Smart Money Concept: How to Trade Like Institutional Investors in 2025

Smart Money Concept: How to Trade Like Institutional Investors in 2025

Smart Money Concept (SMC) represents a fundamental shift in how retail traders approach financial markets. Unlike traditional technical analysis that relies on lagging indicators like moving averages or RSI, SMC trading focuses on reading institutional order flow and understanding how large market participants manipulate price before executing their positions. This methodology teaches traders to identify the footprints that banks, hedge funds, and institutional investors leave in the market through order blocks, liquidity grabs, and fair value gaps.

The core principle behind smart money concept trading centers on a simple reality: institutional investors move markets, while retail traders react to those movements. By learning to recognize where institutions are likely to enter and exit positions, traders gain a significant edge over those using conventional technical analysis. The learning curve for mastering SMC typically spans six to twelve months of dedicated practice, but the methodology proves effective across multiple timeframes from M15 charts up to daily analysis. Success rates with proper risk management consistently fall within the 60-75% range, making SMC one of the most reliable trading frameworks when applied systematically.

Modern trading platforms have made implementing smart money concept strategies more accessible than ever. Traders can now analyze institutional behavior patterns, identify key liquidity zones, and execute precision entries based on order flow analysis. The methodology works equally well across forex pairs, cryptocurrency markets, and traditional stock indices, though each market presents unique characteristics in how institutions operate.

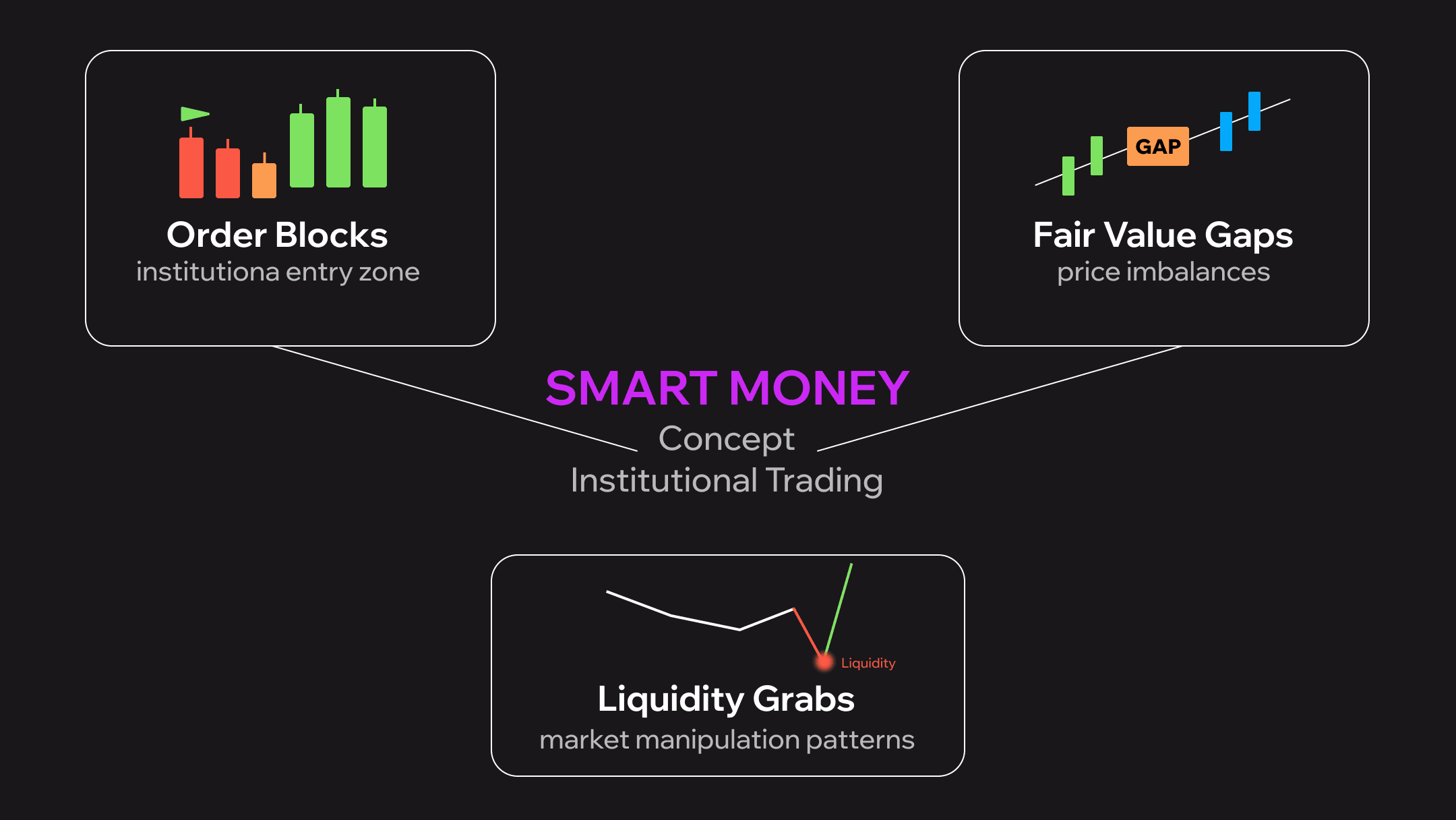

Core Smart Money Concept Components

Understanding the fundamental building blocks of smart money concept creates the foundation for successful institutional-style trading. These components work together to reveal where large market participants have placed their orders and how they intend to move price.

Order Blocks - Institutional Entry Zones

Order blocks represent the last opposing candle before a significant price move and identify areas where institutional orders were placed. When banks and hedge funds enter large positions, they cannot simply execute market orders without causing massive slippage. Instead, they accumulate positions over time, creating distinctive price patterns that SMC traders learn to recognize.

Bullish order blocks form when a down candle is followed by a strong upward move, indicating institutions finished selling and began aggressive buying. Bearish order blocks appear when an up candle precedes a sharp decline, showing where institutions completed their buying before initiating short positions. The key to identifying valid order blocks lies in the impulsive move away from the zone. Institutional orders create explosive price action because of the sheer volume being executed.

Smart money concept order blocks function differently from traditional support and resistance. Rather than zones where price repeatedly bounces, order blocks represent unfilled institutional orders waiting to be matched. When price returns to these zones, institutions add to their positions, creating strong reactions. Traders using platforms with advanced charting capabilities can mark these zones precisely and set alerts for when price approaches, allowing for systematic entry strategies based on institutional behavior rather than lagging technical indicators.

Fair Value Gaps and Market Structure

Fair value gaps emerge when price moves so rapidly that it leaves inefficiencies in the market structure. These gaps appear as spaces on the chart where no trading occurred at certain price levels, creating imbalances that the market typically seeks to fill. In smart money concept methodology, fair value gaps represent areas where institutional orders overwhelmed available liquidity, causing price to jump without normal auction process.

Market structure analysis within SMC focuses on identifying higher highs, higher lows, lower highs, and lower lows to determine trend direction and strength. Break of structure (BOS) occurs when price definitively breaks through a previous high or low, confirming trend continuation. Change of character (ChoCH) happens when price breaks counter to the established trend, signaling potential reversals. These structural breaks often coincide with fair value gaps, as institutions execute large enough orders to both break structure and create price inefficiencies simultaneously.

Understanding how fair value gaps interact with market structure provides traders with high-probability zones for entries. When price pulls back to fill a gap within a bullish market structure, it creates optimal long entry opportunities. Conversely, rallies into bearish fair value gaps during downtrends offer ideal short positions. The combination of structural analysis and gap identification separates smart money concept from basic price action trading.

Liquidity Grabs - Reading Institutional Manipulation

Liquidity grabs represent one of the most powerful concepts in smart money trading methodology. Institutions need substantial liquidity to fill their large orders, and that liquidity sits just beyond obvious support and resistance levels where retail traders place their stop losses. Before making major moves, smart money will often push price beyond these levels to trigger retail stops, creating the liquidity pool they need for their actual positions.

Classic liquidity grab patterns include stop hunts below recent lows in uptrends and raids above recent highs in downtrends. These moves appear designed to shake out retail traders before price reverses sharply in the intended direction. Confirmation signals include rapid reversals on high volume, engulfing candles that reclaim the broken level, and immediate movement back into the prior range. Traders who recognize these patterns avoid getting stopped out and can even enter positions in the direction of the true institutional move.

Smart Money Concept Trading Strategy Framework

Implementing smart money concept trading requires a systematic framework that combines all core components into a coherent strategy. The process begins with multi-timeframe analysis, typically starting on daily or four-hour charts to identify overall market structure and trend direction. Traders mark key order blocks, fair value gaps, and liquidity zones on higher timeframes before drilling down to lower timeframes for precise entries.

Entry rules within the SMC trading framework demand confluence between multiple factors. An ideal entry occurs when price reaches a higher timeframe order block within market structure, creating a fair value gap on the entry timeframe, after sweeping liquidity from obvious levels. This confluence significantly increases probability compared to single-factor entries. Traders wait for confirmation through candlestick patterns, typically seeking engulfing candles or strong closes back into the order block zone before executing positions.

Exit criteria focus on logical profit targets rather than arbitrary risk-reward ratios. The first target typically sits at the next opposing order block or fair value gap, while final targets aim for major liquidity pools beyond obvious highs or lows. Stop losses are placed beyond the order block being traded, accounting for potential liquidity grabs that might occur before the main move. This approach aligns exits with where institutions are likely to take profits rather than using round numbers or fixed percentages that lack market structure context.

Position sizing in smart money concept trading follows institutional risk management principles. Rather than risking fixed percentages on every trade, SMC practitioners scale position sizes based on confluence factors and setup quality. High-confluence setups with multiple confirming factors warrant larger positions, while lower-probability trades receive reduced capital allocation. This variable position sizing approach mirrors how institutional traders allocate capital across opportunities with varying conviction levels.

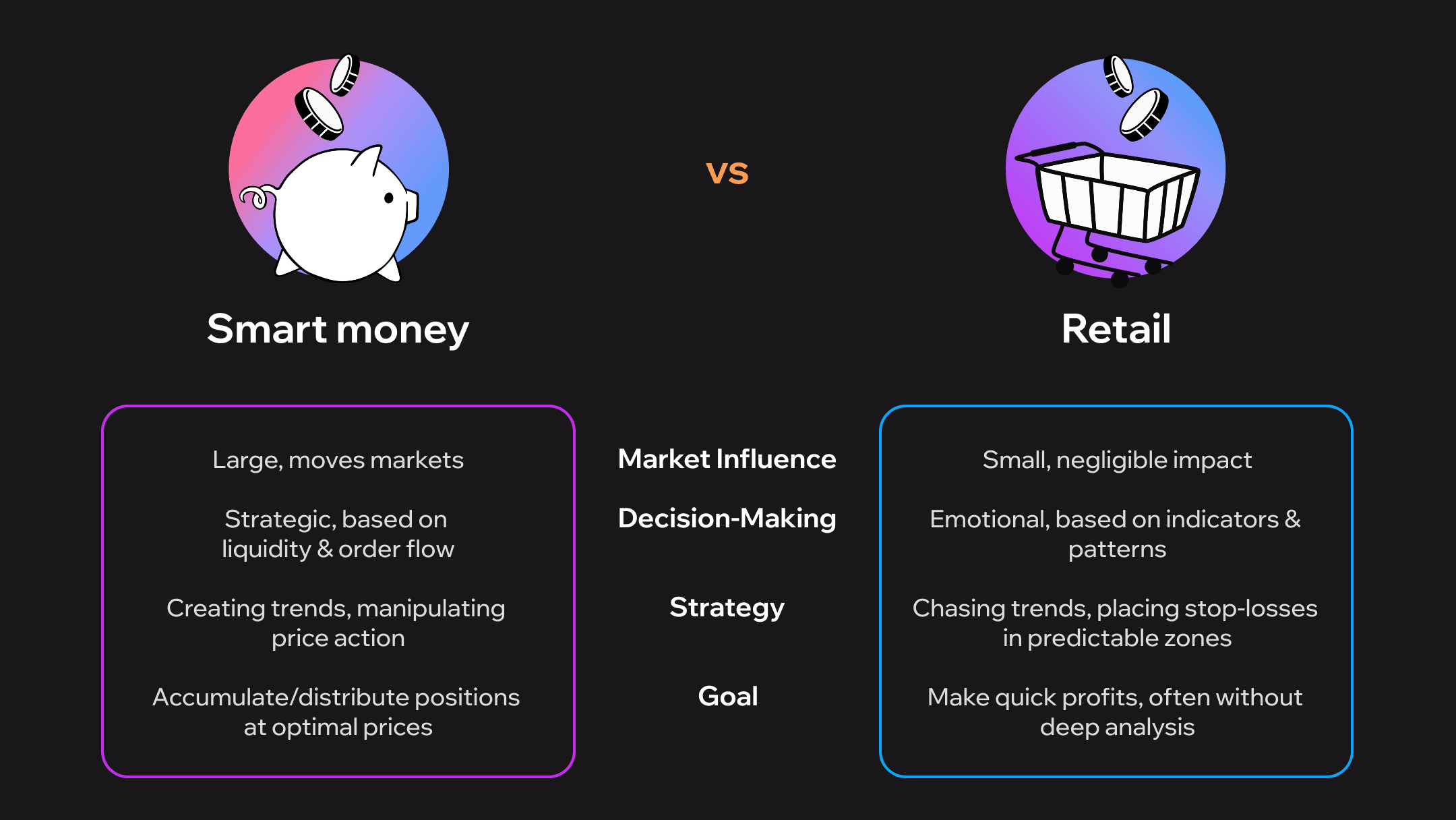

SMC vs Traditional Trading Methods

The distinction between smart money concept and traditional technical analysis extends far beyond simple terminology differences. Traditional trading relies heavily on lagging indicators that calculate values from past price data. Moving averages, MACD, RSI, and similar tools all react to price movements that already occurred, creating inherent delays in signal generation. By the time these indicators trigger entries, institutions have often already positioned themselves and begun taking profits.

The distinction between smart money concept and traditional technical analysis extends far beyond simple terminology differences. Traditional trading relies heavily on lagging indicators that calculate values from past price data. Moving averages, MACD, RSI, and similar tools all react to price movements that already occurred, creating inherent delays in signal generation. By the time these indicators trigger entries, institutions have often already positioned themselves and begun taking profits.

Smart money concept trading operates proactively rather than reactively. By identifying where institutions must go to find liquidity and fill orders, SMC traders position themselves ahead of major moves rather than chasing momentum after it develops. This fundamental difference in approach explains why SMC practitioners often enter positions that appear counterintuitive to traditional technical traders. When conventional analysis shows oversold conditions suggesting bounces, SMC traders recognize liquidity grabs preparing for further declines.

Supply and demand trading represents the closest traditional methodology to smart money concept, as both focus on identifying zones where significant orders exist. However, supply and demand typically treats these zones as static areas where price repeatedly reacts, while SMC recognizes the dynamic nature of institutional order flow. Order blocks represent unfilled orders that institutions actively manage, adjusting positions as market conditions evolve. This nuanced understanding allows SMC traders to distinguish between zones that will hold and those likely to break as institutional sentiment shifts.

The effectiveness gap between methodologies becomes evident in ranging markets where traditional technical analysis struggles. Indicators generate conflicting signals in consolidation, while smart money concept clearly identifies the liquidity zones institutions are targeting and the order blocks they're building positions from. This advantage proves particularly valuable for traders seeking consistency across varying market conditions.

Market-Specific Applications

Smart Money Concept in Forex Trading

Foreign exchange markets provide ideal conditions for smart money concept application due to the massive institutional participation required for currency transactions. Central banks, commercial banks, and multinational corporations constantly execute large currency orders, creating clear order blocks and liquidity patterns. Major pairs like EURUSD, GBPUSD, and USDJPY display particularly clean SMC setups because of the concentrated institutional flow and high liquidity that prevents excessive manipulation.

The forex market's 24-hour nature allows traders to identify institutional order flow across different trading sessions. London and New York sessions typically show the most significant smart money activity, with clear liquidity grabs occurring during session opens as institutions position for the day ahead. Currency pairs often respect order blocks for extended periods because institutional forex positions remain active for days or weeks, creating reliable zones for multiple entry opportunities. Traders implementing smart money concept forex strategies focus on higher timeframe structure while using M15 or M30 charts for entries, aligning with the methodical pace at which institutions build currency positions.

Day Trading with Smart Money Concept

Applying smart money concept to day trading requires adjustments in timeframe focus while maintaining the same core principles of reading institutional behavior. Day traders typically work with M5 to M15 charts for entries while referencing H1 and H4 for structure and order block identification. The faster timeframes demand quicker decision-making, but the advantage comes from catching institutional moves within a single session rather than holding positions overnight.

Intraday smart money concept patterns often revolve around liquidity grabs at the beginning of major sessions. The Asian session low frequently gets swept during London open as institutions collect stops before pushing price higher, creating classic SMC entry setups. Similarly, New York open commonly sees raids of European session highs or lows before the true directional move emerges. Day traders who understand these patterns position themselves to capitalize on the reversals that follow liquidity collection.

The compressed timeframes in day trading amplify the importance of execution precision. Entries must occur at the exact edge of order blocks rather than anywhere within the zone, and stops need tight placement to maintain favorable risk-reward on shorter-term moves. Modern trading platforms with one-click execution and precise order placement capabilities become essential tools for implementing SMC day trading strategies effectively. Traders can practice these faster-paced setups through demo accounts before committing capital to live markets where execution speed directly impacts profitability.

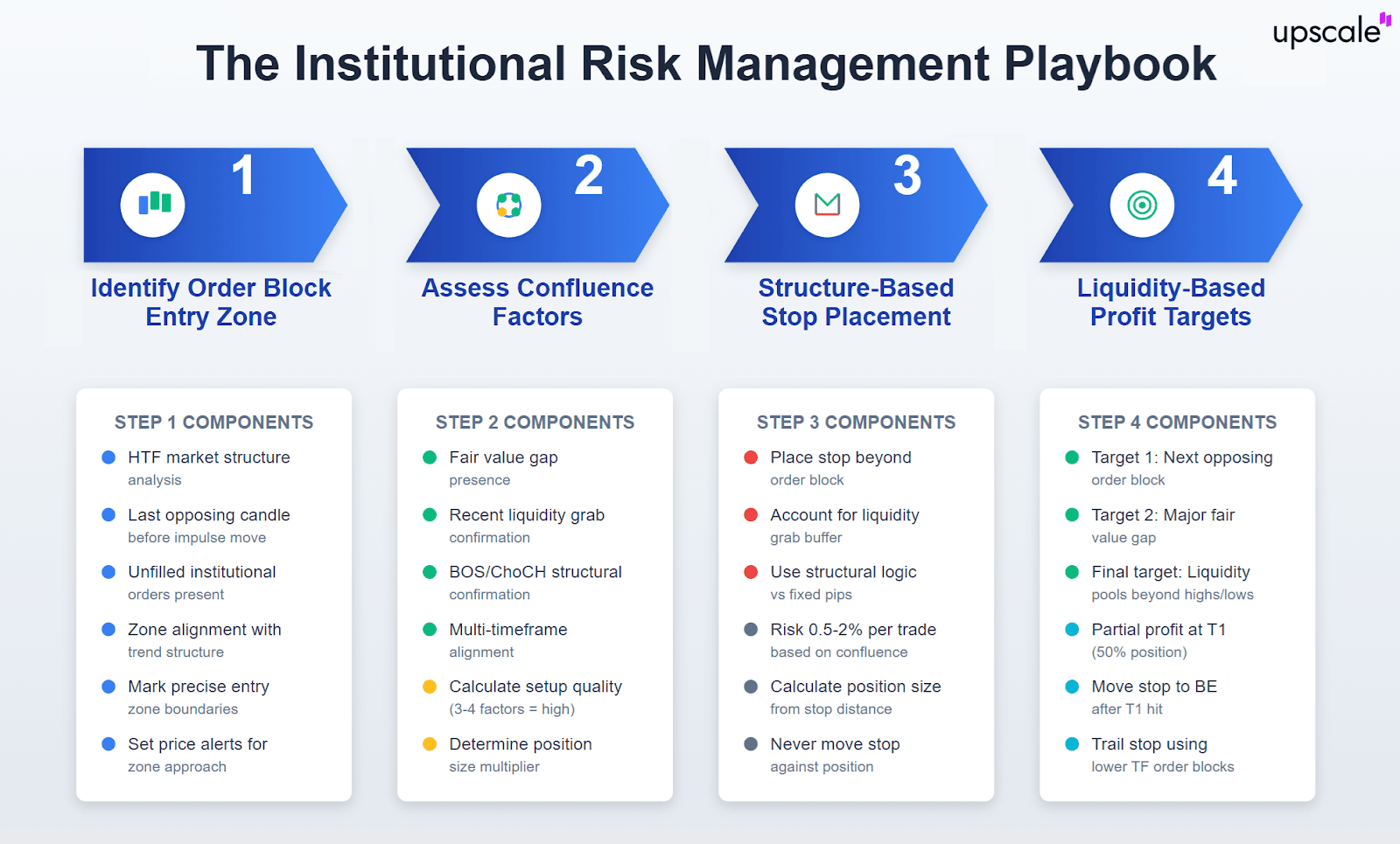

Risk Management for SMC Trading

Institutional-style risk management separates consistently profitable smart money concept traders from those who struggle despite understanding the technical concepts. Unlike retail risk management that focuses primarily on percentage-based stop losses, SMC risk management considers market structure context and institutional behavior patterns when determining position parameters.

Institutional-style risk management separates consistently profitable smart money concept traders from those who struggle despite understanding the technical concepts. Unlike retail risk management that focuses primarily on percentage-based stop losses, SMC risk management considers market structure context and institutional behavior patterns when determining position parameters.

Stop loss placement in smart money trading always accounts for potential liquidity grabs beyond the order block being traded. Rather than placing stops at obvious levels like just below order block lows, institutional-minded traders add buffer room for wicks that might sweep stops before reversing. This approach accepts slightly wider stops in exchange for avoiding premature exits on positions that ultimately work. The trade-off makes sense because SMC entries occur at structural levels where directional conviction runs high, justifying the additional risk to avoid manipulation-induced stop outs.

Position sizing methodology within smart money concept adjusts based on setup confluence and conviction level. When multiple factors align including higher timeframe order blocks, fair value gaps, market structure confirmation, and liquidity grab evidence, traders can comfortably increase position sizes because probability dramatically improves with confluence. Conversely, trades based on single factors receive minimum position sizing. This variable approach ensures capital allocation matches opportunity quality rather than treating every setup identically.

The risk-reward framework in SMC trading differs fundamentally from traditional fixed-ratio approaches. Rather than targeting arbitrary 2:1 or 3:1 ratios, institutional-style traders identify logical profit targets based on market structure. The first target typically sits at the next opposing order block or major fair value gap, while final targets aim for liquidity pools beyond obvious structural levels. This structure-based targeting often yields reward-to-risk ratios exceeding 5:1 or even 10:1 on well-executed trades, though the focus remains on structural logic rather than ratio achievement.

Advanced SMC Psychology and Implementation

Mastering the smart money concept extends beyond technical pattern recognition into understanding the psychological dynamics between institutional and retail participants. Institutions deliberately engineer price action to trigger emotional responses in retail traders, creating the liquidity and positioning they need for their actual trades. Recognizing this manipulation while avoiding emotional reactions separates successful SMC implementation from theoretical knowledge.

Breaker blocks represent an advanced SMC concept where previously bullish order blocks fail and become bearish zones, or vice versa. This occurs when institutional sentiment shifts significantly enough that former support becomes resistance. Traders who adapt to these breaker patterns avoid fighting against repositioned institutional flow. The psychology behind breaker blocks centers on recognizing when market narrative changes demand strategic flexibility rather than stubbornly holding bias.

Mitigation blocks function similarly to order blocks but represent areas where institutions need to mitigate existing positions before establishing new directional trades. These zones often appear as minor pullbacks within strong trends where smart money takes partial profits or adjusts positions before the next leg. Understanding mitigation versus primary order blocks prevents confusion about which zones will hold for major reversals versus brief pauses in existing trends.

Implementation framework for systematic smart money concept practice begins with paper trading or demo account work until pattern recognition becomes second nature. Traders should mark order blocks, fair value gaps, and liquidity zones in real-time daily, then review how price interacted with those levels after the fact. This deliberate practice builds the pattern recognition neural pathways required for live trading success. Progressing to live markets should start with minimum position sizes, gradually scaling up as consistency develops over months rather than rushing into full-size positions immediately.

Conclusion - Your SMC Action Plan

Smart money concept provides retail traders with a framework for understanding and trading alongside institutional participants rather than being their counterparty. The methodology's effectiveness stems from its foundation in market mechanics and order flow reality rather than mathematical indicators divorced from actual buying and selling pressure.

Your path forward starts with education and practice. Begin by studying price charts through the SMC lens, identifying order blocks, fair value gaps, and liquidity grabs on instruments you plan to trade. Mark these levels in advance and observe how price reacts when reaching them. This observational practice builds intuition faster than theoretical study alone. Consider structured learning through quality educational resources or mentorship programs that provide feedback on your analysis, accelerating the pattern recognition development process.

Implementation should progress methodically from paper trading through small live positions to full-size trading only after demonstrating consistent profitability. The journey from learning smart money concept to mastering its application typically requires six to twelve months of dedicated effort, but the resulting edge in understanding market mechanics provides lasting competitive advantages. Trading platforms with advanced charting, precise execution capabilities, and comprehensive order management tools support this implementation journey by allowing you to focus on analysis and decision-making rather than fighting technology limitations.

Trading like institutional investors in 2025 means mastering Smart Money Concepts — understanding order blocks, liquidity zones, and institutional footprints on the chart. With Upscale.trade, traders can apply these methodologies using AI-powered analytics and real-time order flow data, scaling their strategies with company capital and transparent profit-sharing. This integration allows retail traders to align with institutional moves, execute with precision, and maximize returns in volatile markets.

FAQ

How do I identify valid order blocks in smart money concept trading?

Valid order blocks show specific characteristics including an impulsive move away from the zone, clean candle structure without excessive wicks, and positioning within broader market structure context. The candle preceding the impulse should have clear rejection from one direction followed by explosive movement opposite. Higher timeframe order blocks carry more significance than lower timeframe ones, and blocks forming after liquidity grabs prove more reliable than random swing points. Confluence with fair value gaps or major structural levels strengthens order block validity considerably.

What's the typical success rate with SMC trading strategies?

Smart money concept trading achieves win rates between 60-75% when implemented with proper risk management and selective trade filtering. Success rates improve significantly when traders demand confluence between multiple factors rather than taking every potential setup. The methodology's strength lies not just in win rate but in favorable risk-reward profiles, as structure-based targeting often yields ratios exceeding 3:1 or 5:1. Consistency develops over time as pattern recognition improves through deliberate practice and market observation.

Can I use smart money concept with small trading accounts?

SMC works effectively with accounts of any size because the methodology focuses on percentage-based risk management rather than absolute position sizes. Small accounts benefit particularly from SMC's high-probability setups and favorable risk-reward profiles, allowing capital growth through consistent execution. The key lies in accepting position sizes appropriate to account balance rather than over-leveraging to achieve arbitrary profit targets. Starting with micro lots or cent accounts while learning prevents significant capital loss during the skill development phase.

How does smart money concept differ from supply and demand trading?

While both methodologies identify zones where significant orders exist, smart money concept recognizes the dynamic nature of institutional order flow versus static supply-demand zones. SMC incorporates liquidity grabs, fair value gaps, and changing market structure into analysis, while traditional supply-demand focuses primarily on reaction zones. Smart money traders understand that institutions actively manage positions and create manipulation patterns before major moves, adding layers of analysis beyond basic zone identification.

What technical indicators complement smart money concept analysis?

Smart money concept functions as a complete standalone methodology requiring no indicators, as it focuses on pure price action and order flow. Some traders incorporate volume analysis or VWAP to confirm institutional participation levels, but lagging indicators like moving averages or oscillators typically conflict with SMC principles. The methodology's strength lies in reading price structure directly rather than filtering it through mathematical transformations that introduce lag and reduce clarity.

Is smart money concept suitable for complete trading beginners?

SMC presents a steeper initial learning curve than basic technical analysis because it requires understanding market mechanics and institutional behavior rather than simply following indicator signals. However, beginners who commit to proper education often develop better trading foundations through SMC than those starting with indicator-dependent approaches. The six to twelve month mastery timeline assumes consistent study and practice, making structured learning programs valuable for accelerating the education process and avoiding common misconceptions that delay progress.

Where can I find quality smart money concept learning resources?

Quality SMC education comes from sources emphasizing practical application over theoretical discussion. Look for programs providing chart examples, trade breakdowns, and feedback on student analysis rather than vague conceptual explanations. Many successful SMC traders share educational content through various platforms, though distinguishing between quality instruction and superficial coverage requires careful evaluation. Consider starting with free resources to grasp core concepts before investing in comprehensive courses or mentorship that provide structured learning paths and personalized guidance for skill development.