Real Prop Firm Payouts: 9 Funded Trader Success Stories 2025

Verified crypto prop trading results with payouts ranging from $91 to $30,000+

Looking for proof that crypto prop firms actually pay out? You're not alone. With only 5-10% of traders passing prop firm challenges and even fewer receiving consistent payouts, skepticism is warranted. That's why we've compiled real, verified success stories from Upscale traders — complete with actual payout amounts, trading strategies, and lessons learned.

What you'll learn in this article:

- 9 detailed case studies of funded traders with verified payouts from $91 to $30,000+

- Proven trading strategies: Price Action, Smart Money Concept, indicator-based trading, and news trading

- Common mistakes that cost traders their funded accounts — and how to avoid them

- Why trading psychology matters more than your entry point (the 70/20/10 rule)

- Practical risk management tips from traders who've passed prop firm challenges

📌 Pricing note: These success stories span summer 2024 through 2025. Early cases ($18 per challenge) reflect launch pricing. Current Upscale challenge prices start at $59 (Basic RWA $5,000 account).

Vladislav: $30,000+ in Payouts — 12 Years of Price Action Mastery

Funded account size: $100,000

Total payouts: $30,000+

Challenge cost: $899

ROI: 3,337%+

Strategy: Price Action + trend following

Vladislav represents what's possible with long-term dedication to prop trading. With 12 years of trading experience, he's developed a refined approach based on trend following and price action — almost entirely abandoning indicators.

How Vladislav's Trading Strategy Works

His primary timeframe is M30 for identifying market direction, with entries on M5 and occasionally M1 for intraday positions. Moving averages serve only as visual aids, not trading signals.

Core principles:

- Trade exclusively with the trend — "mathematically, this always beats catching reversals"

- Place stop-loss immediately after entry — non-negotiable

- Minimum risk-to-reward ratio of 1:2, typically 1:3, historically reaching 1:26

- Strict pre-trade checklist prohibiting trades during unsuitable conditions or major news events

Key Prop Trading Lessons from Vladislav

"I've made every possible mistake. Large financial losses taught me discipline — lose a five-figure sum in one day, and your brain rewires itself fast."

His most critical rule: place your stop-loss within seconds of entry. A single candle can destroy an entire funded account. Interestingly, he considers the "stop trading after three losses" rule counterproductive — sometimes the real signal appears only after several stop-outs.

His success formula: "A trading strategy is a future business, not improvisation. Stability beats speed — small risks and strict planning let you pass challenges and maintain profits for months."

speculator1337: How $540 Became $11,231 in One Month

Funded account size: $50,000

Challenge cost: $540

Payout: $11,231

ROI: 2,080%

Strategy: Trend trading on BTC and ETH

On June 12, trader @speculator1337 purchased a $50,000 prop challenge. By July 2 — just 20 days later — he'd passed all requirements and received his funded account.

Within 2 weeks of getting funded, trading primarily BTC, ETH, and WIF, he generated approximately $14,000 in profits. On July 17, he withdrew $11,231 — a 20x return on his initial investment.

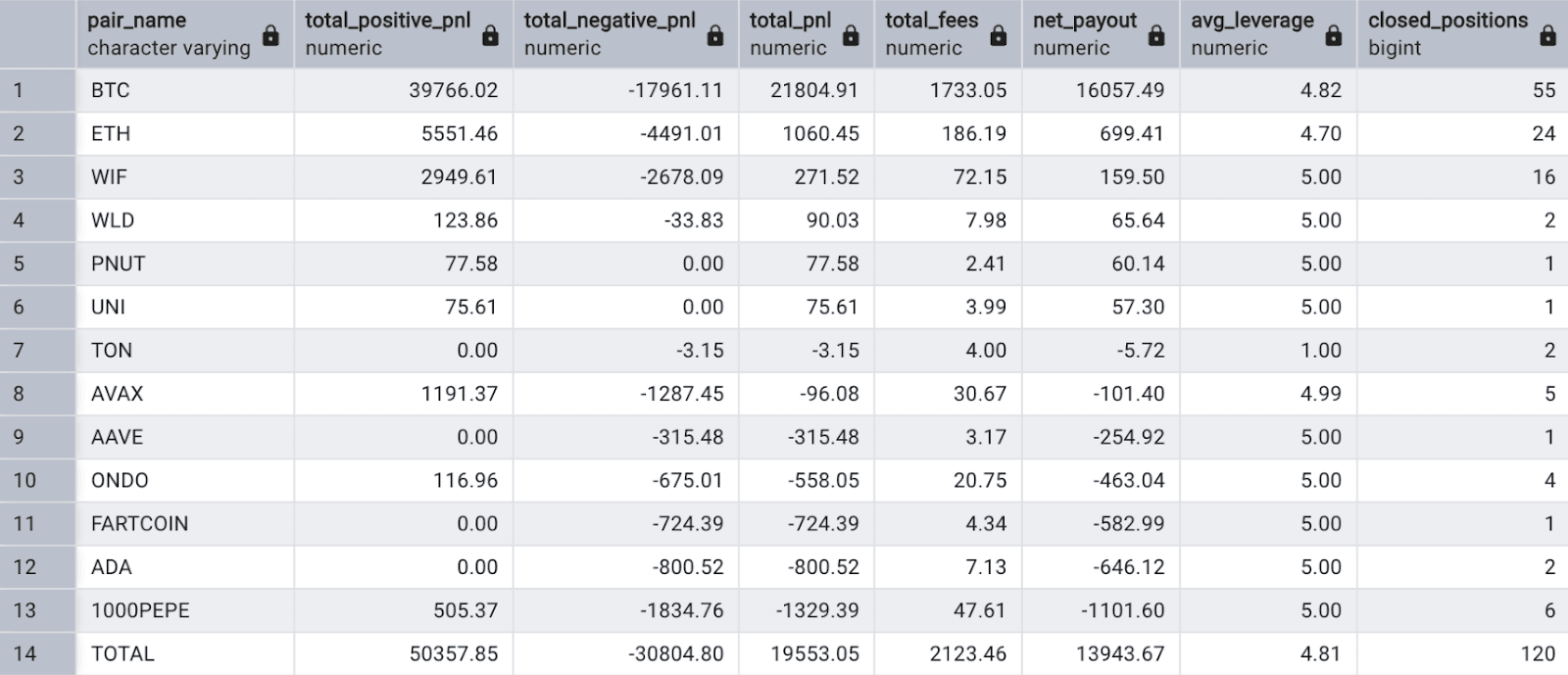

Trading Statistics

💡 Trading the same strategy with his own $540 would have yielded roughly $150. The prop trading model amplified his results by 75x.

This success came from disciplined risk management, trend-following execution, and a clear trading plan — not luck or excessive risk-taking.

Vlad: $3,600 Payout Using Indicator-Based Trading

Funded account size: $10,000

Payout: $3,600

Challenge cost: ~$144

ROI: 2,500%

Strategy: Indicator trading (GoTrade system)

Vlad is an intraday trader whose entire approach is built on technical indicators — proof that indicator-based strategies work in crypto prop trading when executed with discipline.

Vlad's Technical Toolkit:

- Divergence indicator — identifying overheated zones and potential reversals

- Weekend range — classic consolidation patterns for breakout trading

- Monday range — forms by end of day, provides signals throughout the week

- Color-coded trend indicator — quick visual confirmation of market direction

- Additional scalping indicators

Entry criteria: Only at points confirmed by multiple indicators and market structure. He'll commit up to half the account with 5x leverage — but only when the setup is strong and stop-loss is immediately placed.

Trading Psychology Insights from Vlad

"The biggest mistake is revenge trading. After 2-3 consecutive losses — step away. The charts will still be there tomorrow."

Vlad came dangerously close to daily drawdown limits multiple times. The prop firm's risk limits actually saved him — forcing discipline when emotions pushed for more.

Why he chose prop trading: "Trading your own money creates fear. You close too early, enter too late, hesitate constantly. Prop trading provides structure — clear rules, daily drawdown limits — that protect you from yourself and revenge trading."

He calls his first payout "the moment I knew this works" and believes prop trading is ideal for beginners: low entry cost, real experience, minimal personal risk, and actual withdrawable profits.

zverskyzver: From $18 to $2,744 — The Power of Persistence

Funded account progression: $1,000 → $25,000

Initial challenge cost: $18

Total payouts: $2,744

ROI: 15,244%

Strategy: Altcoin trading with 4-5x leverage

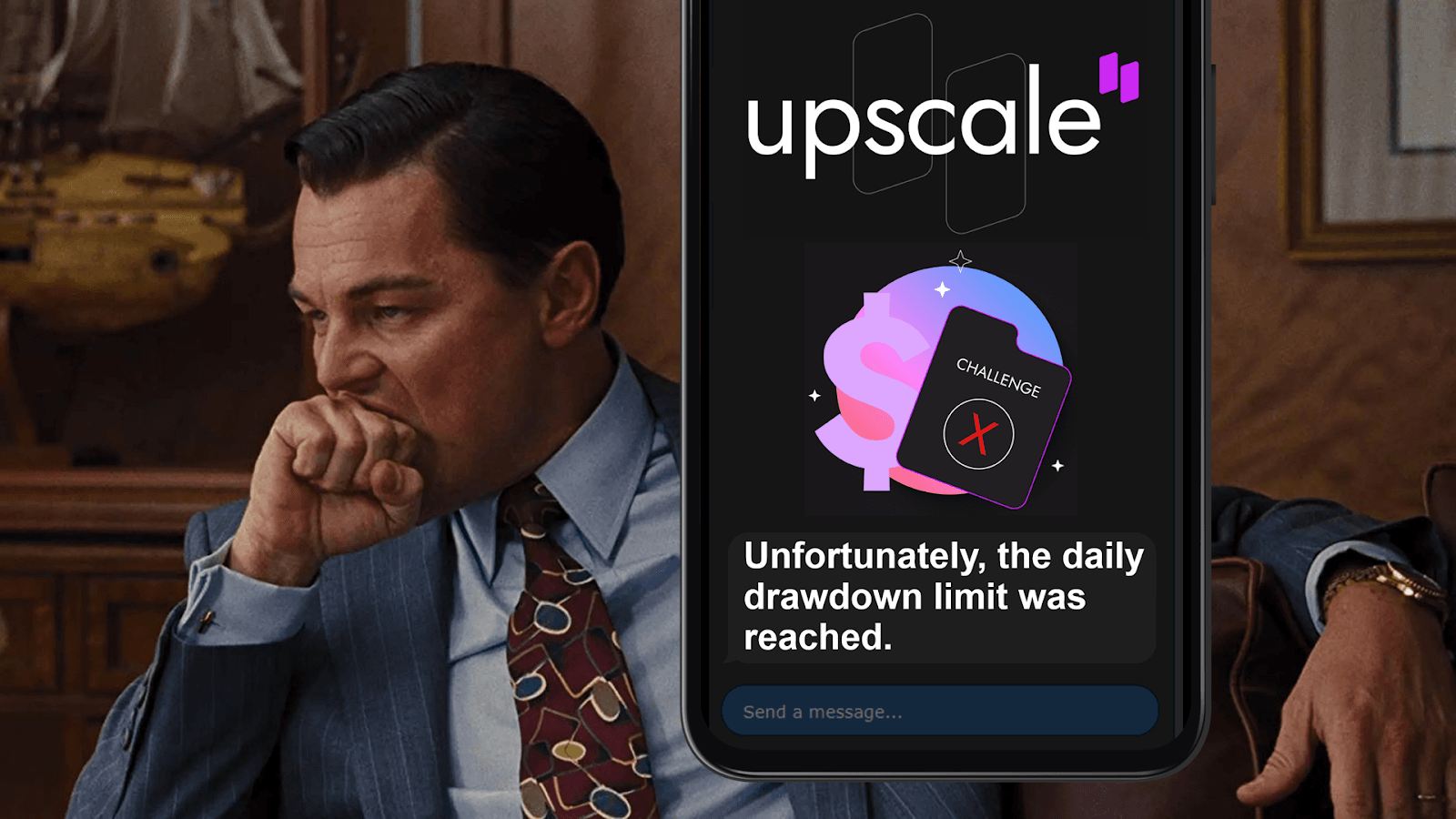

Trader @zverskyzver started with just $18 — the cost of a $1,000 challenge during Upscale's launch period. His first account? Blown.

Instead of quitting, he analyzed his mistakes and tried again. This time, he focused on 1000PEPE, TON, and DOGE with 4-5x leverage while strictly respecting drawdown limits.

Payout Timeline:

- June 22: First payout — $744

- July 6: Second payout — $960

- July 20: Third payout — $1,040

Over his trading period, he executed nearly 5,000 positions. After proving himself, he reinvested profits into a $25,000 challenge, continuing to scale his prop trading career.

Ruslan: $1,057 from News Trading

Funded account size: $25,000

Payout: $1,057

Challenge cost: $315

ROI: 335%

Strategy: News trading + trend following

Ruslan doesn't consider himself a traditional trader — he's a crypto enthusiast and investor. His approach is unconventional: trading the news, based not on charts but on information flow.

How the News Trading Strategy Works:

Ruslan monitors Twitter, Telegram, and Discord communities 24/7, receiving news before most traders and entering positions early. He catches sudden announcements — partnerships, releases, protocol updates — such as Pavel Durov's TON news, ApeChain launch, or Mantle teasers.

He trades only major assets: ETH, TON, ARB, ApeCoin, Mantle — avoiding low-caps and meme coins where information advantage matters less.

Hard Lesson: Emotions Destroy Traders

"My most painful lesson was a series of shorts on the meme token PENGU. The market kept rising, but I kept shorting emotionally. Lost $1,100 in one day and nearly liquidated my account."

Ruslan calls this "kill tilt" — emotions kill traders, not strategies. He finds prop trading psychologically easier because clear boundaries, mandatory stops, and drawdown limits protect against impulsive decisions.

Maxim: $860 with Smart Money Concept (SMC)

Funded account size: $10,000

Payout: $860

Challenge cost: ~$144

ROI: 597%

Strategy: Smart Money Concept (SMC)

Maxim trades predominantly intraday with a clear philosophy: fewer trades, higher quality.

SMC Trading Tools:

- Order blocks and liquidity zones

- Structure breaks (BOS/CHoCH)

- Volume Profile

- RSI, MACD, Stochastic, EMA (relied on for no more than 10% of decisions)

Risk management rules: Maximum 10% of account per position, stop-loss around 0.7-0.8% of account. On volatile coins, position size drops to 3-5%.

The Path Through Failed Challenges

"The journey was hard: multiple blown challenges, psychological breakdowns, attempts to go all-in. But each time I stopped trading, closed the charts, returned the next day, and recovered the drawdown strictly following my strategy."

Maxim emphasizes that discipline isn't theory — he quit smoking after 27 years, returned to fitness, started reading books. These lifestyle changes translated directly into trading stability.

His mindset: "If I lose this account, I'll buy another and continue." For Maxim, Upscale represents a path to financial independence.

Evgeny: $473 Trading Exclusively from Phone

Funded account size: $10,000

Payouts: $287 + $186 = $473

Challenge cost: ~$144

ROI: 328%

Strategy: Support/resistance levels

Evgeny trades 100% from his smartphone because his strategy requires no complex tools — just pure price levels and consolidation zones, no indicators.

Evgeny's Trading Approach:

- Analyze weekly BTC, ETH, and Solana charts for overall market context

- Solana matters because its ecosystem altcoins mirror SOL movements with amplified volatility

- Enter only based on price reaction at key levels

- Risk 0.3-1% per trade, daily drawdown limit 2%

- Minimum risk-to-reward ratio 1:2

The 70/20/10 Success Formula

"Psychology is the main success factor: 70% of results. Risk management accounts for 20%, and only 10% comes from the entry point itself."

On prop trading vs. personal capital: "Trading your own $10,000 makes no sense — invest that in spot and DeFi. Move trading to company capital where risks don't fall on you."

Daniil: $91 from a $1,000 Challenge — Everyone Starts Somewhere

Funded account size: $1,000

Challenge cost: $18

Payout: $91

ROI: 505%

Strategy: Technical analysis + Volume Profile

Daniil demonstrates that you don't need massive capital to start. His strategy relies on technical analysis without complex pattern recognition.

Core Trading Tools:

- Volume Profile — primary analytical tool

- Support/resistance levels and mirror zones

- First hours of New York session analysis

- SMC concepts: imbalances, order blocks, structure breaks

- Average RR of 1:2.5-1:3, sometimes reaching 1:5-1:6

Daniil's Core Trading Philosophy

"If you have a plan — follow it. Otherwise, it becomes gambling. Any strategy collapses when you increase risk. Your stop-loss belongs where the idea is invalidated, not where you feel comfortable."

Why prop trading works: "Invested $18, withdrew $91 — that's 5x. This is exactly why prop trading exists: small risk, real experience, consistent rules."

sciencebiotech: From Factory Shifts to $1,800 Payout

Funded account size: $10,000

Payout: $1,800

Challenge cost: $144

ROI: 1,250%

Strategy: RSI + EMA + price levels

Trader @sciencebiotech started on KuCoin, trading "by feel" and consistently blowing accounts.

After 4 failed attempts on $1,000 and $5,000 challenges, he learned the rules and passed his fifth challenge — a $10,000 account.

What Changed:

- Shifted from "button-clicking" to systematic analysis

- Learned proper stop-loss placement and stopped moving them

- Combined RSI and EMA with price levels

- Found an edge trading TON

- Trades from phone during commute and work breaks

"Trading larger challenges is actually easier — you develop respect for the money and naturally reduce risk-taking."

Upscale Trader Payout Summary Table

| Trader | Account | Cost | Payout | ROI | Strategy |

|---|---|---|---|---|---|

| Vladislav | $100,000 | $899 | $30,000+ | 3,337%+ | Price Action |

| speculator1337 | $50,000 | $540 | $11,231 | 2,080% | Trend Trading |

| Vlad | $10,000 | ~$144 | $3,600 | 2,500% | Indicators |

| zverskyzver | $1,000 | $18 | $2,744 | 15,244% | Altcoins |

| sciencebiotech | $10,000 | $144 | $1,800 | 1,250% | RSI + EMA |

| Ruslan | $25,000 | $315 | $1,057 | 335% | News Trading |

| Maxim | $10,000 | ~$144 | $860 | 597% | SMC |

| Evgeny | $10,000 | ~$144 | $473 | 328% | Price Levels |

| Daniil | $1,000 | $18 | $91 | 505% | Volume Profile |

What Successful Prop Traders Have in Common

1. Non-Negotiable Stop-Loss Discipline

Every trader places a stop-loss immediately after entry — no exceptions. As Vladislav says: "Your stop should be set within seconds of entry — one candle can destroy your entire account."

2. Strict Risk Management Rules

- Risk per trade: 0.3-2% of account

- Risk/reward ratio: minimum 1:2, typically 1:3

- Daily drawdown limit: 2-4%

3. Psychology Over Strategy (The 70/20/10 Rule)

According to Evgeny's formula: 70% of success comes from psychology, 20% from risk management, and only 10% from entry points.

4. Prop Structure Removes Emotional Pressure

All traders report the same phenomenon: trading personal capital triggers fear, FOMO, and revenge trading urges. Prop trading's built-in rules and limits protect traders from their own worst impulses.

5. Strategy Diversity, Consistent Results

These traders use completely different approaches — pure price action, indicator stacking, news trading, Smart Money Concepts. The common thread isn't the strategy itself, but systematic execution and unwavering discipline.

FAQ

What's the best trading strategy for crypto prop firms?

There's no single "best" strategy. Successful Upscale traders use Price Action, indicator systems, SMC, news trading, and pure level-based approaches. Choose what you understand deeply and develop it into a repeatable system. Consistency matters more than the specific methodology.

How much can you realistically earn with a crypto prop firm?

Based on 2024-2025 Upscale data, verified payouts range from $91 to $30,000+. ROI relative to challenge cost ranges from 300% to over 15,000%. Results depend on account size, trading skill, and risk management discipline.

How many attempts does it take to pass a prop firm challenge?

It varies significantly. Some traders pass on their first attempt; others need five tries (@sciencebiotech). Industry data suggests only 5-10% of traders pass evaluations. The key is analyzing each failure, adjusting your approach, and persisting.

Can you trade crypto prop accounts from your phone?

Yes. Evgeny trades exclusively via smartphone using Upscale's Telegram bot. His level-based strategy doesn't require desktop-only tools. Mobile trading works well for strategies that don't depend on complex charting software.

Why is prop trading better than trading your own money?

Psychological advantage is the primary benefit. With prop trading, you risk only the challenge fee — not your entire savings. Built-in rules (daily drawdown limits, max loss thresholds) enforce discipline and protect against emotional trading and revenge trading spirals.

What's the typical profit split at crypto prop firms?

Most crypto prop firms offer 70-90% profit splits to traders. Some firms increase the split based on consistent performance. Always verify the exact terms before purchasing a challenge.

How fast are prop firm payouts processed?

Processing times vary by firm. Upscale processes payouts within a competitive timeframe. Industry leaders typically process within 24-48 hours, with some offering same-day withdrawals in cryptocurrency (USDT/USDC).

Conclusion: Real Traders, Real Payouts, Real Proof

These 2024-2025 success stories from Upscale demonstrate a clear truth: the path from minimal investment to substantial payouts is real and achievable. From $18 to $30,000+ isn't marketing — it's verified results from real traders with different experience levels and trading strategies.

The pattern is consistent: don't quit after initial failures, learn from every mistake, maintain strict risk management, and develop a systematic approach to cryptocurrency trading.

The pattern is consistent: don't quit after initial failures, learn from every mistake, maintain strict risk management, and develop a systematic approach to cryptocurrency trading.

If you're looking to scale your crypto trading skills and access significant capital without risking your personal savings, these trader stories prove it's possible.