What is a Prop Firm & How Does It Work

What is a Prop Firm & How Does It Work?

Trade with millions, not thousands. Access professional capital today. Transform your trading career without risking personal savings.

Understanding Prop Firms in Trading

A proprietary trading firm provides capital to traders. You trade the firm's funds, not yours. Profits get split between you and the firm.

Think of it like this. You're a talented chef. The restaurant provides the kitchen, ingredients, and customers. You cook, they handle everything else. Both share the profits.

Traditional brokers use your money. Prop firms provide their capital. You risk evaluation fees, not life savings. The firm absorbs trading losses.

Prop trading revolutionized financial markets. Talented traders access significant capital immediately. A $500 evaluation unlocks $100,000 accounts. Your skills matter more than bank balance.

Professional prop traders typically earn 70-80% of profits. Trade forex, stocks, crypto, or commodities. The best prop firms provide multiple asset classes. Modern platforms offer remote access globally.

The Evolution of Proprietary Trading

The prop industry transformed dramatically. Understanding this evolution helps you choose wisely.

From Traditional to Modern Prop Firms

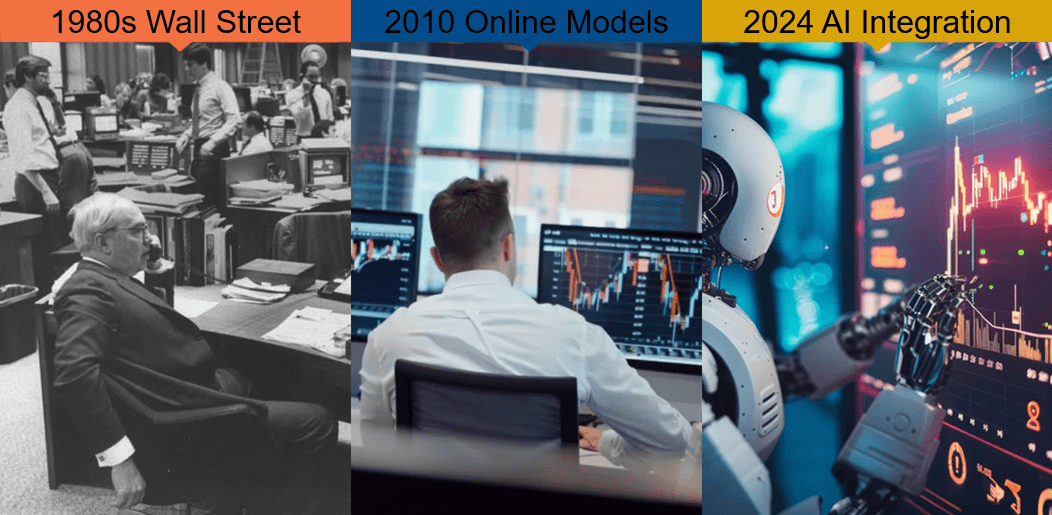

Wall Street created proprietary trading in the 1980s. Investment banks traded their capital for profits. Only elite traders gained access. Physical presence was mandatory.

Technology changed everything. Online trading democratized access. Modern prop firms emerged around 2010. Anyone with skill could join.

Traditional prop firms required relocation to trading floors. Traders sat in Manhattan offices. Commutes cost hours daily. Work-life balance suffered.

Today's firms operate entirely online. Trade from Bali beaches or Denver mountains. Location means nothing. Performance means everything.

The evaluation model revolutionized recruitment. Pass a trading challenge. Receive funded accounts immediately. No interviews, no degrees required.

Modern vs. Traditional Prop Trading Models

These models differ fundamentally. Each serves different trader needs.

| Factor | Traditional Prop Firms | Modern Prop Firms |

|---|---|---|

| Location | Office mandatory | 100% remote |

| Evaluation | Interviews & resumes | Trading challenges |

| Capital Access | Gradual over years | Immediate after passing |

| Profit Splits | 40-60% typical | 70-90% standard |

| Technology | Firm's systems only | Your preferred platform |

| Minimum Capital | Often $25,000+ | Start with $500 |

| Training | Intensive on-site | Self-paced online |

Modern evaluation-based firms dominate now. Pass the challenge, get funded. Traditional firms still exist for institutional trading. Most retail traders choose modern models.

Remote work enables global talent access. Mumbai traders compete with London professionals. Merit beats geography every time.

How Do Prop Firms Work? The Business Model Explained

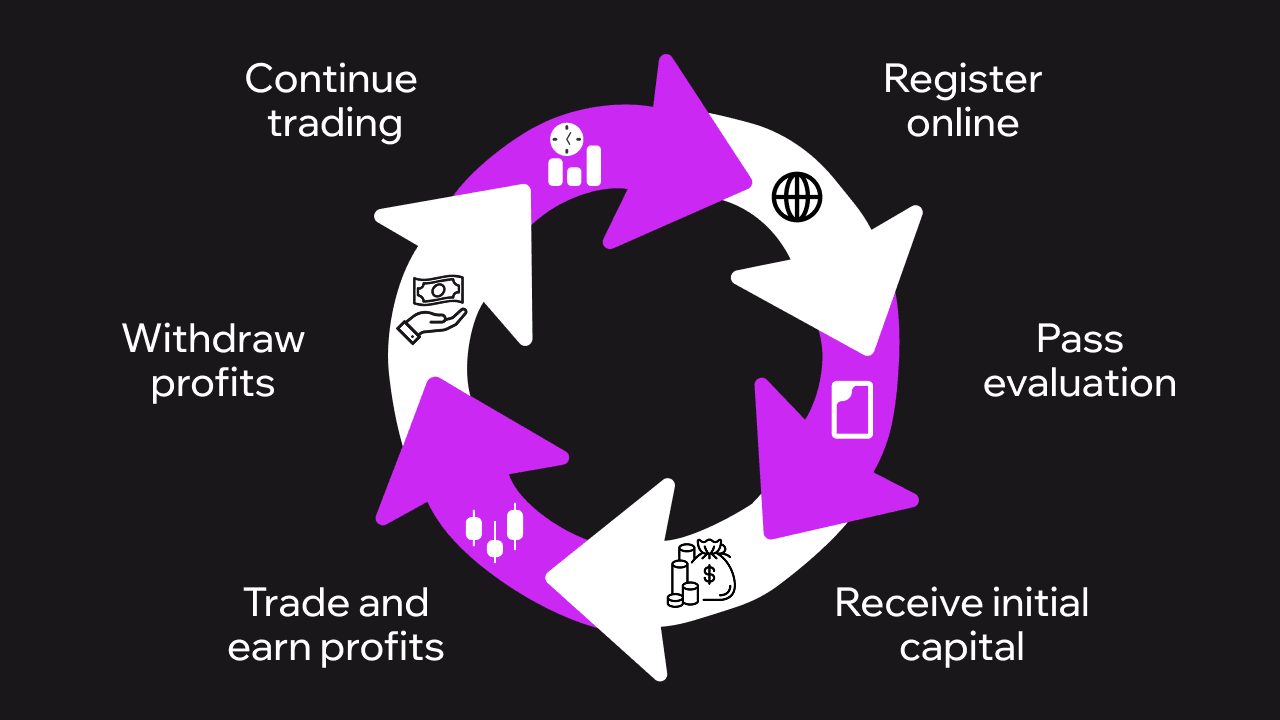

Prop firms operate on evaluation fees and profit sharing. Understanding their model helps you succeed.

The business starts with trader evaluation. Thousands apply monthly. Each pays $100-500 for challenges. Only 5-10% pass evaluations. Failed attempts to fund operations.

Successful prop traders receive funded accounts. Trade with $10,000 to $2,000,000. The firm provides capital and infrastructure. You provide skills and discipline.

Profit sharing drives mutual success. Traders keep 70-80% typically. Firms take 20-30% for providing capital. Both parties win together.

Risk management protects firm capital. Maximum daily loss limits apply. Monthly drawdown rules exist. Break rules, lose access. These constraints ensure longevity.

Revenue streams include:

- Evaluation fees from challenges

- Profit shares from successful traders

- Data feed markups

- Educational course sales

- Trading tool subscriptions

Costs involve:

- Trading capital allocation

- Technology infrastructure

- Regulatory compliance

- Customer support

- Marketing expenses

The best prop trading firms balance all factors. Low evaluation fees attract traders. High profit shares retain talent. Strong technology ensures smooth operations.

Sustainable firms focus on trader success. They provide education and mentorship. Community support improves pass rates. Long-term relationships generate consistent profits.

Revolutionary Prop Trading Technology

Technology transforms how prop trading works. Innovation removes traditional barriers.

Modern Prop Trading Platforms and Innovation

Artificial intelligence revolutionizes prop trading. Algorithms analyze your performance instantly. Risk management happens automatically. Manual oversight becomes minimal.

Mobile trading changed everything. Execute trades from smartphones. Monitor positions during lunch. Manage risk while traveling.

Cloud infrastructure enables instant scaling. Prop firms provide capital to thousands simultaneously. Server crashes become extinct. Uptime exceeds 99.9%.

API integration streamlines operations. Connect any trading platform. Use familiar tools and strategies. No learning curve required.

Upscale leads this technological revolution. Their platform combines AI optimization with Telegram integration. Access up to $100,000 capital. Keep 80% of profits generated.

No complex platforms needed. Trade directly through Telegram. AI handles position sizing. Risk management runs automatically. Visit Upscale.trade to experience the future.

| Traditional Prop Trading | Upscale’s Innovation |

|---|---|

| Complex platforms | Simple Telegram interface |

| Manual risk calculations | AI-powered optimization |

| Desktop-only trading | Mobile-first approach |

| 60-70% profit sharing | 80% profit sharing |

| Limited scaling | Up to $100,000 capital |

Capital Allocation and Profit Sharing Structures

Capital allocation varies by firm. Most start traders at $10,000-25,000. Consistent profits unlock scaling. Reach $1,000,000+ eventually.

Profit sharing reflects trader value. Beginners might receive 50/50 splits. Experienced traders negotiate 90/10 deals. Performance drives percentages higher.

Common structures include:

- 50/50 Split: Entry-level standard. Fair for both parties. Motivates initial performance.

- 70/30 Split: Intermediate traders earn this. Proven track record required. Most firms offer this.

- 80/20 Split: Professional level sharing. Consistent profitability necessary. Upscale offers this immediately.

- 90/10 Split: Elite trader status. Millions in profits generated. Rare but achievable.

Monthly payouts dominate the industry. Request withdrawals anytime. Receive profits within 24-48 hours. Some firms offer weekly payments.

Types of Proprietary Trading Firms

Different prop firms serve different needs. Understanding categories helps selection.

- Evaluation-Based Firms: Most common model today. Pass challenges to receive funding. Pay small evaluation fees upfront. Best for retail traders starting out.

- Direct-Funded Firms: Immediate capital access provided. Higher fees required upfront. No evaluation process needed. Suits experienced traders with capital.

- Hybrid Models: Combine both approaches. Choose evaluation or direct funding. Flexibility attracts diverse traders. Higher costs but more options.

- Asset-Specific Firms: Focus on single markets. Forex prop firms dominate. Crypto firms are emerging rapidly. Stock-focused firms exist too.

- Educational Prop Firms: Training programs included. Mentorship from profitable traders. Higher fees for added value. Good for complete beginners.

- Institutional Prop Firms: Serve professional traders only. Require licenses and experience. Provide millions in capital. Not accessible to retail traders.

The best prop trading firms offer flexibility. Multiple account sizes available. Various evaluation options exist. Choose what fits your style.

Specialization matters for success. Forex traders need forex prop firms. Crypto enthusiasts want crypto access. Match firm focus with your expertise.

The Trader Evaluation Process

Evaluation determines funding eligibility. Understanding the process improves success rates.

Challenge Phases and Funding Criteria

Most prop firms use two-phase evaluations. Phase one proves profitability. Phase two confirms consistency.

Phase One Requirements:

- Profit target: 8-10% typically

- Maximum drawdown: 10-12%

- Minimum trading days: 4-5

- Maximum period: 30 days

- No time pressure

Phase Two Requirements:

- Profit target: 5% usually

- Maximum drawdown: 10-12%

- Minimum trading days: 4-5

- Maximum period: 60 days

- Consistency focus

Real example: John takes a $100,000 challenge. Phase one requires $8,000 profit. He achieves it in 12 days. Phase two needs $5,000 profit. Completed in 8 days. Funded account activated immediately.

Strategy matters more than speed. Rushing increases failure risk. Take full time allowed. Focus on risk management first.

Pro tip: Trade your normal strategy. Don't force trades. Let setups come naturally. Consistency beats home runs.

Common Rules and Requirements for Funded Traders

Funded traders follow specific rules. Violation means account termination. Understand before trading.

- Daily Loss Limits: Maximum 5% typically. Protects from revenge trading. Stop emotional decisions. Reset each day.

- Maximum Drawdown: Usually 10-12% total. Calculated from highest balance. Trails your profits upward. Never resets lower.

- Trading Hours: Some firms restrict news trading. Weekend holdings are prohibited sometimes. Check specific rules carefully.

- Position Sizing: Maximum lot sizes apply. Typically 20-30 lots forex. Prevents excessive risk. Ensures sustainable trading.

- Prohibited Strategies: High-frequency trading often banned. Arbitrage is usually forbidden. Martingale strategies prohibited. One-sided betting restricted.

Tips for compliance:

- Set personal limits below firm limits

- Use automated risk management

- Review rules weekly

- Track metrics daily

- Never gamble on news

Benefits and Considerations of Prop Trading

Prop trading offers unique advantages. Consider both benefits and limitations.

Access to Capital Without Personal Risk

Prop firms provide game-changing capital access. Trade $100,000 without owning $100,000. Your personal risk stays minimal.

Compare the math. Personal account: Risk $10,000 of savings. Make 10% monthly = $1,000 profit. All yours but limited scale.

Prop account: Risk $500 evaluation fee. Trade $100,000 firm capital. Make 10% = $10,000 profit. Keep $8,000 (80% split).

Leverage amplifies results dramatically. Small accounts can't compete. Prop firms offer institutional-level access. Your skills scale instantly.

Psychological benefits matter too. Trading firm money reduces stress. Losses don't affect rent payments. Focus improves without survival pressure.

Potential Drawbacks and Limitations

Prop trading isn't perfect. Several challenges exist for traders.

Evaluation fees add up quickly. Multiple attempts cost hundreds. Not everyone passes initially. Budget for several tries.

Trading restrictions feel limited sometimes. Can't hold positions overnight always. News trading is often prohibited. Some strategies won't work.

Profit splits reduce earnings. Give up 20-30% typically. Pure profit goes to the firm. Consider the capital rental cost.

Consistency pressure exists always. Must maintain performance standards. One bad month hurts. Accounts can be terminated.

Mitigation strategies:

- Start with smallest evaluation size

- Perfect strategy on demo first

- Join firm-specific communities

- Track every metric religiously

- Build emergency fund separately

Choosing the Right Prop Firm

Selection determines your success. Evaluate firms carefully before committing.

Step-by-step selection process:

- Define Your Trading Style Know your strategy type. Scalping needs different conditions. Swing trading requires overnight holding. Match firm rules accordingly.

- Compare Evaluation Costs Evaluation fees range $50-600. Refundable options exist sometimes. Calculate total investment needed.

- Analyze Profit Sharing Higher splits mean more income. But consider other factors. Best prop firms provide balance.

- Check Withdrawal Policies Weekly payouts beat monthly. Minimum amounts vary greatly. Processing fees matter too.

- Review Technology Stack Platform choices affect performance. MT4/MT5 most common. Some offer proprietary platforms.

- Investigate Reputation Read Trustpilot reviews thoroughly. Check regulatory status. Join Discord communities first.

- Test Customer Support Email questions before joining. Response time indicates quality. Support quality predicts experience.

Red flags to avoid:

- Unrealistic profit targets (>20% monthly)

- Hidden fees everywhere

- No public reviews

- Vague rules documentation

- Pressure sales tactics

Green flags to seek:

- Transparent pricing

- Active trader community

- Regular payouts proven

- Clear rules published

- Reasonable targets

The Future of Prop Trading

Prop trading evolves rapidly. Technology drives constant innovation.

Artificial intelligence transforms evaluation. Automated systems judge performance objectively. Human bias disappears completely. Fair assessment becomes standard.

Blockchain integration approaches. Smart contracts automate payouts. Transparency increases dramatically. Trust requirements diminish.

Mobile-first platforms dominate soon. Desktop trading becomes optional. Trade professionally from anywhere. Geographic barriers vanish entirely.

Democratization accelerates yearly. Evaluation costs decrease. Profit shares increase. More traders access professional capital.

Upscale exemplifies this future. Their Telegram integration seems futuristic today. Tomorrow it becomes standard. AI optimization leads the way. Visit upscale.trade to start your professional journey.

Traditional barriers crumble. Anyone can become a funded trader. Skills matter more than connections. Performance beats pedigree always.

The prop industry expects massive growth. Retail traders discover the benefits. Professional trading becomes accessible. Your opportunity exists today.

FAQ

What are the benefits of joining a prop firm?

Access significant capital without personal risk, trade with $10,000-$1,000,000 while risking only evaluation fees. Keep 70-80% of profits generated. Receive professional tools, technology, and infrastructure without upfront investment costs.

What types of prop firms are there?

Main categories include evaluation-based firms requiring challenges, direct-funded firms with immediate capital, educational firms combining training with funding, and asset-specific firms focusing on forex, crypto, or stocks exclusively.

What are the key characteristics of top prop trading firms?

Leading firms offer generous profit sharing (70-80%), reasonable evaluation criteria, multiple asset classes, advanced technology platforms, flexible trading conditions, and strong risk management systems that protect capital while enabling trader success.