals from amateurs. Protect capital first. Profits follow naturally.

Position sizing determines survival. Never risk over 2% per trade. Most pros risk 1%. Consistency beats home runs.

Calculate position size properly:

-

Account: $10,000

-

Risk per trade: $100 (1%)

-

Stop distance: $2

-

Position size: 50 shares

Stop-loss placement requires precision. Too tight gets stopped prematurely. Too wide risks unnecessarily. Find logical levels.

Risk-reward ratios filter trades. Minimum 2:1 required. Risk $100 to make $200. Skip inferior setups.

Correlation risk destroys accounts. Don't buy five tech stocks. Diversify across sectors. Manage total exposure.

Maximum daily loss: 3% account value. Maximum weekly loss: 6%. Monthly maximum: 10%. These limits ensure survival.

Trading capital preservation enables compounding. Losing 50% requires 100% gain to recover. Protect downside always.

Real-World Swing Trading Examples and Case Studies

Real swing trading examples teach best. Theory meets reality here.

Case Study 1: TSLA Breakout Trade

Tesla consolidated between $200-210 for two weeks. Triangle pattern formed. Volume decreased during consolidation.

-

March 15: Price broke above $210. Volume doubled average. Entry at $211. Stop at $206 (below triangle). Target $225 (measured move).

-

March 18: Price reached $218. Moved stop to breakeven. Locked in risk-free trade.

-

March 22: Hit $225 target. Sold 75% position. Trailed stop on remainder.

-

March 24: Stopped at $223. Total gain: $14 on $211 entry (6.6%). Risk-reward achieved: 2.8:1.

Case Study 2: AAPL Pullback Failure

Apple uptrended from $140 to $155. Pulled back to 50-day MA at $148.

-

Entered long at $148.50. Stop at $146. Target $160. Seemed perfect setup.

-

Next day: Earnings warning issued. Price gapped down to $143. Stop triggered. Loss: $2.50 per share.

-

Lesson: News trumps technicals. Always check the earnings calendar. Fundamental events destroy technical setups.

-

Wait for the stock to confirm reversal. Don't anticipate. React to price action.

-

Capture gains systematically. Partial profits reduce risk. Trailing stops protect gains.

Common Swing Trading Mistakes and How to Avoid Them

Every swing trader makes mistakes. Learning from them accelerates success.

Overtrading destroys accounts fastest. Quality beats quantity always. Three good trades beat ten mediocre ones.

Ignoring stop-losses ranks second. Pride prevents admitting wrong. Small losses become devastating. Always honor stops.

Emotional trading follows losses. Revenge mindset emerges. Position sizes double. Risk management disappears.

Frequent trading without a plan wastes money. Random entries based on feelings. No edge exists. Commissions accumulate.

Swing traders hold losers too long. Hope isn't a strategy. Cut losses quickly. Let winners run.

Solutions for common mistakes:

-

Set daily trade limits (maximum 2)

-

Use automatic stop orders

-

Walk away after losses

-

Document every trade taken

-

Review trades weekly

-

Follow written trading plan

Trading discipline beats intelligence. Smart traders fail without discipline. Disciplined traders succeed consistently.

The Pros and Cons of Swing Trading

Swing trading offers unique advantages. But limitations exist too.

Advantages:

-

Better work-life balance than day trading

-

No pattern day trader rule restrictions

-

Compounds gains faster than investing

-

Captures substantial price movements

-

Lower stress than day trading

-

Works with full-time jobs

-

Fewer trades mean lower commissions

Disadvantages:

-

Overnight gap risk exists

-

Requires patience for setups

-

Psychology challenges during drawdowns

-

News can destroy positions

-

Less exciting than day trading

-

Slower gains than successful day trading

Swing trading and long-term investing serve different goals. Investing builds wealth slowly. Swing trading generates income actively.

Disadvantages of swing trading pale against benefits. Proper risk management mitigates downsides. The lifestyle flexibility appeals most.

Personality determines the best fit. Patient people excel at swing trading. Adrenaline junkies prefer day trading.

Getting Started: Swing Trading Action Plan for Beginners

How to do swing trading successfully requires structure. Follow this proven roadmap.

-

Week 1-2: Education phase. Read three swing trading books. Watch successful trader interviews. Understand basic concepts.

-

Week 3-4: Platform familiarization. Open demo account. Practice order types. Learn charting tools.

-

Month 2: Strategy development. Choose one strategy. Backtest 100 trades. Document results meticulously.

-

Month 3: Paper trading. Trade live markets with fake money. Follow real rules. Track performance.

-

Month 4: Small live trading. Start with minimal size. Focus on execution. Perfect the process.

Beginner traders aim for consistency first. Not massive profits. Small consistent gains compound.

Sample first-month plan:

-

Week 1: Master moving averages

-

Week 2: Learn RSI and MACD

-

Week 3: Practice breakout identification

-

Week 4: Combine indicators for confirmation

Your trading setup needs:

-

Reliable internet connection

-

Charting platform (TradingView)

-

Broker account

-

Trading journal

-

Risk calculator

-

Market scanner

Advanced Swing Trading Techniques and Market Adaptation

Advanced swing trading builds on fundamentals. Professional techniques improve results significantly.

Multi-timeframe confluence increases probability. Daily, 4-hour, and hourly align. All show the same signal. Entry becomes obvious.

Volume profile analysis reveals hidden levels. Where institutions accumulate. Strong support and resistance zones. Price reacts predictably.

Market regime filters prevent bad trades. Trending markets favor breakouts. Ranging markets favor mean reversion. Adapt accordingly.

Options flow indicates institutional positioning. Large call buying suggests upside. Put buying warns of downside. Follow smart money.

Relative strength compares stocks to indexes. Strong stocks outperform in uptrends. They fall less in downtrends. Trade the strongest.

Short-term trading during earnings season requires caution. Volatility increases dramatically. Position sizes should decrease.

Trading opportunities multiply with experience. Patterns become intuitive. Risk management becomes automatic. Consistency improves naturally.

Building Your Swing Trading Future

Successful swing trading combines knowledge with discipline. Technology accelerates the learning curve.

Master one strategy completely. Then add others gradually. Complexity doesn't equal profitability.

Professional trading access democratizes opportunity. No longer need millions. Start with evaluation accounts. Scale with success.

Modern platforms remove traditional barriers. Complex analysis becomes simple. AI assists decision-making. Execution happens instantly.

Upscale represents this evolution perfectly. Telegram integration simplifies trading. AI optimization improves results. Access professional capital easily. Visit Upscale.trade to begin your journey.

Swing trading success requires commitment. But rewards justify effort. Financial freedom becomes achievable. Start your transformation today.

FAQ

How do I select stocks for swing trading?

Look for stocks with daily volume above 2 million shares, price range $20-200, clear technical patterns, and strong sector momentum. Screen for 2-5% daily volatility and clean support/resistance levels for optimal swing setups.

How much capital do I need to start swing trading?

Minimum $1,000 starts paper trading, but $5,000+ enables proper position sizing and risk management. Pattern day trader rules don't apply to swing trading. Consider funded accounts for $10,000-100,000 access without personal risk.

How does one identify a breakout in swing trading?

Confirm breakouts with volume 50% above average, clean close above resistance, and sector strength alignment. Wait for price to hold above breakout level or retest it as support before entering positions.