VWAP Indicator: Calculation and Strategies for Volume Weighted Average Price Trading

Volume-Weighted Average Price (VWAP) Guide: Definition and Calculation

VWAP indicator transforms day trading success. This volume weighted average price guide reveals professional techniques. Master VWAP calculation and trading strategies for consistent profits.

What is VWAP? Understanding the Volume Weighted Average Price

VWAP meaning centers on volume-weighted price calculation throughout each trading session. What is VWAP exactly? The cumulative average price weighted by trading volume. This powerful technical indicator outperforms traditional moving averages for intraday analysis.

Think of VWAP as the market's fairest price calculator. Simple moving averages ignore trading volume completely. VWAP incorporates both price and volume for superior market analysis. Professional traders rely on VWAP for execution benchmarking.

What is VWAP in trading terms? Professional benchmark for execution quality. Institutional traders use VWAP to measure trade performance. Buying below VWAP indicates favorable execution. Selling above VWAP demonstrates profitable timing.

What is VWAP in stock market analysis? Dynamic reference line showing volume weighted average price. VWAP trading provides edge through volume analysis. Crypto markets adopted VWAP for 24/7 trading optimization.

VWAP represents smart money's average cost basis. Traders use VWAP to identify fair value zones. Price action around VWAP reveals institutional positioning. VWAP indicator shows where volume concentration occurs.

VWAP represents smart money's average cost basis. Traders use VWAP to identify fair value zones. Price action around VWAP reveals institutional positioning. VWAP indicator shows where volume concentration occurs.

The Significance of Volume in VWAP Calculation

Volume component makes VWAP superior to simple price averages. Trading volume reveals market participant conviction. High-volume price movements carry more significance than low-volume changes.

VWAP in stock market analysis accounts for actual transaction sizes. Large institutional orders impact VWAP significantly. Small retail trades barely register in calculation. Volume weighting creates accurate price representation.

Volume and price relationship determines market strength. Price movements supported by high volume confirm trends. Low-volume price changes often reverse quickly. VWAP filter separates noise from genuine price action.

Smart money concept emerges through volume analysis. Institutional investors create significant volume footprints. VWAP calculation captures these large transaction effects. Retail traders benefit from institutional execution data.

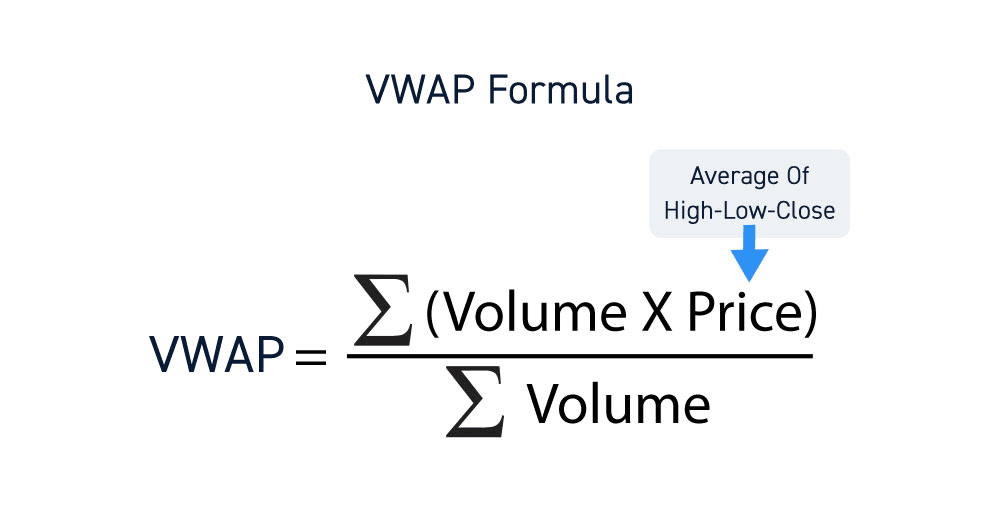

How to Calculate VWAP: Breaking Down the Formula

Understanding VWAP calculation enhances trading decision-making across all markets. Modern platforms calculate VWAP automatically. VWAP formula combines typical price with volume data. Manual calculation deepens understanding of indicator mechanics.

Calculate VWAP through systematic process. Typical price represents each period's average. Volume tracking accumulates throughout session. Cumulative values produce running VWAP calculation.

Calculate VWAP through systematic process. Typical price represents each period's average. Volume tracking accumulates throughout session. Cumulative values produce running VWAP calculation.

Data is used to calculate running VWAP value continuously. Calculate the VWAP by maintaining cumulative volume and price-volume products. VWAP formula: Cumulative (Price × Volume) ÷ Cumulative Volume

Standard VWAP vs. Anchored VWAP Calculation

Standard VWAP resets at the start of every new trading session. Anchored VWAP allows custom starting points. Traders anchor VWAP to significant market events. Major earnings announcements or economic releases create natural anchor points.

Anchored VWAP provides flexible analysis periods. The start of every new trading day creates a standard VWAP reset. Anchor points remain fixed until manually adjusted. Multiple anchored VWAPs reveal different timeframe perspectives.

Crypto anchored VWAP addresses 24/7 market challenges. Traditional session breaks don't apply to cryptocurrency markets. Anchored VWAP creates artificial sessions for analysis. Bitcoin traders anchor VWAP to major news events.

VWAP Trading Strategy: Practical Applications for Day Traders

Successful VWAP trading requires systematic approach and disciplined execution. Professional traders develop rule-based VWAP systems. Combining VWAP with volume analysis improves decision quality. VWAP day trading focuses on intraday price action.

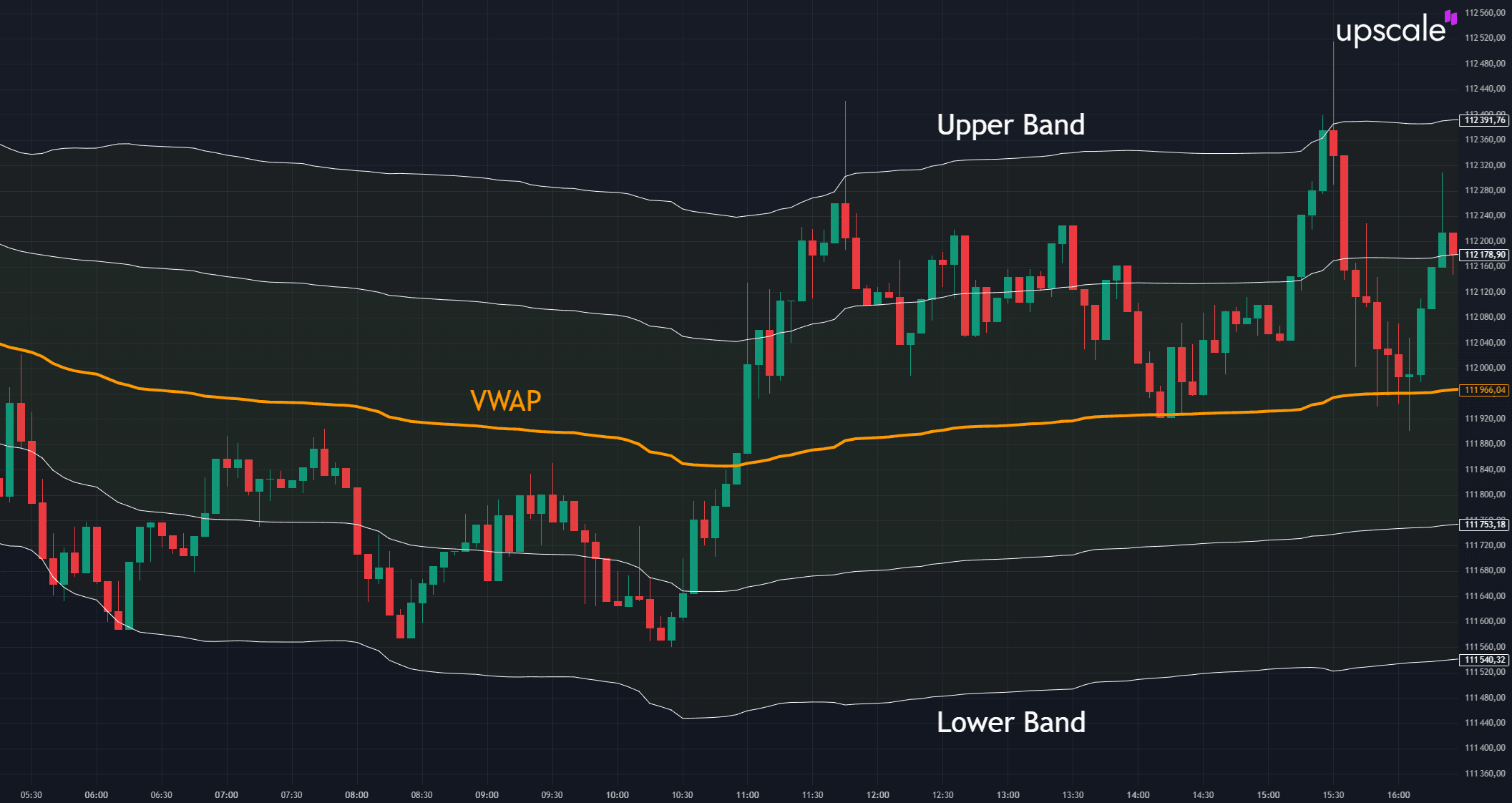

VWAP trading strategy centers on price-volume relationship analysis. VWAP trading provides multiple entry and exit signals. Trend direction relative to VWAP guides position bias. VWAP bands extend analysis beyond single reference line.

VWAP intraday strategy focuses on session-based analysis. Trading strategy selection depends on market volatility. Trending markets allow VWAP breakout trading. Range-bound conditions favor mean reversion approaches.

Using VWAP as Support and Resistance Levels

VWAP functions as dynamic support and resistance throughout trading sessions. Price goes above the VWAP during bullish conditions. Support forms at VWAP during pullbacks. Resistance develops when price approaches VWAP from below.

How to use VWAP as a decision-making tool involves multiple confirmations. Support and resistance levels strengthen with repeated tests. Volume analysis confirms VWAP level significance. Multiple timeframe VWAP adds conviction.

Price action around VWAP reveals market sentiment. Bullish markets maintain price above VWAP consistently. Bearish conditions keep price below VWAP. Consolidation periods show price oscillating around VWAP.

Entry & Exit Strategies Using VWAP

Entry and exit timing improves through systematic VWAP analysis. Taking long positions above VWAP in uptrends. Short positions below VWAP during downtrends. Mean reversion trades target VWAP from extremes.

VWAP entry signals include volume confirmation requirements. Long position entries require VWAP support hold. Short entries need VWAP resistance rejection. Stop-loss placement below/above VWAP manages risk.

VWAP profit targets use statistical analysis for optimal exits. Crypto entry signals around VWAP provide high probability setups. Bitcoin VWAP trading combines with momentum indicators. Exit strategies adapt to market volatility levels.

VWAP vs. Other Moving Averages: Key Differences

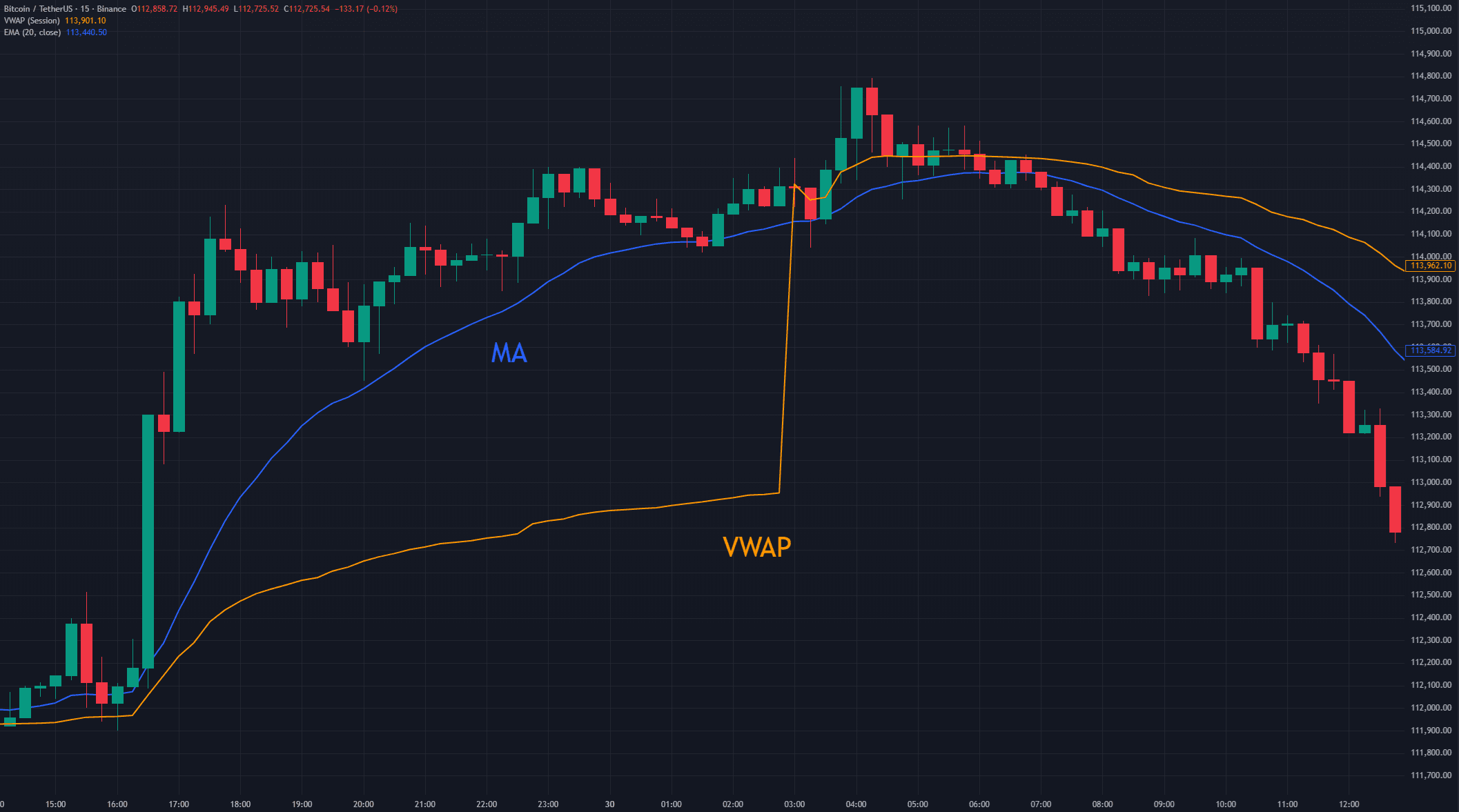

VWAP indicator differs fundamentally from traditional moving averages through volume weighting. Simple moving average treats all periods equally. Volume weighted average price prioritizes high-volume periods. This distinction creates superior intraday analysis.

VWAP vs traditional indicators shows superior intraday performance. Simple moving average calculations ignore transaction sizes. VWAP calculation incorporates actual trading volume. Exponential moving average adds recent price emphasis but lacks volume integration.

Moving average lines lag price action during volatile periods. VWAP line responds dynamically to volume changes. Price and volume relationship captured in single indicator. VWAP bands add statistical analysis capabilities.

Moving average lines lag price action during volatile periods. VWAP line responds dynamically to volume changes. Price and volume relationship captured in single indicator. VWAP bands add statistical analysis capabilities.

When to Use Each Indicator

When to use VWAP depends on the trading timeframe and objectives. VWAP timeframes work best for intraday analysis. Moving averages suit longer-term trend identification. Multiple indicator combinations improve overall analysis.

Indicator selection follows a systematic decision-making process. Indicator is used based on specific trading goals. VWAP suits day trading and scalping approaches. Simple moving average works for swing trading timeframes.

VWAP excels during high-volume trading sessions. SMA works better for longer-term trend identification. Exponential moving average balances recent price emphasis. Weighted moving average offers customizable sensitivity.

Used by traders for different analytical purposes. May use VWAP for execution benchmarking. Trader may prefer moving averages for trend following. Combining indicators creates robust analysis framework.

Common Mistakes to Avoid When Trading with VWAP

VWAP trading mistakes stem from misunderstanding the indicator's intraday limitations. VWAP pitfalls include over-reliance on single indicator signals. Multi-day VWAP analysis produces misleading signals. Understanding VWAP constraints prevents costly errors.

How to use VWAP indicator correctly requires recognizing its constraints. VWAP trading works best during active trading sessions. Low-volume periods reduce VWAP reliability significantly. Combining VWAP with other indicators improves accuracy.

Common errors include over-relying on VWAP signals. Trading Activity levels must support VWAP interpretation. Volume confirmation strengthens VWAP analysis. Market context determines VWAP signal validity.

Not Understanding VWAP's Intraday Limitation

VWAP limitations include daily reset functionality. VWAP intraday only application prevents multi-day analysis. Overnight gaps disrupt VWAP calculation continuity. Session-based reset creates fresh starting point daily.

VWAP trading day restrictions limit analytical scope. Intraday charts that resets prevent longer-term trend analysis. Moving averages handle multi-day analysis better. Anchored VWAP partially addresses this limitation.

Crypto session management requires different approaches. 24/7 cryptocurrency markets challenge traditional VWAP implementation. Anchored VWAP creates artificial sessions for analysis. Custom reset periods adapt to crypto trading patterns.

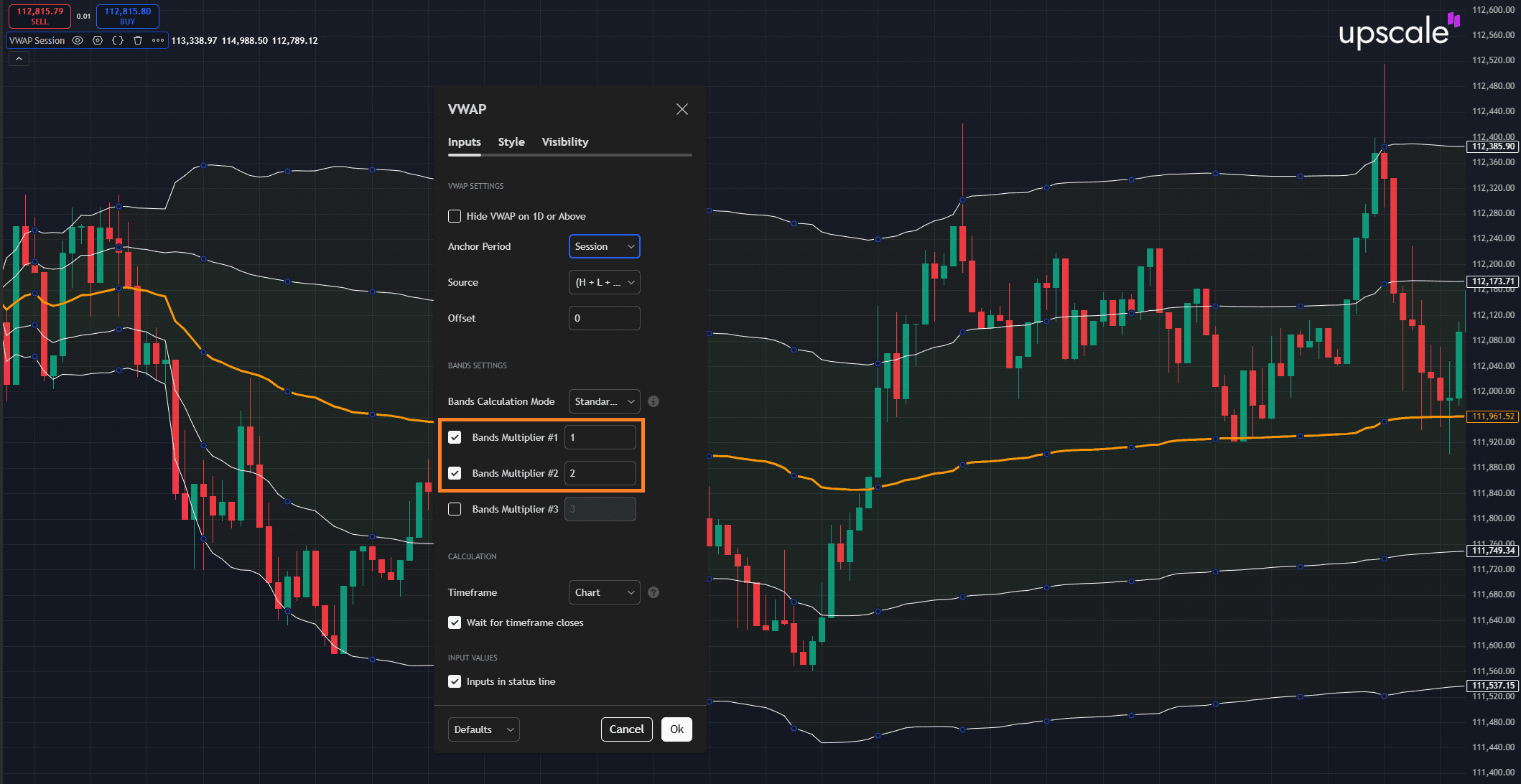

Best VWAP Settings for Day Trading Success

Optimal VWAP configuration adapts to specific market conditions and trading objectives. Best VWAP settings balance responsiveness with reliability. Standard settings work across most assets. Customization improves performance for specific instruments.

Price fluctuations in volatile markets need adjusted settings. Indicator to a streaming chart requires real-time data feeds. Platform selection impacts VWAP calculation accuracy. Professional tools provide superior implementation.

VWAP intraday strategy optimization involves testing different configurations. Standard settings work well for major indices. High-frequency trading needs tick-level precision. Swing trading uses broader period calculations.

VWAP intraday strategy optimization involves testing different configurations. Standard settings work well for major indices. High-frequency trading needs tick-level precision. Swing trading uses broader period calculations.

Recommended configurations vary by asset class:

- Large-cap stocks: Standard daily VWAP

- Small-cap stocks: Volume threshold filters

- Major cryptocurrencies: Extended session anchoring

- Altcoins: Higher deviation tolerances

- Forex pairs: Session-specific calculations

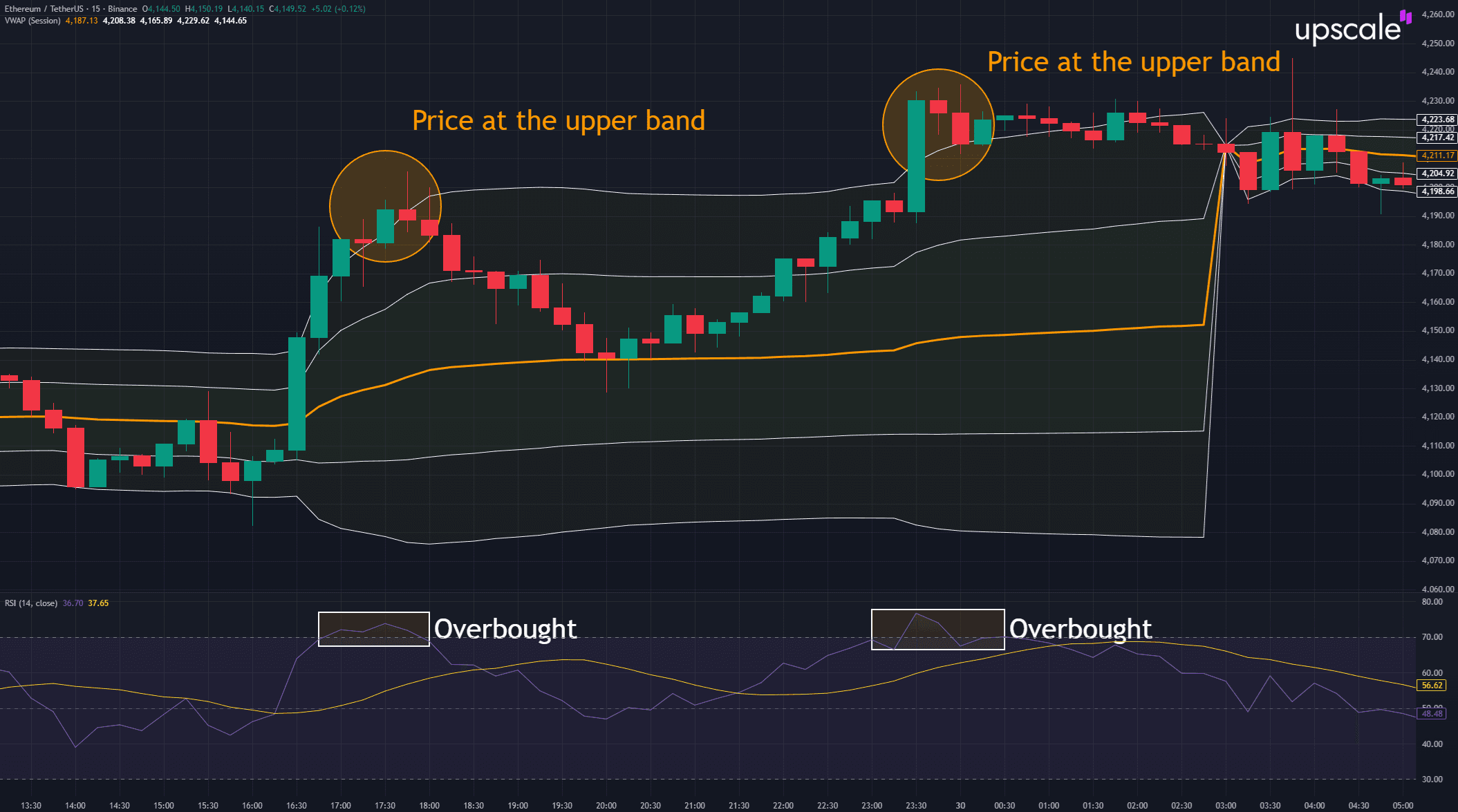

Combining VWAP with Other Indicators for Enhanced Trading

VWAP combinations with complementary indicators filter false signals and improve trade timing. VWAP and RSI combination identifies overbought oversold conditions. VWAP with volume profile reveals price acceptance zones. Multiple indicator confirmation reduces trading errors.

VWAP confirmation indicators include momentum oscillators and moving averages. Momentum indicators like RSI validate VWAP signals. Volume analysis confirms price action legitimacy. Moving average crossovers add trend context.

VWAP with moving averages creates a robust signal confirmation system. Multiple timeframe analysis improves decision quality. Combining volume profile with VWAP enhances support resistance identification. Professional trading systems integrate multiple technical tools.

VWAP with moving averages creates a robust signal confirmation system. Multiple timeframe analysis improves decision quality. Combining volume profile with VWAP enhances support resistance identification. Professional trading systems integrate multiple technical tools.

VWAP in Cryptocurrency Markets: 24/7 Trading Considerations

Cryptocurrency VWAP trading requires adaptations for continuous market operations. Crypto VWAP analysis lacks traditional session breaks. Anchored VWAP creates meaningful analysis periods. Bitcoin trading volume patterns differ from traditional markets.

24/7 VWAP analysis uses anchored calculations for meaningful periods. Bitcoin VWAP and Ethereum VWAP follow similar implementation principles. Major crypto events create natural anchor points. Volume patterns vary across global trading sessions.

Digital assets exhibit unique volume patterns throughout global sessions. Crypto exchanges provide continuous liquidity. Asian, European, and American session overlaps create volume spikes. VWAP calculation captures these regional patterns effectively.

Building Your VWAP Trading System

Systematic VWAP implementation requires structured approach combining technical analysis with risk management. VWAP system development follows disciplined methodology. Backtesting validates strategy effectiveness across different market conditions. Live trading refinement optimizes real-world performance.

VWAP day trading success depends on consistent application of proven techniques. VWAP best practices include proper risk management and position sizing. Entry rules based on VWAP signals combined with volume confirmation. Exit strategies use both profit targets and stop-losses.

VWAP system components include entry rules, exit criteria, and risk parameters. Crypto VWAP system accounts for 24/7 market operations. Professional platforms provide real-time VWAP calculation and alerts. Risk management preserves capital during inevitable losing periods.

Visit Upscale.trade for professional trading infrastructure optimized for VWAP-based strategies across crypto and traditional markets. Access institutional-grade execution, real-time data, and comprehensive trading tools.

FAQ

What is the VWAP indicator and how does it work?

VWAP indicator calculates volume weighted average price throughout trading sessions. Volume weighted average price reflects institutional execution levels. VWAP works by combining typical price with volume data. Traders use VWAP to gauge fair value and execution quality.

How is VWAP calculated?

Calculate VWAP using typical price multiplied by volume for each period. VWAP formula divides cumulative price-volume product by cumulative volume. Data is used to calculate continuously throughout trading session. Modern platforms perform VWAP calculation automatically.

How can traders use VWAP for entry and exit strategies?

Traders use VWAP as dynamic support and resistance levels. Used by traders for timing entries near VWAP during pullbacks. Exit strategies involve profit targets at standard deviation bands. VWAP crossovers signal potential trend changes.

What are the limitations of the VWAP indicator?

VWAP is used for intraday analysis only due to daily reset functionality. Trading session limitations prevent multi-day trend analysis. Low-volume periods reduce VWAP reliability. Cryptocurrency markets require anchored VWAP adaptations.

How does VWAP differ from Simple Moving Average?

VWAP incorporates volume weighting while moving average line treats all periods equally. Average price calculation differs fundamentally between indicators. VWAP responds to volume changes dynamically. Simple moving average ignores transaction size completely.