What is Slippage in Trading: Expert Guide to Understanding and Minimizing Its Impact

What is Slippage in Trading: Expert Guide to Understanding and Minimizing Its Impact

Slippage silently eats trading profits. Every trader faces this execution challenge. Master slippage management to maximize returns.

What is Slippage in Trading?

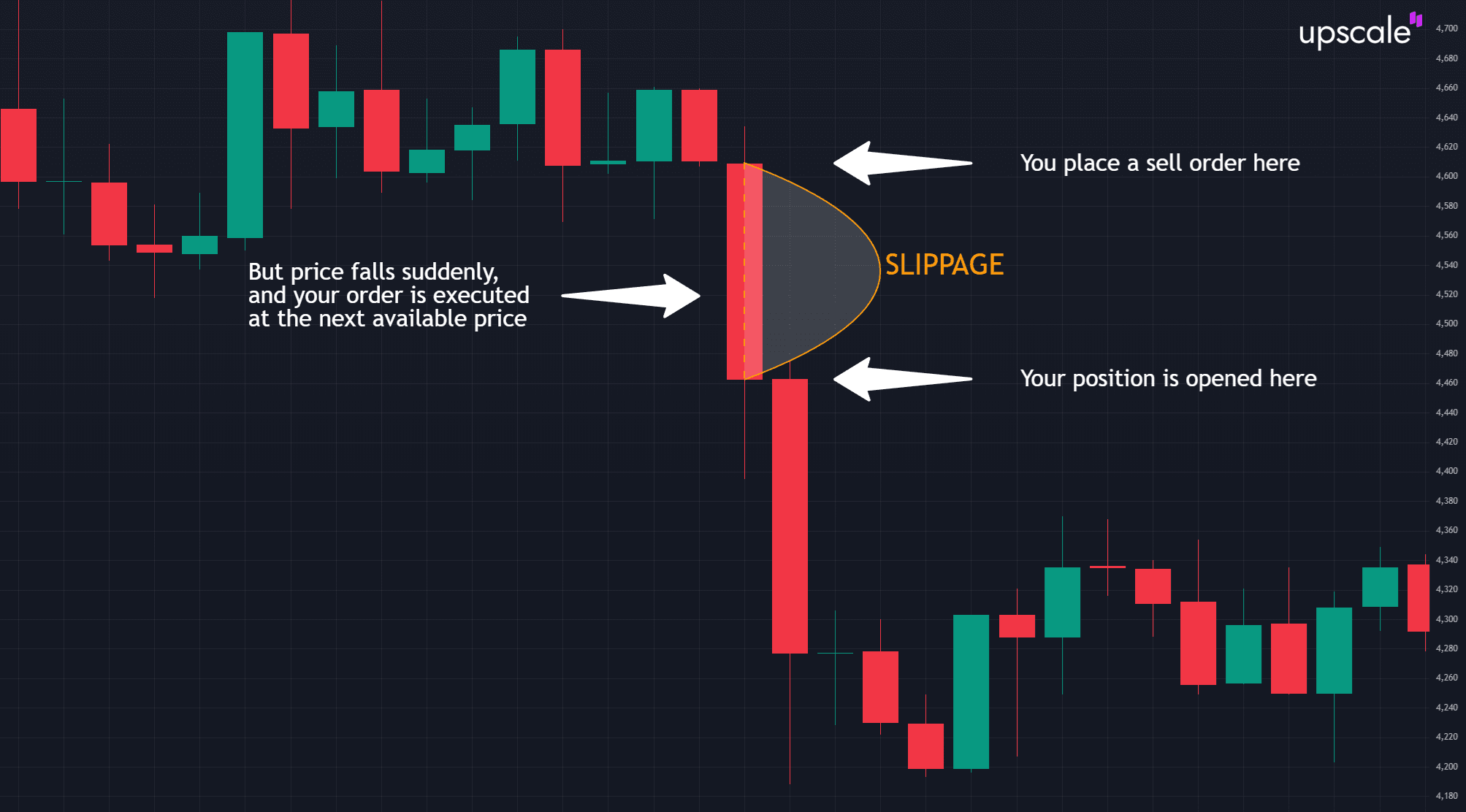

Slippage occurs when your trade executes at a different price than expected. The difference between requested price and execution price defines slippage. Market orders suffer most from this phenomenon.

Picture ordering coffee for $5 but paying $5.20 instead. That extra twenty cents represents slippage. Markets move constantly, creating price differences between order placement and execution.

Market participants create slippage through constant buying and selling. Fast-moving markets amplify this effect. Order size relative to available liquidity determines slippage magnitude.

Cryptocurrency markets show extreme slippage examples. BTC/USDT trades often execute above intended prices during volatile periods. Large orders face worse slippage than small ones consistently.

Positive vs. Negative Slippage: Two Sides of Execution

Positive slippage gives you a better price than expected. Negative slippage costs more than planned. Most traders experience both types throughout their trading careers.

Market conditions determine slippage direction randomly. News events trigger both positive and negative scenarios. Professional traders plan for negative slippage while accepting positive surprises.

Examples help clarify both types:

- Buy order at $100, executed at $99.50 = positive slippage

- Buy order at $100, executed at $100.75 = negative slippage

- Sell order at $50, executed at $50.25 = positive slippage

- Sell order at $50, executed at $49.80 = negative slippage

Types of Slippage: Understanding the 2% Impact

Slippage tolerance settings protect against extreme price deviations. Most platforms allow 0.5% to 5% tolerance levels. 2% slippage tolerance balances execution certainty with price protection.

Calculate slippage percentage using simple formula: Slippage % = (Executed Price - Expected Price) / Expected Price × 100

Example calculation:

- Expected: $1000

- Executed: $1020

- Slippage: ($1020 - $1000) / $1000 × 100 = 2%

The Technical Mechanics Behind Slippage

Market microstructure creates slippage through order book dynamics. Order execution speed cannot match price movement velocity during volatile periods. Understanding these mechanics helps traders minimize slippage impact.

Order books show available liquidity at different price levels. Large orders consume multiple price levels sequentially. Insufficient liquidity at requested price forces execution at worse levels.

High-frequency trading algorithms compete for best prices. Your market order arrives after price-improving opportunities disappear. Institutional traders use sophisticated algorithms to minimize their market impact.

Slippage During Market Gaps and News Events

Market gaps create extreme slippage scenarios. Weekend gaps affect forex markets significantly. Crypto markets trade 24/7 but still experience gap-like price jumps.

Major news announcements trigger volatility spikes. Earnings reports move stock prices rapidly. Central bank decisions impact currency pairs instantly. Gap trading requires careful slippage management.

Examples of gap-related slippage:

- Friday close: EUR/USD at 1.1000

- Monday open: EUR/USD at 1.0950

- Your buy order executes at 1.0948 instead of 1.1000

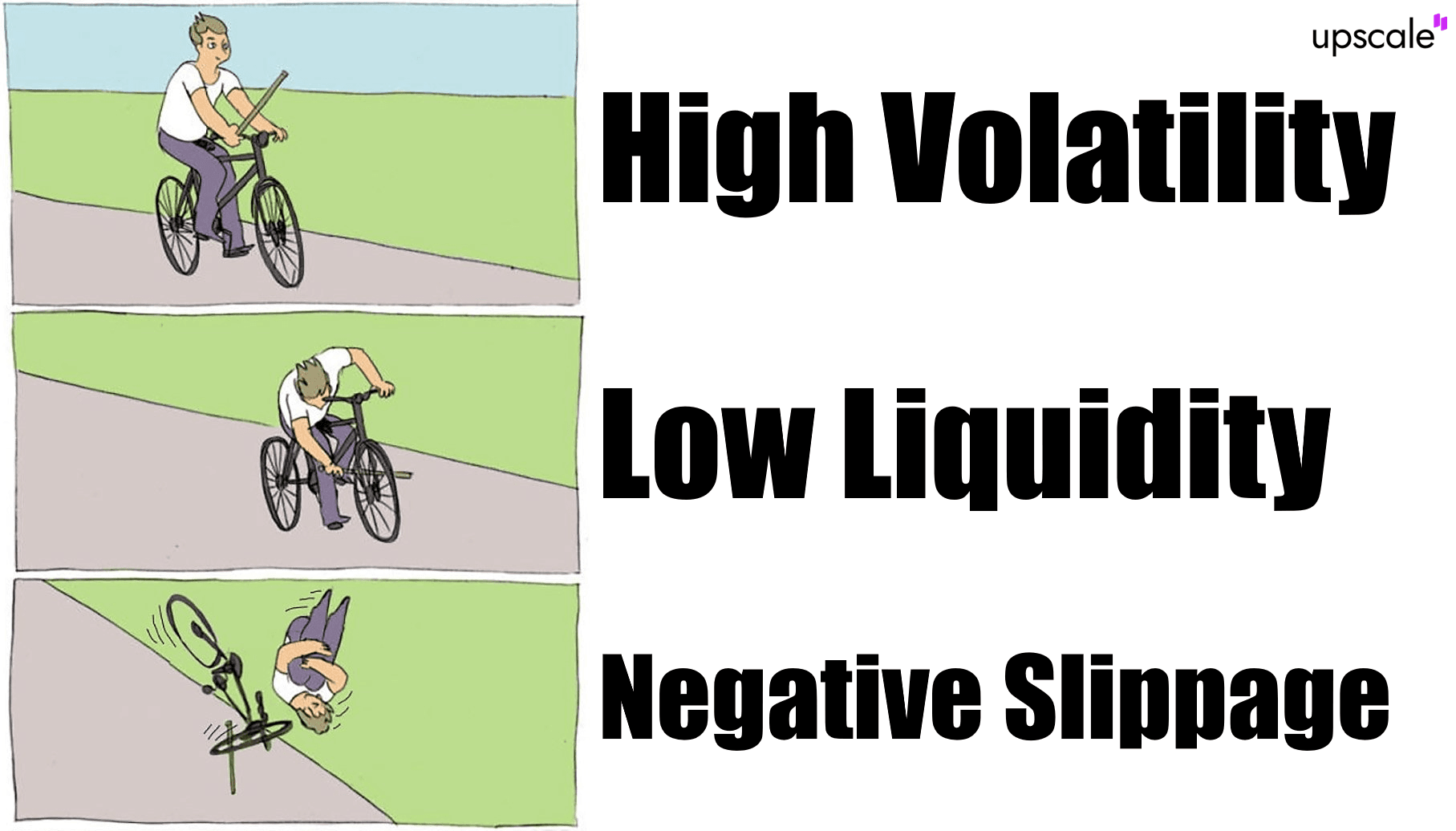

Root Causes of Slippage: Volatility, Liquidity, and Market Structure

Market volatility directly correlates with slippage frequency and magnitude. High volatility periods increase price movement between order placement and execution. Traders face larger slippage during turbulent markets.

Market depth determines slippage potential. Thin markets cannot absorb large orders without significant price impact. Deeper markets provide better execution quality consistently.

Contributing factors include:

Contributing factors include:

- Sudden news events disrupting normal trading

- Market opens and closes with reduced liquidity

- Large institutional orders moving prices

- Low trading volumes during off-peak hours

- Technical issues affecting exchange operations

- Regulatory announcements impacting specific assets

Slippage Across Markets: Crypto, Forex, and Traditional Assets

Cryptocurrency markets exhibit higher average slippage than traditional forex pairs. Bitcoin volatility creates execution challenges. Altcoin markets face even worse liquidity conditions.

Forex markets provide better execution during active sessions. Major currency pairs like AUD/USD show minimal slippage. Minor pairs experience worse execution quality consistently.

Stock markets concentrate slippage around market opens. After-hours trading increases slippage risk substantially. Options markets show even wider execution spreads.

Professional prop trading firms adapt strategies across markets. Upscale.trade provides execution infrastructure optimized for crypto and traditional markets.

Market-specific characteristics:

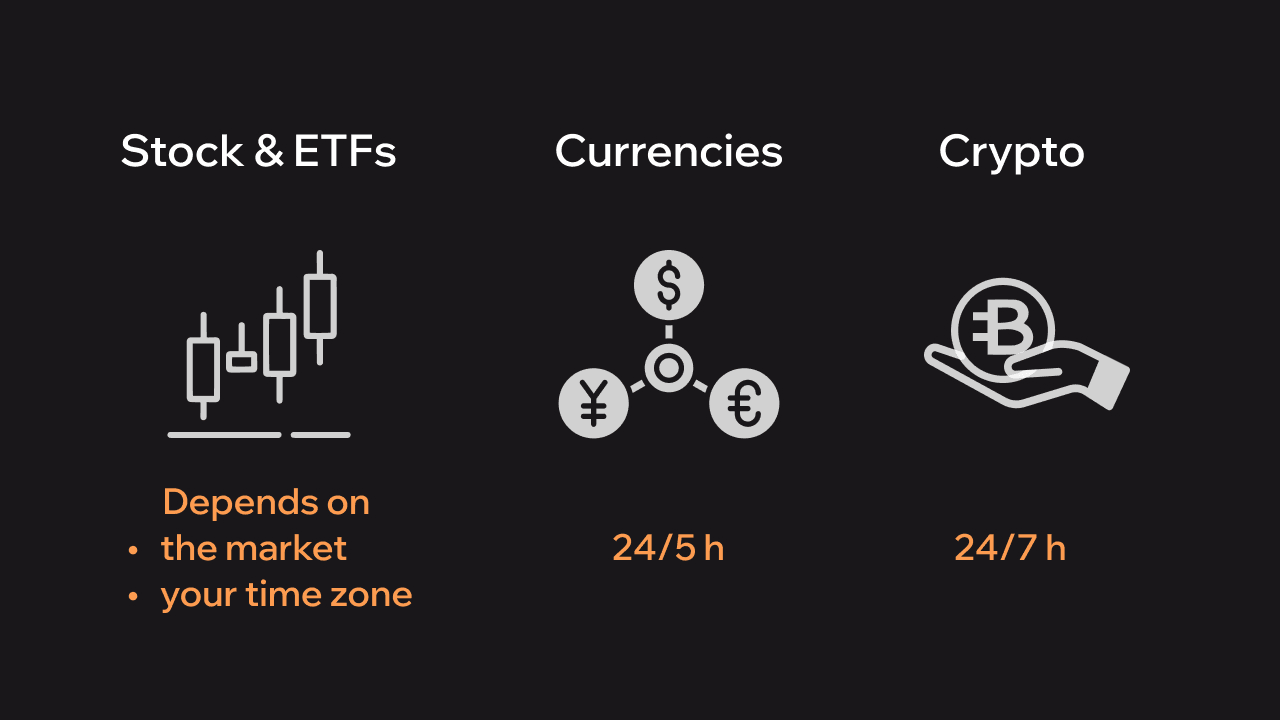

- Crypto: 24/7 trading but extreme volatility

- Forex: Predictable sessions with major pair liquidity

- Stocks: Concentrated trading hours with gap risks

- Commodities: Seasonal patterns affecting execution

- Bonds: Generally low slippage but interest rate sensitivity

Measuring Slippage Impact: Calculating Your Slippage Ratio

Systematic slippage measurement reveals hidden trading costs. Track actual execution prices against intended prices. Monthly analysis identifies problematic patterns.

Slippage ratio formula: Average Slippage = Total Slippage Cost / Total Trade Value × 100

Monthly tracking example:

- 50 trades executed

- Total slippage cost: $250

- Total trade value: $25,000

- Slippage ratio: 1.0%

Performance metrics to track:

- Average slippage per trade

- Maximum single-trade slippage

- Slippage by market conditions

- Platform comparison analysis

- Time-of-day slippage patterns

Professional Strategies to Minimize Trading Slippage

Timing trades during high liquidity periods reduces slippage significantly. Avoid trading during news announcements unless specifically targeting event volatility. Session overlaps provide optimal execution conditions.

Optimal Order Types for Slippage Control

Limit orders eliminate negative slippage completely. Market orders sacrifice price certainty for execution guarantee. Understanding order type trade-offs optimizes strategy implementation.

Order type comparison:

- Limit orders: No slippage but execution risk

- Market orders: Guaranteed execution with slippage

- Stop orders: Slippage risk during trigger events

- Guaranteed stops: Premium cost for slippage protection

Setting Effective Slippage Tolerance Levels

Conservative slippage tolerance prevents execution during extreme volatility. Platform settings should reflect market conditions and asset characteristics. Dynamic adjustment improves results.

Recommended tolerance levels:

- Major forex pairs: 0.1-0.3%

- Minor forex pairs: 0.3-0.8%

- Major cryptocurrencies: 0.5-2.0%

- Altcoins: 1.0-5.0%

- Stocks during earnings: 1.0-3.0%

Timing Your Trades: Leveraging Optimal Market Hours

London-New York session overlap provides highest forex liquidity. Asian session shows reduced liquidity across most pairs. Timing strategy significantly impacts execution quality.

Optimal trading windows:

- Forex: 8 AM - 12 PM EST (session overlap)

- US Stocks: 9:30 AM - 4 PM EST (regular hours)

- Crypto: Varies by asset and news events

- Commodities: Based on underlying market hours

Weekend considerations affect different markets:

Weekend considerations affect different markets:

- Forex: Sunday evening gaps common

- Crypto: 24/7 trading but weekend volatility

- Stocks: Monday morning gaps possible

- Commodities: Weather and news over weekends

Advanced Considerations: Slippage in Automated Trading

Algorithmic trading systems must model realistic slippage assumptions. Backtesting without slippage creates unrealistic expectations. Production systems face execution reality immediately.

Algorithm design considerations:

- Slippage modeling in backtests

- Dynamic tolerance adjustment

- Order size optimization

- Execution timing algorithms

- Cross-exchange arbitrage challenges

- DeFi front-running protection

Professional trading platforms integrate slippage management automatically. Advanced systems adjust parameters based on market conditions. Real-time monitoring enables quick strategy adjustments.

Building Your Slippage Management Strategy

Systematic slippage management provides a measurable trading edge. Professional traders treat execution quality as seriously as strategy development. Continuous monitoring and adjustment maintain competitive advantage.

Integration strategies include:

- Platform evaluation and selection

- Order type optimization

- Timing strategy development

- Performance measurement systems

- Risk management integration

Visit Upscale.trade for professional trading infrastructure with optimized execution quality across crypto and traditional markets.

FAQ

What is slippage in trading?

Slippage occurs when your order is executed at a different price than requested. Price movement between order submission and execution creates this difference. Both positive and negative slippage happen regularly.

How can you reduce the impact of slippage?

Use limit orders instead of market orders when possible. Trade during high liquidity periods. Set appropriate slippage tolerance levels. Avoid trading during major news events. Choose brokers with superior execution quality.

What's the relationship between spread and slippage?

Spreads represent the bid-ask difference before execution. Slippage occurs during execution itself. Both increase trading costs. Tight spreads reduce but don't eliminate slippage.

Why does slippage happen?

Slippage occurs when market prices change between order submission and execution. Fast-moving markets create larger slippage. Low liquidity amplifies the effect. Large orders relative to available liquidity increase slippage significantly.

Is positive slippage good?

Positive slippage gives better prices than expected, benefiting your trade. However, relying on positive slippage creates unrealistic expectations. Most traders experience net negative slippage over time. Focus on minimizing negative instances rather than expecting positive ones.