Crypto Bull Run Guide: Timing, Indicators & Winning Strategies

Crypto Bull Run Guide: Timing, Indicators & Winning Strategies

Understanding crypto bull runs transforms chaos into opportunity. These periods create life-changing wealth for prepared investors. This guide reveals how to identify, navigate, and profit from the next major market surge.

⚠️ Important Disclaimer: This article analyzes historical cryptocurrency market patterns and cycles. While these patterns provide valuable frameworks for understanding market behavior, past performance never guarantees future results. Cryptocurrency markets remain highly volatile, unpredictable, and subject to regulatory changes. Each bull run cycle brings unique characteristics, external factors, and market conditions. The information presented here is educational and should not be considered financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

What is a Crypto Bull Run Meaning?

A crypto bull run represents sustained upward price momentum across digital assets. Markets rally for months. Optimism spreads like wildfire through trading communities.

The bull run meaning extends beyond simple price increases. Bitcoin often gains over 1,000% during these periods. The entire market capitalization can grow five to ten times. Volume builds gradually throughout the cycle.

True bull markets last between 12 and 18 months typically. They differ fundamentally from temporary price spikes. Market sentiment indicators like the Fear and Greed Index consistently read above 70. Capital flows steadily into crypto assets.

Key Takeaways:

- Definition: Sustained period of rising cryptocurrency prices with widespread market optimism

- Duration: Typically 12-18 months from accumulation to peak

- Bitcoin Performance: Historical gains exceeding 1,000% per cycle

- Market Growth: 5-10x increase in total market capitalization

- Sentiment: Fear and Greed Index readings consistently above 70

Market cycles follow predictable patterns. Smart money accumulates during bear markets. Retail investors enter during markup phases. Understanding these phases separates successful traders from the crowd.

Bull runs create opportunities across all market participants. Experienced traders scale positions strategically. Newcomers often chase momentum late in cycles. The difference between these approaches determines long-term success.

The Psychology Behind Bull Markets

Market psychology drives bull run dynamics more than fundamentals alone. The Fear and Greed Index measures collective emotions on a 0-100 scale. Bull markets typically show readings between 70 and 100.

During 2017's peak, the index hit extreme greed levels. Social media amplified every gain. New investors entered daily. FOMO (fear of missing out) dominated decision-making across retail traders.

The same pattern repeated in 2021. Bitcoin reached new all-time highs. Altcoins surged exponentially. Everyone became a crypto expert overnight.

These emotional shifts create both opportunity and danger. Disciplined traders recognize when euphoria reaches unsustainable levels. They protect gains while others chase tops.

Bull vs Bear Markets in Crypto

Bull and bear markets represent opposite sides of market cycles. Each phase exhibits distinct characteristics. Recognizing these differences protects capital and maximizes gains.

Bull Market Characteristics:

- Sustained uptrend lasting 12-18 months

- Gradually increasing volume with peaks at cycle tops

- Fear and Greed Index above 70 consistently

- Positive news dominates headlines

- New projects launch successfully

- Retail participation increases steadily

Bear Market Characteristics:

- Extended downtrend spanning 12-24 months

- Declining volume throughout the cycle

- Fear and Greed Index below 30

- Negative sentiment prevails

- Project failures make headlines

- Retail investors exit markets

The accumulation phase marks bear market endings. Smart money recognizes value before crowds. Prices consolidate near cycle lows. Volume remains relatively low.

Markup phases define bull markets. Public awareness grows. FOMO intensifies. Prices accelerate dramatically. This phase generates the largest gains.

Historical Crypto Bull Run History

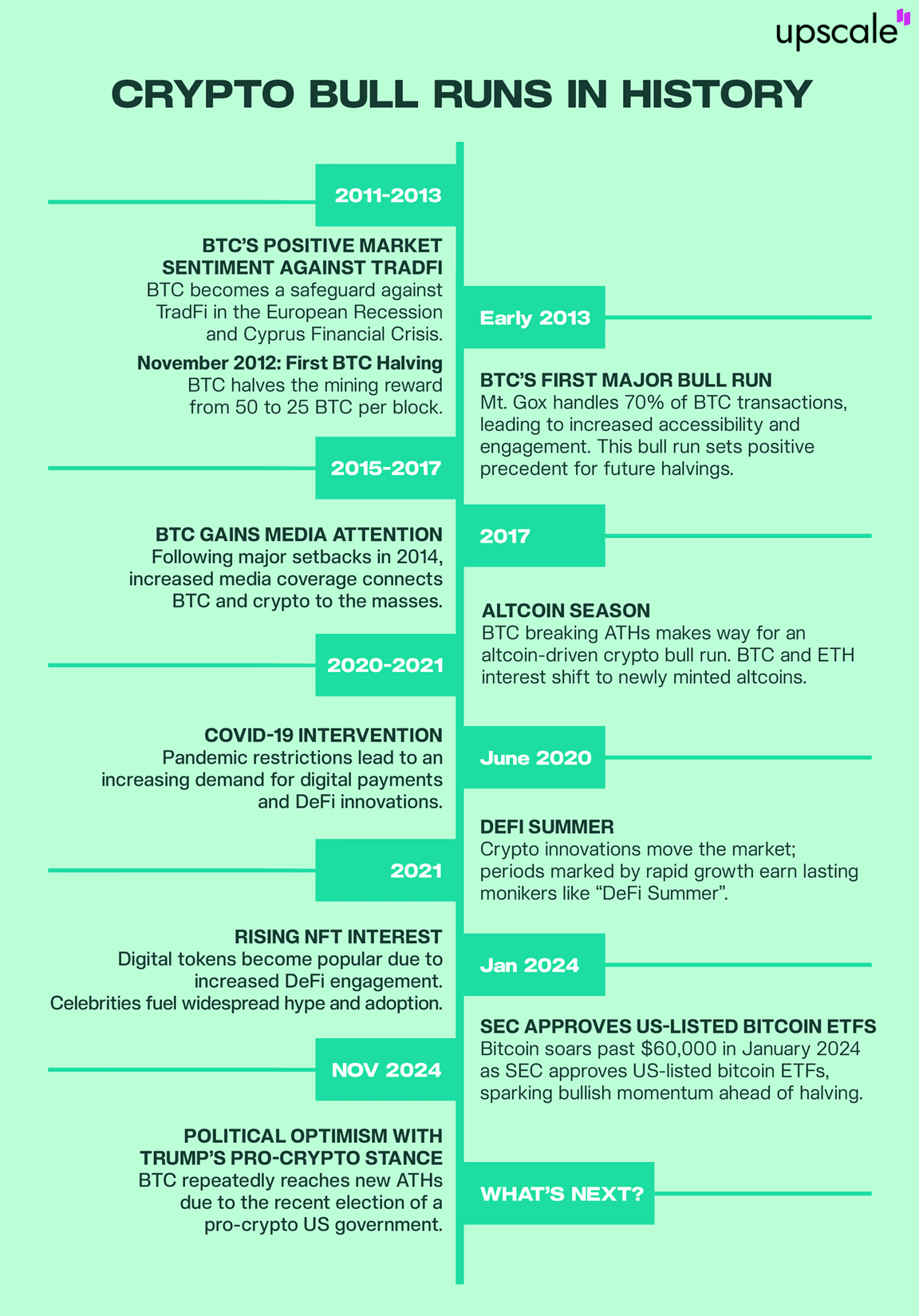

Cryptocurrency markets have experienced three major bull runs since Bitcoin's creation. Each cycle followed similar patterns. Each exceeded previous peaks dramatically. Studying crypto bull run history reveals consistent patterns.

The 2013 bull run saw Bitcoin surge from $13 to $1,100. The Cyprus banking crisis drove adoption. Media coverage intensified. Retail interest exploded. This early crypto bull run history established foundational patterns.

The 2013 bull run saw Bitcoin surge from $13 to $1,100. The Cyprus banking crisis drove adoption. Media coverage intensified. Retail interest exploded. This early crypto bull run history established foundational patterns.

2017's cycle proved even more spectacular. Bitcoin climbed from $1,000 to $20,000. ICOs (initial coin offerings) raised billions. Ethereum enabled smart contract platforms. Altcoins delivered life-changing returns.

The 2021 bull run marked institutional arrival. Bitcoin reached $69,000. Ethereum hit $4,800. The total crypto market cap exceeded $3 trillion. DeFi and NFTs captured mainstream attention.

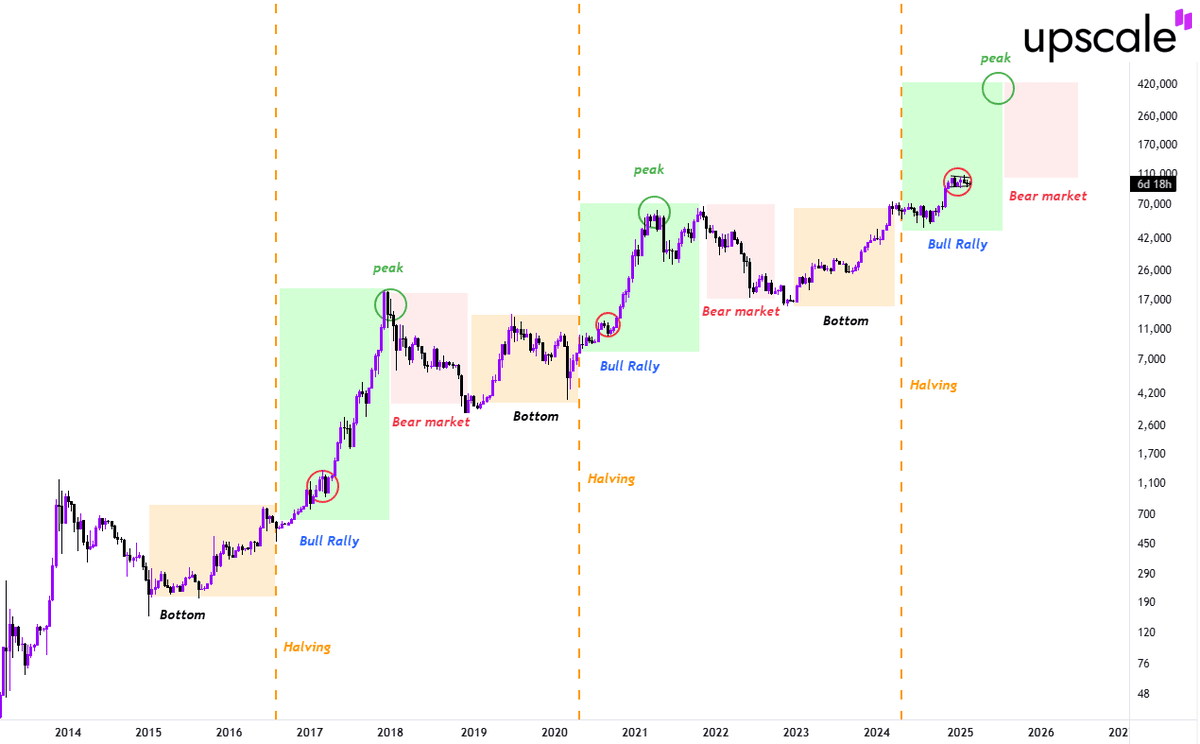

Bitcoin halving events preceded each major bull run. These programmed supply reductions occur every four years. They cut new Bitcoin issuance by 50%. Supply shock dynamics then drive price appreciation.

The 2012 halving preceded the 2013 bull run. The 2016 halving led into 2017's surge. The 2020 halving sparked 2021's rally. This pattern creates predictable timing frameworks.

However, correlation does not guarantee causation. While historical patterns show consistent relationships between halvings and bull runs, numerous other factors influence market outcomes. Economic conditions, regulatory developments, technological changes, and global events all play crucial roles. Future cycles may deviate from historical norms.

Each cycle attracted larger participant bases. 2013 drew tech enthusiasts. 2017 brought retail traders. 2021 welcomed institutions. The next cycle promises even broader adoption.

Learning from past cycles improves future positioning. Early accumulation during bear markets yields maximum returns. Patient holding through volatility preserves gains. Strategic exits near cycle peaks protect capital.

Learning from past cycles improves future positioning. Early accumulation during bear markets yields maximum returns. Patient holding through volatility preserves gains. Strategic exits near cycle peaks protect capital.

The 2021 Bull Run Case Study

The 2021 bull run demonstrated crypto's maturation. Institutional adoption reached critical mass. MicroStrategy accumulated over 100,000 Bitcoin. Tesla added Bitcoin to the corporate treasury. Square (now Block) made significant purchases.

These corporate moves validated cryptocurrency as legitimate assets. Traditional finance could no longer ignore digital currencies. Bitcoin ETF applications multiplied. Regulatory frameworks began taking shape.

Ethereum's ecosystem exploded during this cycle. DeFi protocols locked billions in value. NFT marketplaces processed record volumes. Layer-2 solutions addressed scalability challenges. The entire blockchain infrastructure evolved rapidly.

The cycle peaked in November 2021. Bitcoin reached $69,000. Market sentiment hit extreme greed. Leverage ratios climbed dangerously high. Warning signs accumulated for observant traders.

When Do Bull Runs End?

Recognizing bull market endings preserves hard-earned gains. Several reliable indicators signal approaching tops. Smart money begins exiting positions. Retail enthusiasm reaches fever pitch.

The Fear and Greed Index typically peaks between 90 and 100. Extreme greed readings warn of reversals. Historical data confirms this pattern across all major cycles.

Trading volume characteristics shift noticeably. Climax volume occurs at tops. Buying exhaustion follows. Subsequent rallies show declining participation. These technical signals provide actionable warnings.

Distribution phases unfold gradually at first. Smart money sells into strength. Prices continue rising temporarily. Eventually momentum fails. Sharp corrections begin.

Market cycle phases provide strategic frameworks. Accumulation occurs at bottoms. Markup defines bull markets. Distribution marks tops. Markdown completes the cycle. Understanding current phase positioning improves decision-making dramatically.

On-chain metrics reveal institutional behavior. Large transactions increase during distribution. Exchange inflows surge. Realized profits hit extremes. These data points confirm cycle positioning.

Successful traders prepare exit strategies long before tops. They scale out systematically. They avoid timing exact peaks. They preserve capital for next cycle accumulation.

Key Indicators of an Approaching Bull Run

Identifying early bull market signals creates significant advantages. Multiple indicators confirm emerging trends. Combining signals improves accuracy substantially.

Bitcoin halving events provide primary timing catalysts. The next halving occurred in April 2024. Historical patterns suggest bull markets begin 12-18 months post-halving. This framework guides strategic positioning.

Accumulation phase characteristics signal bull run approaches. Smart money enters quietly. Prices consolidate near cycle lows. Volume remains subdued. Retail interest stays minimal.

Fear and Greed Index readings offer sentiment insights. Extended periods below 20 indicate extreme fear. These zones historically mark excellent entry points. Transitioning from fear toward neutral suggests cycles turning.

On-chain metrics validate emerging trends. Bitcoin accumulation by long-term holders increases. Exchange balances decline as coins move to cold storage. Network fundamentals strengthen progressively.

Technical Signals to Watch For

Technical analysis provides concrete, observable signals. Chart patterns reveal market psychology. Price action reflects all available information.

Golden crosses mark powerful bullish signals. This occurs when the 50-day moving average crosses above the 200-day. Historical data confirms reliability across crypto markets.

Higher lows on weekly and monthly charts demonstrate strengthening momentum. Each correction finds support at elevated levels. This pattern validates underlying demand.

Volume analysis confirms price movements. Genuine bull runs show gradually increasing volume. Explosive volume spikes mark acceleration phases. Declining volume during rallies signals false moves.

The Connection Between Bitcoin Bull Run and Altcoin Performance

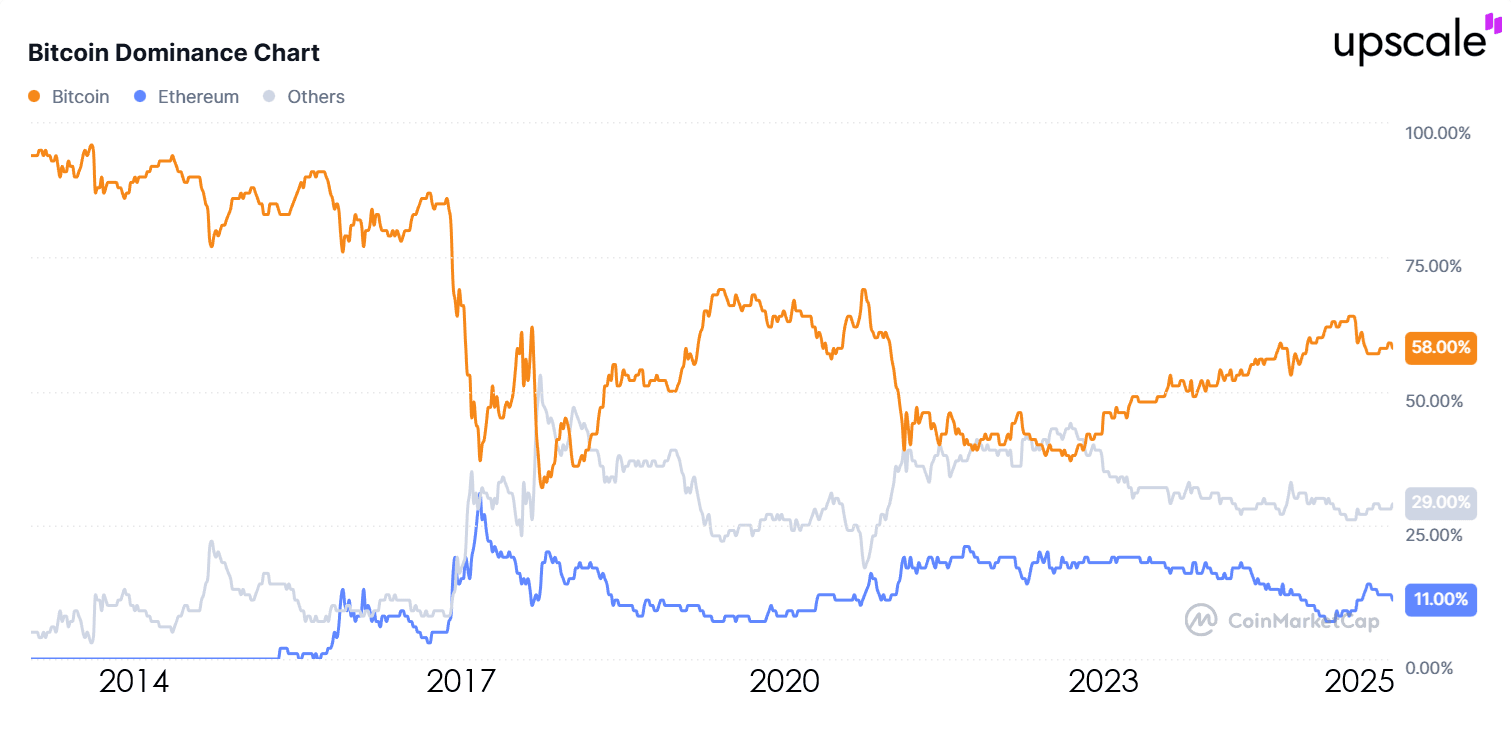

Bitcoin dominates cryptocurrency markets fundamentally. Its price movements influence all digital assets. Understanding this relationship optimizes portfolio allocation. Every bitcoin bull run creates predictable patterns.

Bitcoin typically leads bull market rallies initially. Capital flows into the most established cryptocurrency first. Risk-averse investors seek relative safety. Bitcoin's liquidity and recognition attract initial attention. The bitcoin bull run momentum then spreads to altcoins.

As Bitcoin rallies extend, profits rotate into altcoins. Traders seek higher percentage gains. Ethereum often benefits next as the second-largest cryptocurrency. Then capital spreads across smaller market cap projects.

This rotation pattern creates altcoin season. Smaller cryptocurrencies outperform Bitcoin dramatically. 3-5x multipliers above Bitcoin's gains become common. High-risk, high-reward opportunities multiply.

Understanding Altcoin Season

The altcoin season represents the most explosive bull market phase. Bitcoin's initial rally attracts attention. Profits then chase higher percentage gains elsewhere.

Timing altcoin season entries proves crucial. Too early means underperforming Bitcoin. Too late means buying near cycle peaks. Monitoring Bitcoin dominance charts helps identify transitions.

Performance multipliers during altcoin seasons exceed normal market behavior. 10x, 50x, even 100x gains occur regularly. Smaller market caps allow parabolic moves. This creates both opportunity and danger.

Performance multipliers during altcoin seasons exceed normal market behavior. 10x, 50x, even 100x gains occur regularly. Smaller market caps allow parabolic moves. This creates both opportunity and danger.

Strategies to Capitalize During the Next Bull Run Crypto

Successful bull market navigation requires systematic approaches. Emotional decision-making destroys capital. Strategic frameworks preserve it. Understanding bull run crypto dynamics separates winners from losers.

Position building during accumulation phases provides optimal entries. Dollar-cost averaging reduces timing risk. Accumulating quality assets at cycle lows maximizes eventual returns. Patient capital captures full bull market gains when the next bull run crypto begins.

Portfolio allocation balances risk and reward. Bitcoin provides relative stability. Major altcoins like Ethereum offer enhanced upside. Selected smaller projects provide lottery tickets. Diversification across market caps spreads risk intelligently.

Entry timing uses technical and fundamental signals. Waiting for confirmation reduces false starts. Multiple indicator confluence increases probability. Strategic patience beats impulsive trading consistently.

Position sizing adapts to risk profiles. Conservative allocations favor Bitcoin and major altcoins. Aggressive approaches include more speculative positions. No single strategy suits all investors. Personal risk tolerance determines optimal allocation.

At Upscale.trade, we understand that timing and execution are everything during crypto bull runs. As a leading crypto prop trading platform, we bring together capital, AI-powered analytics, and precision execution tools in one comprehensive solution. When you trade with a funded account from UpscaleTrade, you get the capital to maximize bull market opportunities, advanced tools to identify optimal entry and exit points, and transparent terms that align our success with yours. Our platform helps you implement the systematic strategies discussed here while managing risk effectively throughout the cycle.

Strategy Approaches Based on Risk Tolerance

| Risk Level | Bitcoin Allocation | Major Altcoins | Small Cap Altcoins | Strategy Focus |

|---|---|---|---|---|

| Conservative | 70% | 25% | 5% | Capital preservation with steady growth |

| Moderate | 50% | 35% | 15% | Balanced growth with managed risk |

| Aggressive | 30% | 40% | 30% | Maximum growth potential |

Creating a Bull Market Exit Strategy

Exit strategies separate successful traders from the rest. Greed destroys more capital than fear. Predetermined targets enable disciplined execution.

Percentage-based profit taking provides systematic approaches. Sell 20% at 2x. Sell 20% more at 3x. Continue scaling systematically. This method captures gains while maintaining exposure.

Time-based exits consider cycle positioning. Historical patterns show 12-18 month bull markets. Approaching these timeframes suggests reducing exposure. Cycle awareness trumps price targeting alone.

Market sentiment indicators guide exit timing. Fear and Greed Index above 90 warns of tops. Extreme euphoria in social media signals danger. Smart money exits when retail rushes in.

Technical analysis identifies distribution phases. Volume characteristics change noticeably. Momentum indicators diverge bearishly. Support levels begin failing. These signals confirm cycle endings.

Current Analysis: Where Are We in the Crypto Next Bull Run Cycle?

Market analysis requires combining multiple frameworks. Current positioning determines optimal strategies. Understanding the cycle phase guides decision-making.

The April 2024 Bitcoin halving marked a crucial milestone. Historical patterns suggest bull markets accelerate 12-18 months post-halving. This framework places potential peak timing in late 2025 or early 2026.

Current Fear and Greed Index readings show moderate sentiment. Neither extreme fear nor extreme greed dominates. This neutral positioning suggests accumulation or early markup phase. Historical context supports this assessment.

Institutional adoption continues progressing. Bitcoin ETFs attracted billions in assets. Major financial institutions offer crypto services. Regulatory frameworks improve globally. These developments support a longer-term bullish thesis.

Technical analysis shows constructive patterns. Bitcoin consolidated after reaching new all-time highs. Altcoins demonstrate relative strength. Volume patterns suggest accumulation continues. Market structure supports bullish outlook.

Current positioning suggests an early-to-mid bull market phase. Significant upside potential remains. Corrections will occur inevitably. Long-term trajectory points upward. Strategic patience rewards prepared investors.

Common Mistakes to Avoid in a Bull Run in Stock Market and Crypto

Bull markets create both opportunity and danger. Common mistakes repeat across all cycles. Avoiding these errors preserves capital and maximizes returns.

FOMO (Fear of Missing Out) drives poor decisions. Chasing pumps near cycle peaks destroys capital. Buying after exponential moves guarantees losses. Emotional purchases rarely work. Discipline beats impulse consistently.

Overleveraging amplifies both gains and losses. Leverage works until it doesn't. One bad move liquidates entire positions. Bull markets create false confidence. Conservative leverage protects capital long-term.

Ignoring diversification concentrates risk dangerously. Single-asset concentration creates vulnerability. One project failing wipes out gains. Spreading risk across quality assets reduces exposure. Smart diversification balances concentration and protection.

Neglecting profit-taking leads to giving back gains. Paper profits disappear quickly. Systematic selling preserves real wealth. Greed convinces holders to wait for more. Markets punish this mindset eventually.

Following social media hype creates bagholders. Promoted coins dump after influencers sell. Due diligence beats tips consistently. Research-based decisions outperform hype-driven purchases. Think independently or pay the price.

Ignoring tax implications reduces net returns. Strategic selling considers tax efficiency. Timing transactions optimizes tax treatment. Professional advice saves money long-term. Planning ahead beats scrambling later.

Trading without stop-losses invites disaster. Unexpected crashes occur regularly. Protective orders limit downside. Small losses beat catastrophic ones. Risk management separates professionals from gamblers.

Looking Ahead: Predictions for the Next Crypto Bull Run

⚠️ Disclaimer: The following represents analytical frameworks based on historical patterns, not guarantees or financial advice. Market conditions change. External factors influence outcomes unpredictably. Use this information as one data point among many in your research.

Forward-looking analysis combines historical patterns with current developments. While nobody predicts perfectly, frameworks improve probability. This crypto bull run prediction synthesizes multiple data sources.

The April 2024 Bitcoin halving established primary timing catalyst. Historical patterns suggest peak timing in late 2025 through early 2026. This framework guides strategic positioning currently. Many crypto bull run prediction models point to similar timeframes.

Institutional adoption will accelerate throughout this cycle. More ETFs will launch globally. Major banks will expand crypto services. Regulatory clarity will improve. These developments support sustainable growth.

Bitcoin should lead initially as always. $100,000 marks psychological resistance. $150,000 becomes achievable during peak euphoria. Conservative estimates suggest 2-3x from current levels. Aggressive scenarios project higher.

Ethereum's ecosystem maturation drives strong performance. Scaling solutions improve dramatically. Real-world adoption increases. DeFi and NFTs continue evolving. ETH could reach the $8,000-$12,000 range.

The altcoin season will create spectacular opportunities. DeFi platforms with genuine utility will shine. Gaming and metaverse projects could explode. Infrastructure plays provide lower-risk exposure. Due diligence remains essential.

Macro factors influence crypto more than ever. Central bank policies affect risk appetite. Inflation concerns drive alternative assets. Geopolitical tensions highlight decentralization value. Broader context matters increasingly.

Technology improvements support long-term thesis. Layer-2 solutions address scalability. Interoperability improves. User experience gets better. Real-world utility increases. Fundamentals strengthen progressively.

Cycle characteristics may differ from the past. Institutional participation provides stability. Volatility might decrease somewhat. Bull market duration could extend. Previous patterns guide but don't guarantee. Flexibility beats rigid expectations.

FAQ

What is a crypto bull run?

A crypto bull run is a sustained period of rising cryptocurrency prices accompanied by widespread market optimism. These cycles typically last 12-18 months and feature significant capital inflows, increasing trading volume, and positive sentiment indicators. Bitcoin often gains over 1,000% during bull runs, while the entire market capitalization can grow 5-10x from bottom to peak.

When will the next crypto bull run begin?

The next crypto bull run likely began following Bitcoin's April 2024 halving. Historical patterns show bull markets accelerate 12-18 months after halving events. Current market structure, institutional adoption trends, and on-chain metrics suggest we're in early-to-mid bull market phase, with potential peak timing in late 2025 or early 2026.

How long do crypto bull runs typically last?

Crypto bull runs typically last between 12 and 18 months from the initial accumulation phase to the final distribution phase. However, the most explosive gains often occur in the final 6-8 months. The 2013, 2017, and 2021 cycles all followed similar timeframes, though exact durations varied. Understanding cycle timing helps optimize entry and exit strategies.

What are the signs of a crypto bull run?

Key signs include Bitcoin halving events, Fear and Greed Index readings consistently above 70, golden crosses on major moving averages, increasing trading volume, institutional adoption announcements, and strong on-chain metrics showing accumulation. Technical patterns like higher lows, breakouts from consolidation, and bullish divergences also signal emerging bull markets.

How does the Bitcoin halving cycle affect crypto bull runs?

Bitcoin halving events occur every four years and reduce new Bitcoin issuance by 50%. This programmed supply shock creates fundamental catalysts for bull runs. Historical data shows all three major crypto bull runs (2013, 2017, 2021) occurred 12-18 months after halving events. The April 2024 halving positioned the market for the next bull cycle.

Conclusion

Crypto bull runs create extraordinary wealth-building opportunities. Understanding cycle phases, recognizing signals, and implementing systematic strategies maximize returns while managing risk. The next bull run offers similar potential to previous cycles, but only prepared investors capture full gains.