What Is Prop Trading? How to Get a Funded Account in 2026

💡 Want to earn from trading without risking all your savings? Heard about prop trading but not sure what it is or how to start trading with a firm's capital? Let's break it down in simple terms!

🔎 In this article, you'll learn:

- What prop trading (proprietary trading) is and how it works.

- How prop trading differs from trading with your own money.

- The pros and cons of prop trading for beginners and experienced traders.

- Why more and more traders are choosing prop firms to earn in financial markets.

- Tips and life hacks to help beginners successfully pass a prop trading challenge.

What Is Prop Trading?

Prop trading (proprietary trading) is professional trading in financial markets using a prop firm's capital. Unlike traditional trading, where a trader risks all their personal funds and starting capital, here you trade with the firm's money and receive a share of the profits earned through a profit split arrangement.

For example:

Imagine you only have $1,000 and want to earn from trading. With your own money, you can only afford to open small positions, and even a minor loss would significantly impact your trading account.

If you pass a prop trading challenge (evaluation) at a prop firm, they can allocate capital for you to manage — for example, $50,000 for trading. Now you're working with a much larger volume and trading account, while only risking the challenge fee (e.g., $100–$200).

If you demonstrate profitable trading over a month and earn 5% profit, that's $2,500. Your share (for example, 80% according to the profit split) would be $2,000 — many times more than you could earn trading only with your own money without funding.

How Does a Prop Firm Work?

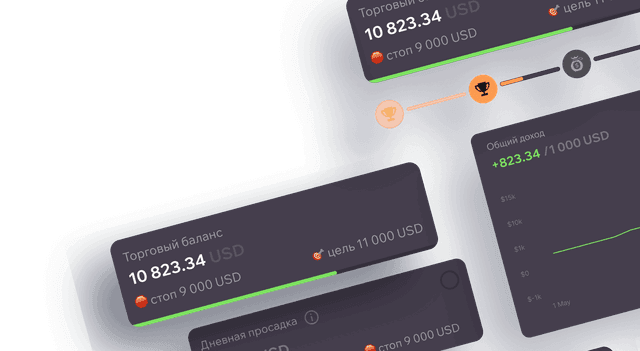

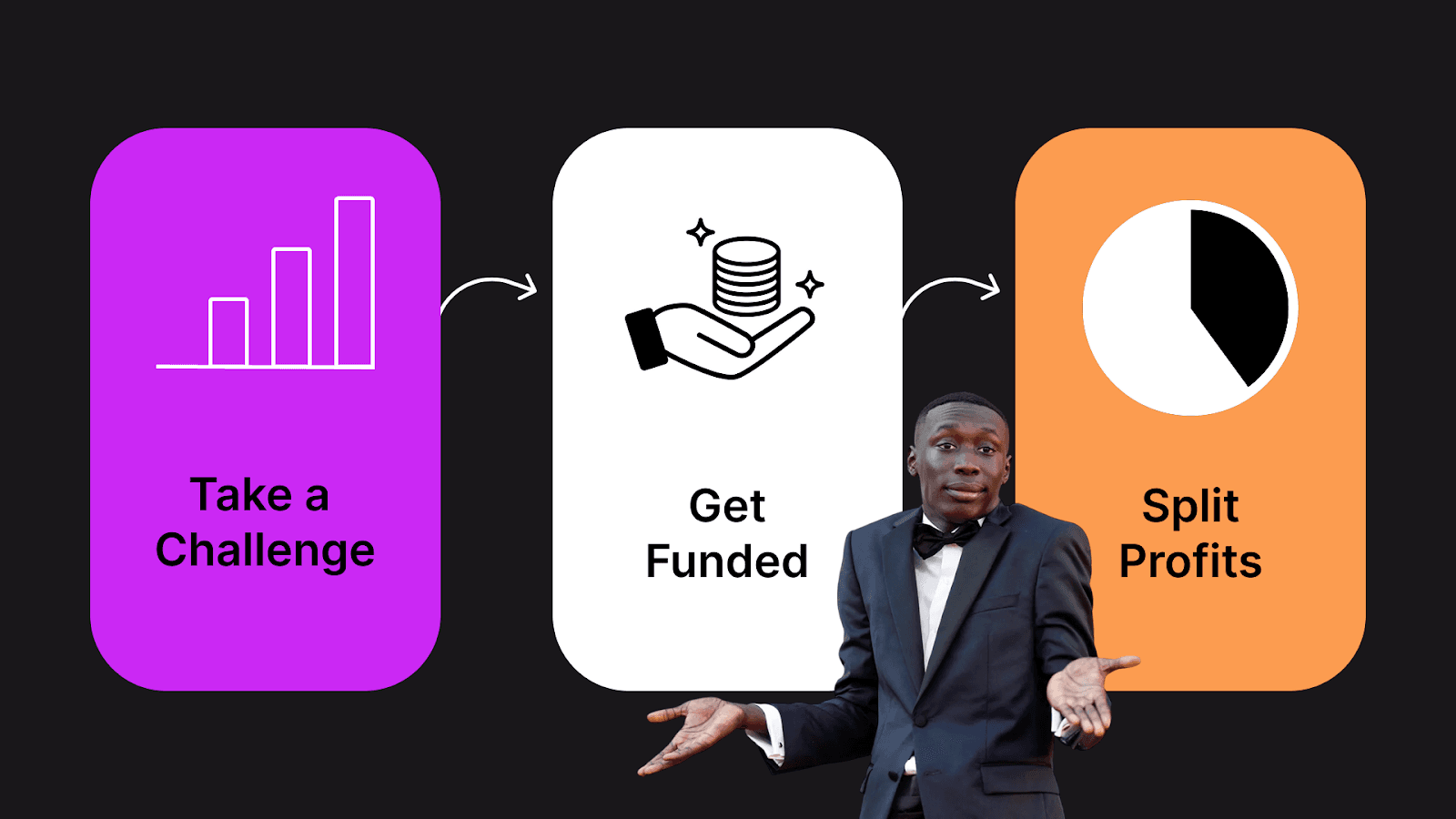

Trader evaluation (prop trading challenge): To gain access to the firm's capital and funding, you need to pass a prop trading challenge or evaluation, proving your risk management skills and ability to trade profitably on a demo account.

Trader evaluation (prop trading challenge): To gain access to the firm's capital and funding, you need to pass a prop trading challenge or evaluation, proving your risk management skills and ability to trade profitably on a demo account.

Trading with prop firm capital: After successfully passing the evaluation, the trader receives a funded account and capital to manage — from $5,000 to $200,000 or more. In case of failure, the trader only loses the challenge fee, not their entire starting capital.

Profit sharing (profit split): Typically, the trader receives 70–90% of the earned profits, with the remaining portion going to the prop firm. Profit payouts occur regularly: monthly or at the end of a trading period.

Why Are More Traders Choosing Prop Trading?

Minimal Personal Risk and Loss Control

You don't risk all your starting capital and personal savings — only the cost of participating in the prop trading challenge. This is a key advantage for beginner traders.

For example:

Imagine you paid $100 to participate in a prop trading challenge. If something went wrong and you didn't pass the evaluation — exceeded the drawdown limit or violated risk management rules — you only lose that $100, not your entire deposit as happens when trading independently with your own money. Even if the funded account had trades worth tens of thousands of dollars, your real losses are limited to the participation fee.

Access to Large Trading Capital

You can work with substantial amounts and a larger trading account, which significantly increases potential profits and earnings from trading, even for a beginner trader.

For example:

Let's say you only have $500 of your own funds, but after passing the prop trading challenge, the prop firm gives you a funded account of $50,000 to manage. If you demonstrate profitable trading and earn 5% profit in a month, that's $2,500. Even after the profit split with the company, your share will be many times greater than if you were trading only with your own money and starting capital.

Clear Risk Management Rules and Trading Discipline

Prop firms require strict adherence to risk management and risk control, which helps prevent completely blowing your account on emotions. This builds trading discipline — a key skill for any professional trader.

For example:

If you start trading too aggressively or violate established loss limits and daily drawdown rules, the system will automatically stop your trading. This protects you from impulsive decisions and teaches emotional control and trading discipline — even if you decide to "chase losses," the risk management rules won't let you blow the entire trading account in one bad session.

Partnership with a Prop Firm and Support

The prop firm is directly interested in your success and profitable trading, as their income directly depends on your profits through the profit split arrangement.

For example:

Projects like Upscale want you to trade profitably and show consistent returns, which is why they offer free trading education to continuously improve your trading level and risk management skills!

Prop Trading vs Trading with Your Own Money

| Parameter | Prop Trading | Trading with Your Own Money |

|---|---|---|

| Trading Capital | Large sums from the prop firm, trader funding | Only personal funds and starting capital |

| Risks | Limited to the prop trading challenge fee | You risk your entire deposit and savings |

| Profits | 70–90% to the trader via profit split | 100% yours, but from smaller capital |

| Discipline & Risk Management | Strict rules, risk and drawdown control | Self-control only |

| Support & Education | Trading education, prop firm support | Everything on your own |

FAQ

1. What's the minimum deposit needed for prop trading?

Usually, you just need to pay the prop trading challenge fee (from $50 to $500 depending on the account size) to gain access to a funded account and the prop firm's capital. You don't need substantial starting capital of your own.

2. Can I lose my money in prop trading?

You only risk the amount paid for the prop trading challenge (evaluation), not your entire deposit and personal savings. This is the key difference from independent exchange trading.

3. What requirements do prop firms have for traders?

You need to follow risk management rules, stay within drawdown limits (daily and overall), and prove your qualifications through profitable trading during the prop trading challenge.

4. What instruments and assets can I trade at a prop firm?

The list of available trading assets and financial instruments (forex, cryptocurrencies, futures, stocks) depends on the specific prop firm and funding conditions.

5. How are profits paid out to traders?

Most commonly, profit payouts occur monthly or at the end of a specific trading period. The trader's share is typically 70% to 90% of earned profits according to the profit split arrangement, with the rest going to the prop firm.

6. What happens if I violate prop firm rules?

If you violate risk management rules (for example, exceed loss limits or allowable drawdown), trading on the funded account may be temporarily blocked or the account closed. This is done to protect both the prop firm's capital and the trader from significant losses. In some cases, you can pay for a reset and start the prop trading challenge again.

7. Can I combine prop trading with a full-time job?

Yes, many prop firms operate entirely online, don't require physical office presence, and allow remote trading at your convenience. For example, Upscale allows you to take the prop trading challenge and trade both in the web platform version and within Telegram via @Upscalebot — convenient for earning from trading without leaving your main job.

8. How do I choose a reliable prop firm for trading?

Pay attention to the prop firm's reputation, challenge and evaluation conditions, payout transparency, availability of trader support and educational materials on trading and risk management. Study reviews from other traders on independent platforms and make sure the company doesn't promise "guaranteed profits" — this is the main sign of fraud in the prop trading market.

Conclusion

⚡ Prop trading (proprietary trading) is a modern and effective way to earn in financial markets without risking all your starting capital and personal savings. If you're looking for a better way to trade — with your own money or with a prop firm's capital — try prop trading and discover new opportunities for professional growth, consistent income, and trading earnings with minimal personal risk.

Pass a prop trading challenge, get funded and receive capital to manage, follow risk management rules — and start your trading journey today!